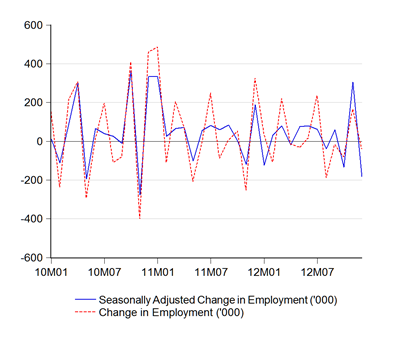

A day after the GDP data came out last week, a more sobering report on employment in December 2012 was issued (‘000):

The economy officially lost about 38.8k jobs in December – the seasonal adjusted number is about 5 times larger, i.e. under normal circumstances, employment should have increased.

Along with a small expansion in the labour force, that raised the unemployment rate to the second highest monthly level this year:

One thing of note here is that the unemployment data for the last six months has been really noisy – very sharp swings in both the unemployment numbers and in the unemployment rate. This has come concurrently with lower volatility in the employment, labour force and outside labour force numbers.

I don’t know whether these observations are an artifact of DOS’ surveys becoming more efficient or if unemployment really is getting more volatile. I’ve seen some anecdotal evidence of retrenchments increasing lately, and the stats say the number is up 21.6% over 2011. But that’s from a low base, and well below the level of retrenchments seen before the Great Recession.

As cold and harsh as this may sound, I wouldn’t be too concerned if unemployment does increase a little more, because the labour market might in fact be a little too tight (job vacancies are down for 2012 as well) and might lead to demand led price pressures (aka inflation) and/or higher consumer imports.

There’s a joke that goes: “An ‘acceptable’ level of unemployment means that the government economist to whom it is acceptable still has a job.” There’s some truth in that, as its a little easier to stomach higher national unemployment when you’re still getting a regular paycheck.

Nevertheless, there is some legitimate cause for concern when economic numbers deviate from their long term established levels. These past couple of years have seen Malaysian unemployment at unsually low levels. We might be seeing a normalisation of unemployment this year.

Technical Notes:

December 2012 Employment Report from the Department of Statistics (warning: pdf link)

Hi, Hisham

ReplyDeleteAny comments on the latest Singapore Budget?

@anon 5.34

DeleteSorry, I don't follow Singapore news on any regular basis. But I'll have a looksee.

a. Are temporary/part-time workers designated as employed in Malaysia?

ReplyDeleteb. Are official migrant labour included in the count for after all they are part of the workforce.

If yes to (a), given it being December, there would be a bump in the figures as shorter working days (due to year end holidays, festivities) result in some crimping of the temp/part time workforce.

I have not visited the DoS data site yet, but would like to know how unemployment is computed here. Are there similar parameters as used elsewhere, say the US for example?

3 plausible (and I stress plausible) reasons for the figures could be :

a. the imposition of the minimum wage, which has had the net effect in inducing layoffs, anticipatory or otherwise. I note too that the protests are being marshaled by a certain ethnic group known for its exploitative streak :

http://thestar.com.my/metro/story.asp?file=/2013/2/24/north/12753945&sec=North

http://thestar.com.my/news/story.asp?file=/2013/1/30/nation/12644060&sec=nation

wonder too what incentives will be provided to attract investments such as this:

http://pcdandf.com/cms/designnews/9835-designtestvalidationsoftware

b. the volatility in crude palm oil prices that would have had an impact in the primary produce sector. Also certain industries are experiencing stagnation especially the electronics sector wherein there is a perceptible shift to mobile platforms:

http://www.themalaysianinsider.com/print/malaysia/as-mobile-sales-rise-local-pc-centric-electronics-sees-flat-q1/

c. the impact of the Eurozone crisis as a number of malaysia's major tading partners are located there.

As for the Singapork budget, I should think commenting on it would be pointless as it is immaterial to our concerns.But more importantly, it is hard to take seriously data of any country which has had its accounts twice restated by the IMF and which has been cited in numerous jurisdictions as being facilitating both money-laundering and tax evasion (ROFL).

Warrior 23

Warrior, for respect to a and b, the answers are "I don't know" and "Yes". The employment and unemployment data is gathered through random surveys. As you say, there may be a seasonal component to this although the strength of it sows through even after seasonal adjustment.

DeleteThe impact of the minimum wage is something I forgot to take into account - yes, that's a definite possibility, as are the structural changes occurring in the E&E sector (I believe Panasonic has just shut down its local plants in December).

Oh I forgot to add on the Singapork thingy lest I sounded Gestapo-like the last time round = "it is your blog anyway and ultimately you decide on its contents."

ReplyDeleteWarrior 231

Ooops forgot the list:

ReplyDeletehttp://www.tradingeconomics.com/cayman-islands/rating

Warrior 231

Banging the drum again.

ReplyDeleteSince it's your blog, Hisham, I shall refrain from clobbering the warrior person. It's neither the time nor the place.

I will only note that his views and posts on Singapore have been thoroughly rubbished by facts and events on the ground.

Much as he would like to claim otherwise.

Cheers.

@anon 9.16

DeleteWhile I don't fully subscribe to conspiracy theory, there is something funny with Singapore's numbers. Prof Balding states that out of all the SWF's he's studied, only Temasek's numbers don't add up. I think his calculations are wrong (it doesn't take into account the monetary nature of some of SG govt borrowings), but I think in principle he's on to something. I can trace more than half of where Singapore's borrowings go to, but not the other half.

As for the tax haven stuff, there's more than enough evidence of it - Singapore attracted 50% of global FDI in retained earnings for 2011. That's ridiculous and implausible.

Measured labour productivity growth in Singapore is low and occasionally negative. While researchers have gone through some tortuous explanations as to why, one simple plausible reason is that the recorded capital base is artificially high (retained earnings are classified as investment in the national accounts), which in turn artificially depresses labour productivity growth.

Third, there are massive discrepancies in the numbers Malaysia-Singapore trade. The net effect suggests a hidden outflow of profits from Malaysia to Singapore - by all accounts, these discrepancies appear to be common across SEA.

But if you accept any or all of the above, the inescapable conclusion is that Singapore's GDP is artificially inflated at the expense of Malaysia and Indonesia and Thailand.

@anon 9.16

Deletehahahahahahahahahahahahahahahaha (breathe) hahahahahahhahahahhahahahaha (breathe0 hahahahahahahahahahahhahaha

reminds me of the time, back during my cricketing days, when I trapped a pesky preening Chingk LBW first ball with a chinaman, raised the middle finger and hollered 'lan#*@%u before the wicket' to which the good umpire acceded for the ball was plumb on for the bails if not for the filthy sliteyed Chingk's balls in the way......

