What goes up must come down, or something like that. I didn’t think many believed that last month’s trade growth numbers were sustainable, and so it has proved (log annual and monthly changes; seasonally adjusted):

On the whole, trade looks like its just treading water, though there’s a lot of heterogeneity in the numbers – ASEAN and US exports are up, but China and Europe are down.

From a sector perspective, electronics exports are continuing their slow decline, but the more worrying sign is the stagnation in non-E&E exports (log annual and monthly changes; seasonally adjusted):

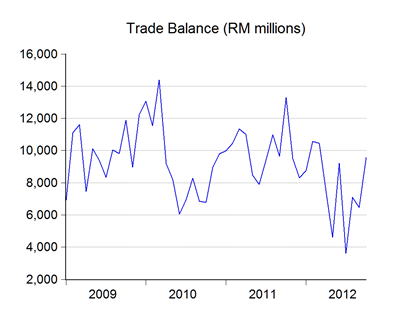

The only piece of goods news here is that for the first time since March, the trade balance has improved to above RM9 billion (RM millions):

Of course that’s not saying much, given how much its suffered this year from the spurt in capital goods imports. I wouldn’t say this is a sustainable return to a strong trade surplus however, since we’ve still got more than a few major infrastructure projects either going on or due to start.

My sense is that over the medium term, we’ve probably reached a plateau as far as manufactured exports are concerned (going by the trend in intermediate imports), and both trade and the trade balance would be subject to greater volatility depending on global commodity prices. Growth will also largely depend on some stability in Europe and a growth acceleration in China – neither are givens at this point.

Technical Notes:

October 2012 External Trade report from MATRADE.

No comments:

Post a Comment