When investing in an international commodity, it really, really matters what currency you’re investing in. Exhibit one (excerpt):

Gold outshines equity, other asset class

NEW DELHI: Gold has witnessed a golden era in terms of returns to investors amid its skyrocketing prices as compared with the share market, which has given negative returns on investments in the last three years, a study revealed.

People who invested in gold in August and September in 2009 have seen their money grow more than double up to August and September this year, thanks largely to the yellow metal becoming the first choice for investors not only in India but throughout the globe.

Investors in the equity market saw their wealth eroding in the same period. The erosion was more prevalent for retail investors, who generally invested in the small mid-cap stocks, said the Associated Chambers of Commerce and Industry of India based on a study conducted by the chambers.

The chambers said property, generally out of reach for small-time investors, saw good returns but not as much as gold, which has outshined all other investment avenues at a time when the global economy was going through tumultuous times.

Standard gold was selling at around Rs15,000-15,500 (RM855-RM884) per 10 grammes in India just about three years ago.

Today it is well above Rs32,000 (RM1,825) per 10 grammes, raking in more than double the returns on investment in three years.

The worst performer has been the equity market. The high point of the Bombay Stock Exchange's benchmark Sensitive Index in 2009/2010 was 17,711...

Now if you saw this in the papers today, you’d think gold might have been a good investment for Malaysians over the past year.

The problem is that unless you’re buying gold with Rupees, the return on gold hasn’t been that great:

The chart above shows the price of one ounce of gold in Rupees, US Dollars and Malaysian Ringgit, converted into index numbers with base year 2000=100 to simplify comparisons. Since the beginning of 2007 up til yesterday, the price of gold has increased approximately 240% in MYR terms, 280% in USD terms, but 340% in INR terms.

But if you bought any time in the past year, returns haven’t been all that kind for gold (log annual changes; 2000=100):

Over the past couple of months, the annual return off gold holdings would’ve been negative in Ringgit and US Dollar terms; you’re only in the black if you bought with Rupees.

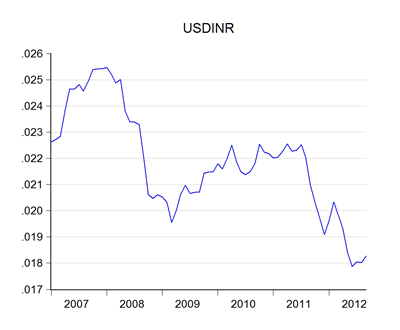

So what the article left unsaid is just as important as what was actually said – the Rupee has taken a hammering, and you’d probably be better off in something else (USD/INR; lower means depreciation):

Just don’t confuse this message as being general to any other currency.

Good Morning Tuan HishamH

ReplyDeleteTun Mahathir had proposed the use of gold dinar, as an international trade currency. To him, this would remove the uncertainties from import & export pricing/valuation. He had argued that gold is a better proxy as its valuation is relatively stable compared to fiat money, particularly the US$, which he noted is universally used for international trade settlement.

In the light of this article and your comments on it, which points to a steady increases in the valuation of gold, would it not make urgent sense to push for the gold dinar proposal to be re-assessed for worldwide implementation?

I don't see why it should. Although gold is appreciating in value, its only in Rupee terms, not in USD or Ringgit.

DeleteBut even if it was appreciating against all other currencies, gold as a commodity might hold its value against other commodities very well but that says nothing about its stability, which would be crucial in reducing pricing uncertainty.

My estimation from the data for the last forty years (dating back to the breakdown of the Bretton Woods system of fixed exchange rates) shows that commodity prices in terms of gold was three times more volatile than in USD terms. And what data I have for pre-Bretton Woods commodity prices (when currencies were fixed, and thus supposedly reducing trade price uncertainty) shows far greater commodity price volatility.

Its like trying to flatten a balloon - if you suppress volatility in one area, it just turns up somewhere else. In this case, using gold for trade settlement will just transfer price volatility from the currency markets into commodity prices. You can't run away from it.