And to top it off, the stern umpire a well known disciplinarian in that state and a kling to boot, shared in the chuckle too......

So here is the .,|,, to you @anon9.16pm and quit making an ars#$%^e of yerself vermin by putting yer filthy LBW (lan$#@^u before wisdom), Chingk scum.....

hahahahahahahahahahahahahahahaha (breathe) hahahahahahhahahahhahahahaha (breathe0 hahahahahahahahahahahhahaha

Warrior 231

Warrior,

ReplyDeleteA couple of issues here - the structured MBS deals referred to in the news reports you linked to are not "plain vanilla". That's obvious from the fact that they were rated by model, which is only done if there is no historical record to form a basis for the rating. Since each structured product is almost by definition largely unique, there will never be a historical record to look at.

Second, credit ratings aren't a measure of economic strength or quality or governance. They are merely a measure of the probability of default (in the case of S&P) or the recoverability of your money (in the case of Moody's). Insofar as most tax havens (with the exception of Singapore) have low debt and surpluses on their current or capital accounts, high credit ratings would be perfectly justified. We might not like the way they do business, but that's different from questioning their ability to cover their liabilities when necessary.

With respect to Singapore, about half the debt is issued to CPF and the other half are essentially used for monetary liquidity management. For the latter, this is a very confusing way of doing things, and I think they've recognised this as MAS has now been allowed to issue their own debt.

Of course, that still leaves the issue of what they're doing with the money sourced from CPF.

This paper may be dated but nevertheless highly relevant to our exchanges today given its high citation index:

ReplyDeletehttp://www.newyorkfed.org/research/epr/96v02n2/9610cant.pdf

It should be stressed that the paper should not be construed as the definitive work as there numerous other papers of more recent vintage that nevertheless assert much the same.

1. You stated that:

“ Second, credit ratings aren't a measure of economic strength or quality or governance”.

I beg to differ as the following parameters are considered vital in assigning ratings in the first place and by default, reflective of economic strength or governance

“Of the large number of criteria used by Moody’s and Standard and Poor’s in their assignment of sovereign ratings, six factors appear to play an important role in determining a country’s rating: per capita income, GDP growth, inflation, external debt, level of economic development, and default history.”

Thus it would be churlish to aver otherwise concerning what are essentially governance, economic strength parameters.

2. More importantly, ratings themselves have an innate capacity to shape market perceptions such as in the determination of sovereign bond yields and spreads (below (a-d) are the related excerpts from the same paper). This by itself is implicative of the fact that ratings do communicate subtle yet imperceptible psychological vibes about economic management etc. In fact (b) below signals clearly, how markets are leery of the risk factors associated with sovereigns below a certain level. Given that, wouldn’t it be profitable for certain sovereigns to maintain Triple 'As' to preserve their reputation as a secure haven?.

a. A regression of the log of these countries’ bond spreads against their average ratings shows that ratings have considerable power to explain sovereign yields (Table 6, column 1). Sovereign yields tend to rise as ratings decline.

b. One interpretation of this finding is that although financial markets generally agree with the agencies’ relative ranking of sovereign credits, they are more pessimistic than Moody’s and Standard and Poor’s about sovereign credit risks below the A level.

c. Agency announcements of a change in sovereign risk assessments appear to be preceded by a similar change in the market’s assessment of sovereign risk. During the twenty-nine days preceding negative rating announcements, relative spreads rise 3.3 percentage points on an average cumulative basis. Similarly, relative spreads fall about 2.0 percentage points during the twenty-nine days preceding positive rating announcements. The trend movement in spreads disappears approximately six days before negative announcements and flattens shortly before positive announcements. Following the announcements, a small drift in spread is still discernible for both upgrades and downgrades.

d. Do rating announcements themselves have an impact on the market’s perception of sovereign risk? To capture the immediate effect of announcements, we look at a two-day window—the day of and the day after the announcement—because we do not know if the announcements occurred before or after the daily close of the bond market. Within this window, relative spreads rose 0.9 percentage points for negative announcements and fell 1.3 percentage points for positive announcements. Although these movements are smaller in absolute terms than the cumulative movements over the preceding twenty-nine days, they represent a considerably larger change on a daily basis. These results suggest that rating announcements themselves may cause a change in the market’s assessment of sovereign risk.

Warrior 231

Part 2

ReplyDelete3. To be fair to you I should have been less opaque on the MBS thingy. What I am trying intimate is that given the clear indications that the ratings in those instances were rigged, what could prevent similar rigging in “the plain vanilla variety” as well. After all, certain sovereigns are awash with money to bribe agencies to rig up exemplary ratings irrespective of ground realities, right? I am not cooking up a conspiracy theory here but the data from (trading economics) seems to suggest that and especially after you map it onto UNCTAD data plus the TI index. and that likelihood increases exponentially with revelations about recent snafus engineered by them agencies during the Great Financial Meltdown of 2008,+ not forgetting of course IMF restating accounts of certain sovereigns.

Go figure that, dude and have a nice day munching on the weed ….hahahahahahaa.

Warrior 231

Warrior

ReplyDelete1. The finding on the difference in rating accuracy between structured products and vanilla debt is not my opinion, it's a research finding:

http://www.voxeu.org/article/origin-bias-credit-ratings

Neither investors nor rating agencies are dumb - with simple products, its easy enough for the market to figure out when a rating is out of line with reality. That caps how much rating inflation is possible - no amount of shopping will change much.

2. It is true that all those variables mentioned you mention are used in the credit rating process (in fact I know of a few more). But the focus is on the relationship between these variables and the probability of a credit default, not economic "performance" or "governance" per se.

In a rating context for instance, GDP growth and GDP per capita are viewed as indicators of potential tax collection. Inflation is another form of "taxation" while external debt (particularly the government's) is pretty much self-explanatory in a credit context.

3. In point of fact, many of these variables are actually used for rating consistency more than anything else i.e. what would be the rating be relative to other countries, given these numbers. And that tells you how easy it is to figure out when a rating is inflated.

4. There are actually two rating "scales" - domestic currency and foreign currency. A sovereign government would almost always have a AAA rating on the domestic currency scale - I actually don't believe I've heard of one that isn't. The foreign currency scale on the other hand can (and typically is) rather different. It's not always clear which scale a published rating uses.

5. Having said all that, I'm as ambivalent as you are about the ratings business model:

http://econsmalaysia.blogspot.com/2010/09/credit-rating-agencies-in-spotlight.html

I just don't think these issues are all that relevant to sovereign ratings.

Warrior,

ReplyDeleteI thought of something a few hours ago - it's a tiny, tiny thing, but it fundamentally undermines your thesis. I'll leave it to you to figure out what that is...

As for what I said previously, I don't see the dichotomy. The difference in treatment isn't mere semantics.

