Apropos of the Monetary Policy Committee Meeting last week, monetary conditions in Malaysia for 2013 up to March mirror developments in prices and incomes (log annual and monthly changes; seasonally adjusted):

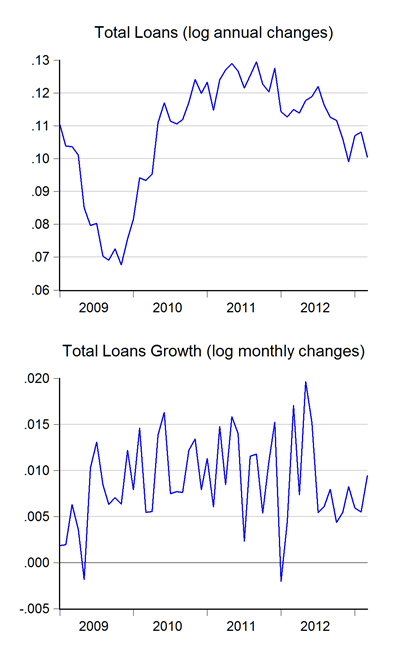

M2 annual growth has tanked to levels last seen in 2010. I’m actually still pretty sanguine about this, given the low inflation rate and elevated asset prices. Almost all the drop-off is coming in from foreign currency deposits – can anyone say election risk – which probably started reversing last week. There’s also the impact of slowing deposit growth from a slower pace of credit creation (log annual and monthly changes):

I’m far more comfortable at 10% loan growth than I am with the 11%-12% the banking system has been doing in 2011-2012.

Loan applications spiked in March, but credit standards appear to have tightened (RM millions):

All this has been occurring while bank lending rates continue to bump along historical lows (percent):

There’s a seeming stability in the money market as well, judging by the lack of action in MGS (percent):

There’s been little to no change in the slope of the yield curve over the past six months or so (to March).

The overall picture here suggests an economic deceleration, not surprising given that the real interest (here proxied by the overnight interbank rate less CPI inflation) is on the high side (percent):

Having said that, we’ve been experiencing a two-speed economy over the last year or so, with high growth in investment but negligible growth in productive sectors of the economy. Monetary conditions therefore might not be fully indicative of what’s really going on.

Reading the tea-leaves is harder than usual these days.

Technical Notes:

Data from the March 2013 Monthly Statistical Bulletin from Bank Negara Malaysia

No comments:

Post a Comment