Last week’s trade report from Matrade showed continued weakness in external demand for Malaysian products. As I thought they might, my July forecasts came in above realisation (log annual and monthly changes; seasonally adjusted):

Seasonally adjusted exports in July came in –1.2% on the year and –6.7% on the month, while imports were up 9.3% and 2.0% in log terms.

Recall that I’m hypothesising that with higher investment pulling in more capital goods imports for domestic use, imports will become an overly optimistic predictor for future exports. That’s certainly been true for the seasonally adjusted numbers in 2012 (RM millions):

Time to review and revise the forecast models methinks. The trend certainly appears to be confirmed by the downshift in the trade balance (RM millions):

We’re now looking at levels we have not seen since just after the 2001 mini-recession.

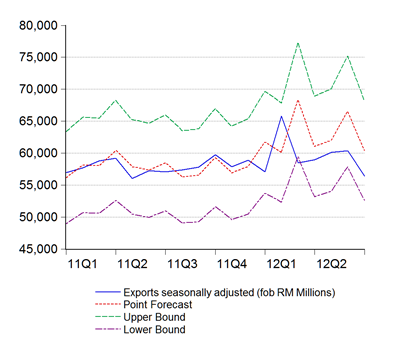

Forget the +/- percentage growth numbers we’re posting this year – on a level basis, apart from the spike in February, exports have been essentially flat since the beginning of 2011 (RM millions):

Imports are a little harder to figure out – intermediate imports are flat, consumption goods are on a mild uptrend, and capital goods imports are highly volatile, due to its “lumpy” nature (Airbus anyone?).

Bear in mind however, that from the perspective of global rebalancing of demand and savings, the changing structure of Malaysian trade is reflecting precisely what policymakers are aiming for – higher domestic demand, and less reliance on consumption in the advanced West.

However, given this changing structure, this will be the last time I’m putting up forecasts from my old forecast models:

Seasonally Adjusted Model

Point forecast:RM61,654m (5.1% yoy, 5.9% mom) Range forecast:RM69,632m-53,675m

Seasonal Difference Model

Point forecast:RM66,454m (12.6% yoy, 13.4% mom) Range forecast:RM76,084m-56,824m

Technical Notes:

July 2012 External Trade Report from Matrade

Just curious, could you describe the export model that you use?

ReplyDeleteTry here:

ReplyDeletehttp://econsmalaysia.blogspot.com/2009/04/forecasting-malaysian-trade-some-simple.html