I haven’t done one of these in quite a while, mostly through sheer lack of time, but given the upcoming Monetary Policy Committee meeting this Thursday, now is as good time as any to reboot.

Over the last quarter, broad money supply growth has fallen off (log annual and monthly changes; seasonally adjusted):

I‘m actually a little happier that it has – this past year, I’ve been more concerned over frothiness in credit creation than I was with overall economic growth. The slowdown in M2 is indicative of slowing loan growth, which is confirmed by looking at actually loan data (log annual and monthly changes):

We’re a little bit in uncharted waters here – on the one hand, current loan growth is well below the rates seen in the go-go days of the 1990s, but on the other, there’s been a very uncomfortable build-up of household debt, which at the end of 2011 has reached 76.6% of GDP.

So as far as household lending is concerned, I’m perfectly sanguine about a slowdown in credit, which is certainly part of the story:

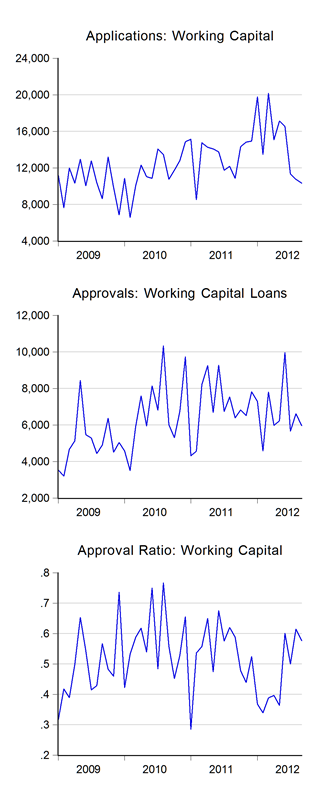

Mortgage applications have plateaued, and credit standards have tightened. Unfortunately, business borrowing looks like its slowing down as well:

So the slowdown looks to be general, and even more sharply in terms of business borrowing, which suggests sequential growth – in private consumption at least – for the second half of the year might be weaker.

As business has dropped off, so has the cost of credit as competition heats up:

I can’t imagine senior commercial bank managers being overly comfortable right now.

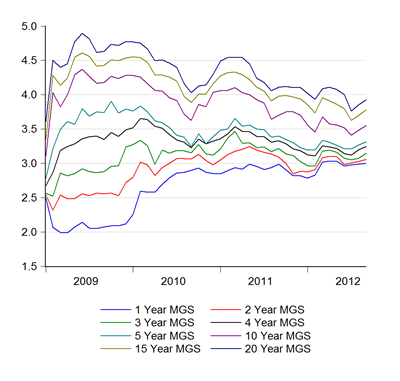

Looking at the other interest rate data, MGS data shows a slight steepening of the yield curve over the past quarter:

It does seem that the market was looking at a sharper growth slowdown scenario in 1H2012 than its looking forward to now. But given the movements over the past couple of years, I don’t want to read too much into it.

Overall of course, there’s really nothing in the data to warrant a move on the monetary front. The external sector is still weakening, but not so drastically as to require a monetary policy response to boost the economy. This is especially true with the dramatic upswing in private and public investment this year, which has largely offset the decline in export growth.

With inflation continuing to be subdued, there’s certainly greater space for a monetary move if warranted, but my preference would be that BNM should stay pat. There’s still a whole lot of big infrastructure projects slated to take off this quarter and next year – a steady hand on the tiller, with inflation continuing to slow, means effectively slow passive tightening of monetary conditions, which is exactly what I think is most appropriate at this juncture.

Technical Notes:

All data from the September 2012 Monthly Statistical Bulletin from Bank Negara Malaysia

No comments:

Post a Comment