As an economist, I can view the way the Singapore government conducts its business as almost parasitical not only to its neighbouring countries, but also on its own citizens. The policies adopted appear calculated to promote the best interests of the Singapore government, but not necessarily the Singaporean people. That offends my sense of social justice.

But at the same time, from those very same factors, I have absolutely no problem with Singapore having an AAA sovereign rating:

1. Preferential tax treatment of MNC headquarters which results in booking of region-wide profits in Singapore artificially enhances domestic GDP, but also expands the government's effective tax base.

2. Systematic under-provisioning of public goods and services means low relative government expenditure so that even though they have a low marginal tax rate, they also have low outgoings.

3. Fixed returns on bonds issued to CPF means Singaporean retirees get shafted - but also mean that any and all excess returns stay in government hands.

4. The SG govt has zero external debt, which means the probability of external sovereign default is also zero. They also have none of the risk factors - no default history, a current account surplus, high forex reserves, balanced budget provisions, stable political environment - which combine to give a foreign currency rating of AAA. The local currency sovereign rating is always AAA anyway.

5. A cyclical balanced budget law that requires any deficit to be offset by surpluses in other years over the life of a parliamentary term.

Almost none of these make much socio-economic or macroeconomic sense, but they make a huge difference in terms of credit rating. Same data, but very very different perspectives.

Think of it this way - when a bank decides on a loan based on your CCRIS report, they're not going to ask about your career goals or personal improvement plans or past or future income growth. All that matters is your current income and what claims exist on that income, that's all. It's a very limited and very narrow viewpoint.

BTW, better rating=lower risk=lower yield is equivalent to saying bonds pay interest and equities pay dividends. It's a statement of the obvious and is so fundamental to the operation of capital markets, its hardly worth mentioning.

And with reference to the correlation you see between tax havens and ratings, you're imputing a causal mechanism that might not exist. Wouldn't bigger non-tax haven countries - especially does with higher debt loads and thus higher yields - have a bigger incentive to ratings shop?

This actually goes back to my first point above about something fundamentally missing from your analysis, so I'll forebear to mention this any further...wouldn't want to deprive you of your fun! :)

Dude, you are preaching to the "initiated" engineer.(ROFL). All those Spork "facts" you reeled out is common knowledge and of course they will look pretty when assayed with the benchmarks. But the key question you should have asked, given the propensity to "cheat" (as you agreed) in other instances, doesnt that make the macroeconomic data dubious, tittivated, steroided whatever...hahahahaha?

ReplyDeleteFrisky with fun, eh dude? So while I search which of my many comments here contain that lil' devil, you just witch-hunted for, have fun reading this:

http://www.academic-foresights.com/Tax_Havens_and_Offshore_Financial_Centres.html

A choice sirloin from the good professor's take would be:

"As long as the financial system appeared to perform well, few bothered to ask too many questions; but when the bubble burst, banks and financial institutions remembered out of a sudden that so much trading takes place either offshore or ‘over-the –counter’ (or both) and lost confidence in all published accounts, ratings, solemn declarations and the like...."

"The evolution of certain tax havens into OFCs, combined in an explosive mix the two rationales: the rationale for tax avoidance and financial regulatory avoidance into one."

Increasingly many economists are coming round to the view that the current financial paralysis in the money markets is largely due to the holes in the system, no thanks to entities known as Offshore Financial Centres/Tax Havens rolled into one:

And you forget one thing dude, the 'ethicality' of assigning sovereign ratings to sham economies, take the Caymans as a point in the article above. Any rating agency worth its salt would know the obvious. It reeks of 'legalising' crooks, if I may say, so what else is new?

And dude, any bank looking at the CCRIS record is mulling the potentiality (stress:potentiality, a future event or probability) of default or otherwise when musing about a loan. That's the future scenario being projected based on the CURRENT evidence of PAST and PRESENT records. In simple language, is Tom GONNA pay his dues promptly and responsibly is the ultimate question they are seeking? If the record data shows, Tom has/had been an incurable laggard or is swimming in debt, its nyet and off he is ushered to brother Ah Long.

Note: Some banks might take the chance but up the interest but I am unsure thats the case in Malaysia as I am not an insider

But it all boils down to risk weighing in the end, the very same thing Financial Marts do when dealing with sovereigns. The principle is the same and that's where a brill Moody (as would a brill CCRIS in the above) ratings come in handy as the New York Feds proved.

And for OFCs/THs, Triple A is the passport to instant riches and more so the incentive to rate shop given they are flush with money.

You really believe no one will notice a deteriorating balance sheet if places, where freedom abounds, say, the US or Japan, does the same, come on lah man. In any case, they may be wedded to the idea of ethical reporting of data when other don't care a hoot. Case of Uncle Sam's Jap's meat being the Sporkian's/ Cayman's poison......hahahahahaha.

Warrior 231

Warrior,

ReplyDeleteThat's one area where we don't appear to be seeing eye to eye - I don't think ethics should necessarily come into a credit rating. I also don't think the causality runs the way you think it does. These tax havens aren't getting rich because they have AAA ratings, but they have AAA ratings because they are already flush with cash.

Nevertheless, good luck finding that little nugget.

Have a good weekend dude. Don't hit the weed too much.

Dude, you sure aint one twisted rascal (ROFL). Even Greenspan was shocked by the market’s inability to self regulate and by the Ayn Randian self centeredness and greed when he himself was an Ayn Rand devotee. And pray how can you square pure utility without goal seeking or intent. For every economic actions by an individual is driven by goals /intent and in establishing that goal/intent, by default an individual is taking an ethical position. One may argue; the profit motive is THE intent but that conveniently leaves the MEANS towards realizing that intent by the wayside.

ReplyDeleteExample: a rating agency fiddling with ratings as in the subprime crisis is taking an ethical position: wilfull misrepresentation ( negative ethical) knowing full well of the repercussions despite the immense profits it is driven by greed to secure. You can almost read that to be a ‘moral hazard’ of sorts (and I stress sorts) cos the agency knows full well it is not going to pick the tab for failure.

And by extension, it is akin to abandoning its role as a market “regulator”/ a warning system, the implication of which was, many investors got burnt through fraudulent advise given by agencies steroided on slush.

I wholly expect you, as an economist, to quote this from your enlightened ‘gospel’:

“Every man, as long as he does not violate the laws of justice, is left perfectly free to pursue his own interest his own way, and to bring both his industry and capital into competition with those of any other man, or order of men. (Wealth of Nations: IV.ix.51).”

