Another quick update on the numbers. Federal government debt rose to RM484.6 billion as at the end of 3Q2012 (RM billions):

A further RM8.1 billion was added in October, to give a grand total of RM492.7 billion. Growth in debt this year has now slowed to below 10% (in log terms), for the first time since 2008 (log annual and quarterly changes):

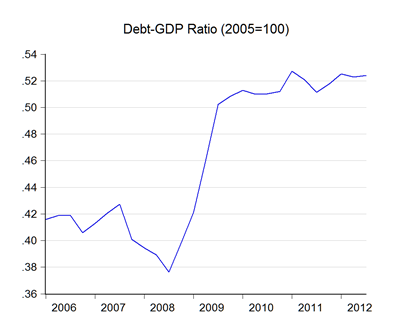

However, since nominal GDP growth has been slowing at the same time, the debt to GDP ratio is still slowly creeping up (ratio to GDP):

In growth terms (log annual changes)…:

…it’s really about slowing nominal GDP growth more than anything else which has been running below trend this year, mostly because of lower average commodity prices.

On a per capita basis (RM)…:

…the current level of debt amounts to an unadjusted RM16.7k per person, and RM12.8k on an inflation adjusted basis. Based on issuance in November and December, total debt will have just breached the half trillion mark by the end of the year.

Technical Notes:

Data from the October 2012 Monthly Statistical Bulletin from Bank Negara Malaysia. Additional data from Bond Info Hub.

Hisham H,

ReplyDeleteThanks for the update. But there is a tendency for Govt to move debt "off balance sheet" by guaranteeing bonds issued by SPV e.g MRT Co. That should count as debt as well and then perhaps we may see that there has been no slowdown in debt growth

Wenger, nice hearing from you.

DeleteI don't agree on the issue of consolidating off-balance sheet liabilities - that would be completely against accepted accounting principles, and is certainly not the way things are done in the private sector (one example: just read the notes of any bank's financial statements; then go to hospital after your heart attack).

It would only be appropriate if such liabilities were to come due and the claims made on the government rather than the SPV involved i.e. the debt is no longer contingent. Even in that case, only the net claims should be carried, not the gross outstanding (technically, default value multiplied by probability of default less whatever security).

The Malaysian government is neither alone in this practice, nor is our level of government guarantees all that high. The Philippines for instance is at around 30% of GDP (mostly infra) and Ireland's at 125% (mostly bank deposits); Malaysia direct explicit liabilities are only around 15%.

Another example: the funding for Europe's €500 billion bailout funds are guaranteed by the member governments and carried as contingent liabilities, not on-balance sheet debt. Many western nations also carry much higher levels of contingent liabilities due to their welfare states (e.g. unfunded future pension claims).

As long as our numbers are disclosed (and they are), I'm ok with it.

Having said that, this is still a bit of a grey area, because the government as a public enterprise has both explicit (which are reported and quantified) and implicit contingent liabilities (which are not), unlike private companies which are subject only to explicit contingencies.

If you want to worry about something, worry about the implicit contingent liabilities, particularly financial sector risk.

Zuo De here,

ReplyDeleteLets think of the alternative and Govt just stop borrowing next year and the following years and so on until debt reduce to 0.

We all just HOPE the GDP will still grow.

Depending what you do (professional, businessmen or whatever) some will be drastically affected while others may not, so like Europe with austerity the way forward??

Zuo De, now why would you want the government to have 0 debt? Of course ideally it's perfect but how much money do you think our government has? And with that little money, everyone wants a piece of it - road upgrades, public transport, fuel subsidy, food subsidy, etc. Debt is a must and the way for any government to continue to serve its people and create more development to achieve whatever government's aspiration. It is how they manage the debt is far more important.

DeleteI am with you Voldemort. i am against those who propose zero debt and that is why i ask for them to think carefully the zero debt govt, what will then happen.

ReplyDeleteSo managing debt, what in your view is a comfortable level of debt then?

Zuo De