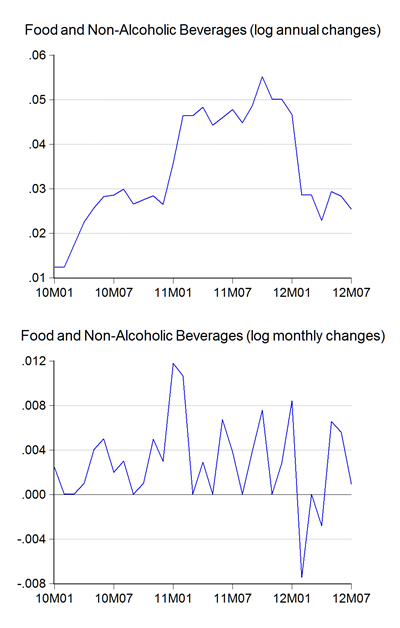

Tucked between the news on GDP, the latest consumer price index numbers show inflation continuing to decelerate (log annual and monthly changes):

The overall index is down, core inflation increased slightly on the month, but was offset by a decrease in the pain index. In fact the annual rate of increase in food and transport prices is now at its slowest pace in more than two years (since March 2010).

Food prices are still rising faster than anything else (log annual and monthly changes):

…but its been offset by drops in the price of RON97 petrol and in clothing prices. The result is that the overall price level was unchanged between June and July.

If this continues, I think overall inflation this year is on pace to drop to 1.6%, about the same rate as 2010 and about half the rate of 2011.

Technical Notes:

July 2012 Consumer Price Index report from the Department of Statistics

Hi, Pak Hisham

ReplyDeleteBelated Hari Raya Aidilfitri greetings!

I am intrigued by the report "Fitch sees Malaysia's fiscal outlook under pressure" in The Star website (Aug 22, 2012).

Fitch has set Malaysia's long-term foreign currency and local currency ratings at A- and A respectively.

Is Fitch being selectively prosecutorial in it's ratings analysis, seeing as how there are only a handful of triple A-rated countries in the world (Singapore being the closest in our neck of the woods)?

I also note that Fitch has expressed some scepticism about whether the Malaysian government can achieve it's target of getting the fiscal deficit down to 3 per cent of GDP by 2015.

Is this a valid analysis?

Indonesian President SBY, in his recent Independence Day message, said that Indonesia would get it's fiscal deficit down to 1.6 per cent of GDP in 2013.

If Indonesia can do it, why can't we, seeing as how both countries are running an onerous level of subsidies?

Am I missing something here?

Hi Jasper, thanks for the holiday wishes, I'm having a relaxing time this week.

ReplyDeleteI haven't read the original Fitch report, but based on the commentary in the various papers, their analysis appears a little superficial. I won't say more than that until I have a chance to read through it in full - my interpretation could be due to the way the journos wrote up their articles.

In any case, international ratings don't actually mean all that much for Malaysia because our external public debt is so low (less than US$6 billion). Our domestic capital markets are deep enough and liquid enough to completely fund public debt.

Indonesia on the other hand has substantially higher external exposure - about 15x higher - and even that's after reining in public spending over the past decade. They have also had a history of difficulty in managing both public and private external debt and thus have to work harder at maintaining credibility with foreign investors. For example, Indonesia was even more badly affected by the 1997-98 financial crisis than we were.

In other words, fiscal consolidation for them is a greater imperative then it is for us, whether they want to or not and whether they like it or not. For Indonesia, it is not a matter of choice but necessity. In Malaysia we can more or less thumb our noses at international ratings.

You also have to consider the fact that their revenue base is far narrower than ours (about 15%-16% of GDP compared to 20%+ for Malaysia), and they thus spend far less on public services (again about 15%-16% of GDP compared to our 20%+). They have less room for maneuver, and the populace correspondingly suffers from a poorer level of service and higher corruption.

BTW Singapore's fiscal surpluses comes from the same source - they stint on public spending, despite revenue levels comparable to Malaysia's. It makes for a better credit rating, but does that really benefit Singaporeans?