But even that same guy had an ethical streak in him as he also wrote this:

To hurt in any degree the interest of any one order of citizens, for no other purpose but to promote that of some other, is evidently contrary to that justice and equality of treatment which the sovereign owes to all the different orders of his subjects. (WN IV.viii.30)

And he knew of the notions of equity as well:

No society can surely be flourishing and happy, of which the far greater part of the members are poor and miserable. It is but equity, besides, that they who feed, cloath and lodge the whole body of the people, should have such a share of the produce of their own labour as to be themselves tolerably well fed, cloathed and lodged. (WN I.viii.36)

And the same guy knew of the folly relying purely on “the Invisible Hand “ for he proposed banking regulations which though “in some respect a violation of natural liberty” upon a few individuals were justified by the government’s duty to protect “the security of the whole society” (WN II.ii.94).

Further, his knowledge on the intrinsic preponderance of the market for imprudence is well known as attested in his recommendations for fixing the interest rate just above prime rates to prevent speculative activities from wrecking the market (to prevent a recurrence of the South Sea Bubble fiasco).

Given all that, It is odd that you frankly eschew ethics coming into play but yet your sense of social justice bristles when Singapork runs a modern day slavery sweatshop!! How you jive the two together is beyond me but it sure must be some traumatic contortionist stunt the conscience must undergo to align the two.

A closet morally” schizoid” Jekyll and Hyde are you dude?

Hahahahahahahaaha……Now easy mate, don’t get worked up..alll I am saying is that contemporary economists infused by some infernal libertarian-an “extremism” have managed to mangle Smith, Mills, Ricardo etc so much that capitalistic ethics propounded by them have been completely neutered.

Cue, the entry of amoral, greed driven, exploitative monster capitalism that a genius (in economics philosophy, that is) railed against. In fact, I would consider Marx the proletarian’s economist to offset capitalist's Ricardos of the day.

Warrior 231

Part 2

ReplyDeleteAnyway, I am no preachy moralist either nor a prince of virtue but when it comes to my economic views, I am pretty frank about where I stand. I am all for ethical economics, social justice and a level playing field. It may stand out as oddly incompatible with my perceptions of them, Chingkies but that’s just an illusion to the ignorant.

You see when I talk about social justice or level playing fields, I stress the need for actions that truly make for those before you start the competition game. Simply put,in a soccer match, you cannot have one side with a billiard table playing surface while the other’s is condemned to struggle with potholes, bumps, humps and what have you. And who stands to win when wooly headed liberals of Pakatan remove the NEP? And do you think those winners care 2 hoots about Malaysia?. They had their chance from 1957-1969 and we know what happened back then? Astronomical Gini, grinding poverty for the Malays, wage imbalances, etc etc

The second thing I hate most are goddamn hypocrites who have a penchant for condescending holier than thou trash talk. What I mean is that my whole being revolts against people who talk about corruption, meritocracy blah-blah when reality hollers that they are no better than those they condemn. A certain ethnic group in Malaysia and Singapork plus elsewhere those yellow devils congregate just love doing that, claiming that they are for transparency, hard work, meritocracy blahblahblah when again the facts clearly shows that they are the worst immoral racist supremacist bastards with megalomaniac feelings of being the Chosen Race.

And that explains my pet peeve with Singapork, not that I am obsessed or envious with a pipsqueak giant wannabe for why should I be bothered about inconsequential mutts. I purposely picked on Singapork to puncture the myth of the hard working, scrupulous, merit driven Chinaman running a rule of law based sovereign. Nothing can be further from the truth as the data clearly shows, For in the end, what is obvious to all and sundry is that the Chinaman aint an iota more hardworking, scrupulous or merit driven than your regular scumbag or douche head fraudster. He is as every bit devious as a fox rustling chickens in a coop, every bit a thief, counterfeiter, liar and moneylaunderer par excellence.

In short, a morally depraved bastard who is all hot ‘airish’ about integrity, transparency, accountability blahblahblah but revels happily in his crookedness. In fact, truth be told, the Chingkie knows innately he is a crook but all that derisory trashtalk against the BN, UMNO, Malaysia whatever is just to hide the unpalatable fact : He hates the Malays’ guts like mad and Islam like hell . He can save us all the trouble by admitting to that instead of hiding behind some showy, pretentious hypocrisy!.

Any surprises then, the Chingk is in cahoots with them Roman Catholic humbugs when facts shows us the RCs are just plain arselovers, who will berate homos but enjoy the same forbidden perversions on the sly on Brokeback Mountain:

http://www.smh.com.au/world/vatican-scandal-cited-in-pope-resignation-20130222-2ev0d.html

http://www.bbc.co.uk/news/uk-21572724

You see birds of a feather do flock together after all…..hahahahahaha

Warrior 231

Part 3

ReplyDeleteAnd for some of those bastards to hold up Singapork as some paragon of sovereign virtue is downright pathetic when we all know better that corruption runs amuck under the carpet, data is massaged day and night, regulations just decorate the statute books etc etc is plain laughable.

To conclude, I am driven by an inner conviction that ethical, just and fair governance can only come about if we steer clear of hypocritical moralism and condescending ‘garbagey’ idealism guided by a broken moral compass. Only then can Malaysia and the world be a better place. For I write in the memory of a fallen hero who stood by the tenets of integrity, ethics and all the good things that make for a great society: arwah Jalil Ibrahim murdered by a chingkie bastard in HK back in the heydays of the BMF circus. Period.

Post Script: The weed? Man that is sublimely great stuff. Only go easy on them root parts where the toxic portions, which are liable to skew your ethical compass, reside. Seems to me you are whacking the wrong end of that “vege” which explains your ‘awkward’ stance (ROFLMAO). Take it easy bro, for fun though grass maybe , it will blow ur egghead to smithereens if u tinker with the wrong portions..leave it to us pros..ahak ahak ahak.

Now let me go ahunting while you read the following before you ‘burn’ some weed to ‘fog’ them brains….hahahahahaahaha. have a nice weekend, man:

http://kenan.ethics.duke.edu/wp-content/uploads/2012/07/Case-Study-Greed-and-Negligence.pdf

http://bbs.cenet.org.cn/uploadimages/200442020285010025.pdf

http://www.cato.org/doc-download/sites/cato.org/files/serials/files/cato-journal/2009/1/cj29n1-12.pdf

Warrior 231

Warrior,

DeleteThat was a fascinating rant and an enjoyable read. Thank you.

My stance on the ethics of credit ratings doesn't require a whole lot of contortions to get to - ethics depends on value systems, and insofar as values are subjective, any judgement on ethics tends to depend on the observer. While there is broad consensus on many ethical issues, difference can and do exist, which makes an ethically driven credit rating system prone to bias (in a statistical sense).

Having said that, you might have hit on a market opportunity here - some people might actually prefer an ethically driven credit rating system (both Islamic and non-Islamic), bias notwithstanding, just as ethically driven unit trusts are now in more popular.

Be that as it may, to return to the issue of ratings shopping, I'll put you out of your misery - the reason why I don't think ratings shopping occurs (much) with respect to sovereign ratings as opposed to corporate ratings is that the vast majority of foreign currency sovereign ratings are both unsolicited and done gratis, especially for major markets tied into the global financial system.

In other words, the governments involved neither ask for ratings nor pay for them. In many instances, they might not even know they are being rated. That makes the idea of ratings shopping a bit of a non-starter for OFCs.

In local currency terms, government bonds are not rated at all, since they form the benchmark for the entire domestic ratings structure i.e. they are considered better than AAA.

MGS is not rated locally, and Malaysia's forex rating is only maintained because we have a small amount in forex government debt. In retrospect this is unnecessary, because the major rating agencies are now rating Malaysia anyway, whether we pay for it or not.

To go back to the Singapore example, the fact that they have zero external debt means that they don't need an FC rating since 1) there's no external debt to rate and 2) it has no impact on domestic government debt yields. The latter (through their monetary policy instrument) is a direct function of Fed policy and domestic demand and supply of government bonds, not some putative rating (which doesn't exist).

Where you might have an argument is with governments that are not "names" on the international market, have a history of international default, and have to borrow externally (e.g. Argentina or Turkey). But OFCs, by their very nature, don't fall into this category.

If you want an argument against credit ratings generally, I'd focus on the pro-cyclical nature of ratings i.e. they don't take into account the business cycle and are thus too optimistic in booms, and too pessimistic in recessions.

That makes ratings not rational or efficient in an economic sense, and imposes friction costs to markets and welfare costs to consumers and investors, especially since rating upgrades and downgrades tend to be retrospective and backward-looking i.e. the data changes first, before the credit reassessment occurs, by which time it is too late.

BTW, have you seen this?

Deletehttp://www.ft.com/intl/cms/s/2/afbddb44-7640-11e2-8eb6-00144feabdc0.html#axzz2MGXpfB7d

Wrong, dude just to prolong your exasperation and misery....hahahahahahaha.

ReplyDelete1. sovereign ratings are solicited and unsolicited:

Let me pose a simple question to you: who pays for rating the creditworthiness of sovereign nations such as the UK and US?

Most people guess that it’s the nation that pays. But that ain’t entirely so.

Warrior 231

Sometimes the nation will refuse to pay, so the ratings agencies go ahead anyway and write unsolicited ratings to sell to investors. The question of which nations are paying, and which are not, is pretty vital, in part because there is a raging debate over whether the ratings agencies are incentivised to provide better ratings to please their paying customers.

So which nations pay?

To get an accurate list I called the press offices of all three and asked which sovereigns pay and which don’t.

The press officer for Fitch, Peter Fitzpatrick, said: “We don’t know”. Seriously! They don’t have a list of which nations pay them and which do not, and finding out was apparently beyond the call of duty. So I asked whether he knew if the UK pays for its rating. Answer: No one at press office knows and cannot find out. Not encouraging.

I then tried Moody’s press office. I asked them who pays for Moody’s sovereign reports. “Moody’s operates on an issuer pays model,” said their press officer Jessica. Hmm. This contradicts what Moody’s told the House of Lords sub-committee investigation into ratings agencies last year: “MIS operates under an issuer-pays business model, meaning that an issuer pays for MIS to assign a rating to it or to its debt. In some cases, sovereign issuers do not pay for a rating and MIS therefore receives no revenue for issuing the credit rating.” When I put this contradiction to the press office they went into a panic, and refused to talk to me on the phone. Bonkers.

Only S&P could provide a coherent answer. “15 of our 128 sovereign ratings are unsolicited. Unsolicited ratings are those credit ratings assigned at the initiative of Standard & Poor’s and not at the request of the issuer or its agents.”

http://www.londonlovesbusiness.com/business-news/economic/are-the-credit-ratings-agencies-suicidal/1818.article

LOL...ahhh, but who's the issuer? The sovereign, or the company domiciled in the same country?

Delete"Sometimes the nation will refuse to pay, so the ratings agencies go ahead anyway and write unsolicited ratings to sell to investors."

This suggests that the writer doesn't actually know how the credit rating business works. And neither it appears, do the press offices of the rating agencies.

Take the Moody's quote - that's a very accurate description. The issuer does indeed pay.

The reason why sovereigns are different is because the foreign currency sovereign rating forms the ceiling for the foreign currency corporate rating. In effect, if any private company wants to tap foreign currency borrowing, the sovereign will automatically be rated at the same time, whether the sovereign pays for it or not and whether they ask for one or not, or whether they are even aware of it or not. The actual issuer(s) pay, and that's usually not the sovereign.

More importantly, none of any of the above has any bearing on the irrelevance of an FC rating with respect to the yield cost of domestic sovereign borrowing - which is what you're actually talking about.

Warrior,

ReplyDeleteNo sarcasm intended - I thought it was a well written and thoughtful rejoinder.

As for the rest, this kind of back and forth is the real fun part of blogging.

Take care dude, and lay off the weed.

Part 1

ReplyDeleteOk I have done with some CIRCALs and have a wee bit of time and breathing space to lob more grenades…hahahahahaha from Lahad Datu (poor taste, ah?)

Lets reverse and go slowmo on a few things:

Your contention 1 (C1): Sovereigns do not rate shop as they have no incentive to. Ratings are incidentally assigned on them gratis cos they are the ceiling benchmarks for all debts issued primarily by their banking/corporate sector who picks up the tab as the ultimate issuer……….

Your contention 2 (C2) : Ethical ratings is a non-starter as ethics themselves are by nature premised on the notion of ‘moral relativitism’ and thus lend themselves susceptible to subjective bias

Your contention 3 (C3) : there is a flawed at causal linkage simply because OFCs are flush with money and hence Triple A is inevitable rather than OFCs seeking Triple A to get flushed with moolah.

Exclusion: I will leave C2 out of the discussion purely for the simple reason that this is something we can never agree upon since our consciences are somersaulting at warp speed on two parallel beams and there is no possibility of transversal ever occurring unless one has an “epiphanious” enlightenment…; )D (ROFL). In any case I leave you to contemplate on this:

“By means of those operations the princes and sovereign states which performed them were enabled, in appearance, to pay their debts and to fulfill their engagements with a smaller quantity of silver than would otherwise have been requisite. It was indeed in appearance only; for their creditors were really defrauded of a part of what was due to them.”

http://bbs.cenet.org.cn/uploadimages/200442020285010025.pdf (warning: tanner lectures are by nature ‘ boringly deep’)

Warrior 231

Part 2b

ReplyDeleteIn the banking sector, such non-disclosure has a deleterious impact on unsolicited ratings:

“In contrast to previous research on the differences in solicited and unsolicited ratings, the analysis of this paper explicitly controls for potential sample selection by using a treatment effect model and an endogenous switching regression model to test whether better quality banks self select into the solicited group (self selection hypothesis). Although the analysis does find a significant difference between solicited and unsolicited ratings, no evidence is found in favour of the sample selection hypothesis. The analysis also tests whether the difference between solicited and unsolicited ratings disappears for banks with unsolicited ratings but which disclose a high enough amount of information (public disclosure hypothesis). Support is found for this hypothesis: banks with unsolicited ratings but a high amount of disclosure receive ratings that are not significantly different from the ratings of similar banks which have solicited a rating.”

http://www.bnb.be/doc/oc/repec/reswpp/wp79.pdf

Now this finding of evident discrepancy between solicited /unsolicited by dint of payment/non-payment of fees to raters is replicated in the post-Basel 2 scenario too and even after IOSCO guidelines on ratings as the paper below indicates:

http://www.econstor.eu/bitstream/10419/30175/1/614142490.pdf

and so do a trove of others.

Now based on the above for banking sector ratings, my simple questions are as follows:

A) Shouldn’t non-disclosure of facts in the sovereign domain (in scenarios of unsolicited ratings) have the same effect as in the corporate sector i.e. inaccessibility to information would yield a conservative determination of ratings.

B. If yes to (A), wouldn’t it be logical for all those listed Triple A (unsolicited) be downgraded. I am anticipating your quibbling over this absurd (hahahaha, can help it for I love tinkering with Beckettian absurdities)extrapolation from corporate sectoral entities to the financial health of nation states but the key Q ; isn’t the principle essentially the same

Ancillary to (A) and (B), can the recent downgrades of Japan, the US, France and UK be surmised as indicative of that absurdity I am alluding to in (B).

Warrior 231

Part 2C

ReplyDeleteIn addition to the above, certain countries themselves seem impervious to ratings change or re-ratings due to their privileged status despite change in their financial circumstances:

1. First of all, countries with a very high rating for long time present less probability of going under revision by a CRA. At the same time, countries that have been subject of several revisions are attracting more frequently the attention of rating agencies.

Which means countries like Spork can get away with fiddling for they are privileged......hahahaha

2. Second, countries with a long history of permanence in the highest array of ratings scale are considered more positively by CRAs, even when their situation presents relevant criticisms, and an authoritative statement is enough to restore the best assessment. Exemplary, under this point of view, have been recent events for UK: they were put on negative outlook by S&P on May 21st 2009 and, just after the announcement by the new government of the spending review, the outlook was removed on October 26th 2010. Very different has been the behaviour of the same agency versus other sovereigns, that sometimes were downgraded at the expiring period of the negative outlook, even in presence of an evident improvement on the critical factors that had justified such outlook.

(1) & (2) from; http://w3.uniroma1.it/ecspc/Cannata.pdf

Given all the above, can you vouchsafe sovereign ratings assigned are accurate, reliable e and beyond reproach?

Yep I do know you are ambivalent on ratings.but just this once......

Warrior 231

Part 3

ReplyDeleteC3: this is a classic chicken and egg situation, which came first, Triple A drawing in money or vice versa. I plumb for Triple A drawing in money as logic dictates that ‘unsolicitation’ means assignment of ratings based on flawed/unverifiable data which in turn drives the inflow of money creating a circular virtuous whirlpool of ratings drawing money drawing ratings ad nauseum…what perfect symbiosis!!!

Moreover, the presence of foreign banks play a significant role. I am not allowed to cite from this one but please check this out, authored by a hot babe I presume, for UCal women usually are hot and smart…hahahaahahaha:

http://ncgg.princeton.edu/IPES/2012/papers/S1115_rm2.pdf

and don’t OFCs by their tax haven shenanigans have those banks loitering about their islands (ahem ahem…….) by the gazillions….hahahahahaha

Ancilliary yet interesting readings :

http://faculty.haas.berkeley.edu/mopp/conference/strobl.pdf

the above paper illustrates that ratings standards are lowered during boom times contributing towards high defaults ( as the subprime illustrates).

Also note that CRAs can be viciously vengeful if denied their slice of the dough:

The Washington Post from November 24, 2004. The article reports that within weeks after Hannover

refused to pay for Moody's services, Moody's issued an unsolicited rating for Hannover, giving it a _nancial

strength rating of \Aa2," one notch below that given by S&P. Over the course of the following two years,

Moody's lowered Hannover's debt rating _rst to \Aa3" and then to \A2." Meanwhile, Moody's kept trying

to sell Hannover its rating services. In March 2003, after Hannover continued to refuse to pay for Moody's

services, Moody's downgraded Hannover's debt by another three notches to junk status, sparking a 10% drop

in the insurer's stock price. The scale of this downgrade came as a surprise to industry analysts, especially

since the two rating agencies Hannover paid for their services, S&P and A.M. Best, continued to give Hannover

high ratings. For a more detailed account of this incident, see Klein (2004); additional anecdotal evidence of

this practice can be found in Monroe (1987) and Schultz (1993).”

Dude..the weed is wearing off and dreamy somnolence is the inevitable outcome after a session of pot. So I leave you to figure out my absurdities…….rest assured its been a learning pleasure which I have thoroughly enjoyed for I don’t wanna be the ignoramus charlatan you talked about on another thread. Now you know why, I kinda like folks like you steering the economy and not boring, econ-illiterate lawyers,doctors, architects and engineers like me….. though mahathir did a relatively good job of it unlike Anwar…ahahahahahaaa (want prove, look at malaysia’s ratings on page 10 and elsewhere here: unctad.org/en/Docs/osgdp20081_en.pdf )

Ok..cherio, dude for its time for woman, wank, wine and weed again in that order…..ROFLMAO.

Thanks for the educational discussion, mate.

Warrior 231

Warrior,

DeleteSorry for the late reply...work.

I'm not going to reply in full, as I don't think I can do full justice to your barrage of evidence, and I've spent as much as I care to on this subject.

1. Some of the confusion I think that's going on here is that you're assuming the foreign currency rating as having an impact on sovereign borrowing yields generally.

That's not true - the rating will only have a direct impact on foreign currency (i.e. external) sovereign borrowing rates and market access. Domestic borrowing yields will be more beholden to domestic monetary conditions and demand and supply of local currency government bonds. The FC rating would also be very important for domestic companies seeking access to external capital markets as the sovereign rating forms a hard ceiling .

Hence why the US, Japan and Singapore can carry AAA comfortably despite high nominal levels of government debt - its all domestic.

2. S&P is only one of many rating agencies and one data point cannot be generalised.

More importantly, it doesn't answer the question I posed earlier - under the issuer pay model and the practice of sovereign ceilings, sovereigns will automatically be rated if a firm in its domicile solicits a rating. Does this then count as a solicited or unsolicited rating for the sovereign? It's not clear that a rating agreement is equivalent to a compensation agreement by the rated government, instead of an implicit levy on the bond issuer(s). Locally, I know that every sovereign rating issued by both RAM and MARC are unsolicited and unpaid for by the governments involved (of course you could argue that a rating from S&P is a lot more valuable and worth paying for...)

3. Verification of data - not sure why this should come up at all. If you take the stand that data is unreliable, no amount of looking at it (or greater access to it) makes it any better. No body trusts official data on China, but everyone uses it anyway. Its certainly not an issue in Singapore (...and yes, I'm pulling your chain with that statement).

I'm far more concerned with the banking sector and property in Singapore than public sector finance at the moment.

[cont...]

[...cont]

Delete4. With respect to your Q B, that's faulty logic - it presumes that a more conservative estimation would necessarily result in a lower rating i.e. that a particular rating label has some absolute value attached to it. Ever consider that it's also relative?

Second, it also presumes that the difference in conservative/realistic estimates would yield an effective change in rating, which is again not necessarily true.

With respect to section 2c:

1. More frequent changes in ratings suggests greater uncertainty over rating accuracy i.e. there's more doubt over the numbers. Paying closer attention is a reasonable and rational reaction. I don't understand why you're viewing rating stability as a problem in itself.

2. Don't be ridiculous, of course ratings are subject to error, especially errors of judgement and bias and market irrationality. But that's a very different thing from saying somebody's trying to fiddle the system.

3. I don't see it as a chicken and egg situation at all - its at once both symbiotic and an evolutionary process. In SG and HK, "foreign" banks have been there since almost the beginning and well before the use of ratings spread through the global financial system. (Anecdotal aside: StanChart has been in Malaysia in one form or another since 1840. The first local banks didn't appear until just before WWI).

As both also functioned as trade access points for their respective regions, its natural for financial firms to concentrate there too - which obviously has, and continues to have, positive feedback loops. I think its more interesting and relevant to look at the factors behind the rest. Typically, its lax regulation but strong enforcement of contracts, and preferential tax rates.

Interesting note: I thought we were discussing in a vacuum, so I've been looking at the data. Interesting to note that nearly all the OFCs have ratings from two or more agencies, except the Cayman Islands. Unless you're arguing they're paying off everyone, that would make ratings shopping less likely as a phenomenon (actually it makes the term "shopping" grossly misleading), except possibly the Cayman's - but in this case, they're three notches below Aaa.

Most ratings are consistent between agencies, though there are some exceptions like the Channel Islands (Moody's has them at the UK rating but S&P has them just below). BVI on the other hand is not rated at all (it carries the UK rating).

More frequent changes in ratings suggests greater uncertainty over rating accuracy i.e. there's more doubt over the numbers. Paying closer attention is a reasonable and rational reaction. I don't understand why you're viewing rating stability as a problem in itself.

ReplyDeleteresponse; the data and findings clearly indicate an underlying towards certain countries and against others. Have you considered the possibility that more frequent ratings yields more accuracy as countries will be on the their toes knowing they are being watched. Conversely, there is less incentive for the less watched to furnish extraneous details that could harm their super duper ratings and the tendency to drift towards opacity increases proportionately. It like why bother..for ratings are unsolicited ( thus information secretive) and prior assumptions have already been made based on their untouchability. Little wonder then France, Japan, US and the other wankers who lost triple As flew so long under the radar.So stability is a problem is a problem in itself!

2. Chicken and egg or fired egg? You just answered your own imbroglio. Foreign banks provide reputational capital plus easier access to funds which in turn lures money to the havens even to those with weak financial architecture. The abstract says as much even if you have no time to read the stuff but the data is robust and withstands analysis:

http://ncgg.princeton.edu/IPES/2012/papers/S1115_rm2.pdf

Read it at your pace, bro with weed in hand.....

Typically, its lax regulation but strong enforcement of contracts, and preferential tax rates.

response; I wrote tax haven up there.

Singapork pulling my chain...(LOL...ROFL). Nope not a bit...for its an inconsequential pipsqueak with questionable morals and shadier data. their property and banking sectors are intertwined though and the trail leads to their SWFs too..and they have a tendency to revise the macro data on a more frequent note than even the US!!...Good luck !!

verifiable data? response; good luck again

Work?part of living man and dying as well.....sorry to have encumbered you with some stealthy carpetbombing...hahahahahaha.. seriously, you should take time to look at the entirety of the evidence before firing away..as our RMAF are finding out now....hahahahahahaha

Warrior 231

"the data and findings clearly indicate an underlying towards certain countries and against others. Have you considered the possibility that more frequent ratings yields more accuracy as countries will be on the their toes knowing they are being watched."

DeleteGiven the nature of economic cycles and uncertainty over tax and expenditure numbers (due to e.g. automatic stabilizers), the likelihood that being "kept on ones toes" due to frequent ratings action leads to more accurate credit assessments isn't likely for governments.

Either you're speculating here, or you're a bone fide genius who's adapted Hyman Minsky to the credit rating universe :)

I'll readily admit that bias can exist in credit ratings (home bias almost certainly exists), but that's not a smoking gun for ratings shopping.

"Chicken and egg or fired egg"

Chicken and egg implies an unknown direction of causality - I wasn't disagreeing with the notion, dude, just your characterisation of it. Also, the foreign bank factor rather strengthens the case against the presence of sovereign ratings shopping.

With respect to data - macro data revisions are the norm, not the exception. GDP data for instance is estimated from surveys and census data and changes in the underlying data changes the estimates. Historical Malaysian GDP data is revised every quarter, and can go as far back as 3-4 years. The last GDP rebasing exercise revised data all the way back to 2005.

I watch bank loan figures pretty carefully, as the disaggregated figures are subject to change up to 1-2 years back - same with IPI data. DOS once "misplaced" 10% of Malaysia's trade, and didn't rectify the mistake for a whole year (they inadvertantly left out data from a couple of ports).

Data revisions are an occupational hazard in this line.

As for Singapore's banking and property sector - this has very little to do with Singapore government fiscal policy and everything to do with the Fed and QE. Because MAS uses an exchange rate target, every Fed action gets transmitted wholesale into Singapore's economy.

It's not just their property market either - borrowed funds from SG banks are flowing here and into the rest of the region. Credit growth is well above 20%, which isn't sustainable. Any fallout from this will impact us too (lest you think I've become softhearted).

Warrior,

ReplyDelete"You may be interested to know that S&P does make an express distinction between solicited and unsolicited:"

Which still does not answer my question - what constitutes S&P's definition of solicited and unsolicited. If the "solicited" is defined as including issuer-based requests, then the distinction isn't meaningful.

Also, I noted with some amusement that Singapore is listed as unsolicited.

"Nope, I am not implying that ( i even stated its was an absurdist contention worthy of an airing anyway) but the point I am stressing is that the underlying principle is similar not the absolutist or relativist nature of the rating."

Again, this misses my point. I wasn't referring to the comparison between banks and sovereigns, but your implied downgrade in ratings. You stated, "...wouldn’t it be logical for all those listed Triple A (unsolicited) be downgraded..."

No, it's not logical, and doesn't necessarily follow.

a. Which still does not answer my question - what constitutes S&P's definition of solicited and unsolicited. If the "solicited" is defined as including issuer-based requests, then the distinction isn't meaningful.........Also, I noted with some amusement that Singapore is listed as unsolicited.

ReplyDeleteResponse: it would answer your Q if you read the first sentence of the second paragraph:

http://www.slideshare.net/shawnmesaros/us-credit-rating-now-downgraded-only-unsolicited-or-removed-same-thing

The issue goes beyond "requested/unrequested" for.

http://lexicon.ft.com/Term?term=unsolicited-rating

Doubtless, ratings for sovereigns are "gratis" by products of in jurisdiction corporate debt issue but that does not detract that unsolicited is based on "limited" information (LI) and you know the implications of (LI) in economic decison making......hey slap yerself warrior, you are speaking to the expert himself. why even S&P issues a caution on that score:

http://www.standardandpoors.com/ratings/articles/en/us/?assetID=1245305318037

Think of Company A and B issuing foreign debt, S&P goes in unsolicited and assigns A ratings based on limited information while B pays fees, discloses fully and gets a solicited ratings and in the process, of rating A and B, S&P rates the mother they sitting under FOC (as per your claim) for ceiling markings, cue, the sovereign, .

Now the Question is the mother does not request as no mothers do (as you claim...see Turkey below) but in deriving that data what metrics does SP uses? Is it limited to information available in the public domain or does the sovereign furnishes the data and be damned with it......

Follow me, dude?..for this is the loaded Q....lets assume the sovereign takes the first course, no data for S&P, which leaves S&P rating the sovereign on limited data (potentially questionable data), right?.

That's what happened in the Greece lightning case....hahahahahahaha

If you are cockahoop that Spork is unsolicited in the list I linked, just quit your joy and note in the same breath that HK is solicited and so are a couple of other prominent tax havens, Liechtenstein, Luxembourg but interestingly again not Switzerland.

http://abcnews.go.com/Business/standard-poors-current-sovereign-rating-list/story?id=14246459

I am sorry Hisham but I get the feeling that you are confused over this "solicited/unsolicited" thingy.(another slap...ouch..me, an engineer, telling you, an economist, that dude) Many of the studies and news feed I have cited note the impact of these two, although they are focused on the corporate side :

http://www.boj.or.jp/en/research/wps_rev/wps_2007/wp07e11.htm/

and now the smoking gun of paid/unpaid sovereign rating...phew at long last....mama mia:

"The credit ratings agency said it had failed to reach a deal with Turkey and would in future only issue an "unsolicited" assessment -- meaning that it is not paid by the country to provide cover but does so anyway to meet investors' needs.".......S&P says that less than 10 percent of its sovereign ratings are "unsolicited", but these do include the United States and Britain.

http://in.reuters.com/article/2013/01/14/us-economy-turkey-rating-idINBRE90D0OM20130114

So why does Spork hide behind unsolicited unlike HK , Liechstenstein, Isle of Man, Guernsey etc apa mau takut when even smaller fries can agree to solicited ratings? ....cos it knows its real finances look damn ugly..that is why and that is the same thing that shielded the US, the UK, France etc this long...........hahahahahaha

Now you cant say that Reuters themselves are ignorant about ratings, can you dude.......In any case, man, all these exchanges merely illustrate that ratings like TI indices etc are just worthless alpha scribblings..nothing more. If not the US, Japan, France would be groveling by now.........

Warrior 231

1. Actually I don't think my Q was satisfactorily answered - you're generalising from 1) corporate ratings to sovereign ratings and 2) S&P as opposed to credit rating agencies in general. Given that S&P's coverage is impressively broad (2/3rds of all global governments), what're the chances of countries paying for multiple ratings?

DeleteI also think the simplest and likeliest explanation for the unsolicited ratings is that those countries had no external debt to rate, and thus didn't see the point of paying for a rating they didn't need.

But I'll concede this point, as far as S&P are concerned.

Also, I think we've been arguing so long, you've forgotten your original argument:

"So why does Spork hide behind unsolicited unlike HK , Liechstenstein, Isle of Man, Guernsey etc apa mau takut when even smaller fries can agree to solicited ratings? "

In the middle ages, the accepted way of finding out if a woman was a witch was to tie her up and throw her into a river. If she floated, she was a witch and burned at the stake. If she sank and drowned, she's innocent. Hence "witch-hunt".

In this case, if a country has an unsolicited rating, they're hiding something, and if they have a solicited rating, they're paying off the CRA?

How much weed have you been smoking, now? :D

"In any case, man, all these exchanges merely illustrate that ratings like TI indices etc are just worthless alpha scribblings..nothing more."

You could have said that right at the start and saved us both the trouble, LOL

Part 2

ReplyDeleteWith respect to data - macro data revisions are the norm, not the exception..............Data revisions are an occupational hazard in this line.

Response: That data revisions (macro/micro) is an occupational hazard is an understood given is already implicit in my earlier statement:

"they have a tendency to revise the macro data on a more frequent note than even the US!!."

It is more a question of frequency rather a question of revision for all economic data is by nature susceptible to revisions due to the lag element (think "recognition lag", "implementation lag", "decision lag"). In any case, it is surprising that a selstyled "well managed economy with its famed fingers on the pulse" approach need to revise so many times and that too for a small city state. and we are not even talking about IMF restatements yet.....

Warrior 231

I'm not sure what you mean here by frequency - AFAIK, US data is revised with every new release (i.e. monthly and quarterly depending on frequency) as is Singapore and Malaysian data. Is Singapore actually doing revisions between release dates?

DeleteHey dude, where is my earlier Part 1 which reveals a smoking gun...dont tell me it fell of the edge of cyberspace!!!

ReplyDeleteWarrior 231

:/ Google apparently thinks you're an evil spammer

Delete:) Fixed now.

Warrior,

ReplyDeleteMore grist for our mill:

http://papers.nber.org/papers/w18923

More or less confirms that the issuer-pay model is not efficient from a rating accuracy perspective, but that there are also issues with alternative approaches.