Recovery on the trade front seems firmly entrenched, based on the latest numbers (log annual and monthly changes; seasonally adjusted):

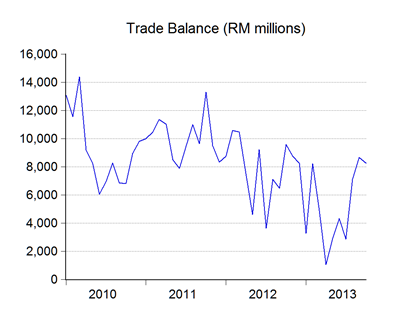

Exports rose an annual 9.0% in log terms and 1.3% on the month. Import growth was even higher at 13.3% and 4.8%. Despite the difference in growth, the trade balance continues to hold steady above RM8 billion:

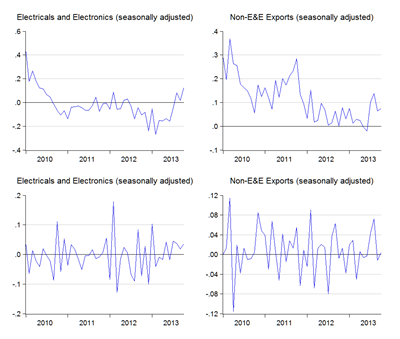

Electrical and electronics exports have now shown positive growth for a third straight month, the first time that has happened in three years (log annual and monthly changes; seasonally adjusted):

It’s not a price effect either, because export prices mostly fell in October, on both annual and monthly bases. The change in trend is even more obvious looking at the levels:

So what we have here is some confirmation that the global economic recovery is getting stronger. I don’t think it will be quite enough to bring full year Malaysian GDP growth above 5.0%, but the possibility is getting stronger.

Technical Notes:

October 2013 External Trade report from MATRADE

Can I ask you an an expert, why the trade statistics are different by countries? For example :

ReplyDeleteJAN-OCT 2013

Malaysia's trade with the USA

From US stats below:

http://www.census.gov/foreign-trade/balance/c5570.html

Total Trade : USD33.68 bil

Total US Exports to Malaysia : USD10.95 bil

Total US Imports from Malaysia : USD22.74 bil

Trade Balance : Deficit USD11.79 bil

While from Malaysia's perspective:

http://www.matrade.gov.my/en/malaysia-exporters-section/209-trade-performance-2013/3101-trade-performance-october-2013-and-january-october-2013

Total Trade : RM90.8 bil (USD29.2 b) * if divided by 3.2

Total Malaysia's Exports to RM48.5 bil (USD15.2 bil)

Total Imports from RM42.3 bil (USD13.2 bil)

Trade Balance : RM6.2 bil surplus (USD1.9 bil)

Can you comment with valid possible reasons?

Thanks.

@Shahrul

DeleteThere are three reasons why such figures don't match:

1. Exchange rate volatility. The USDMYR rate has a trading range in 2013 equivalent to over 10% of its value. The trade figures are however aggregated over the same period. You will not be able to reconcile the numbers using a single exchange rate value.

2. Different definitions. In international trade statistics, exports are always taken as free-on-board (FOB) while imports are always taken as including carriage, freight and insurance (CIF) i.e. shipping services. There will thus ALWAYS be a value difference between exports from one country and the same imports into another, and this difference will vary depending on distance and shipping rates. It's one reason why the gravity model is empirically valid.

3. Tax fraud. This is more common between East Asian countries, but it does look as if importers in the US or exporters in Malaysia are reducing their tax liabilities by under-reporting sales or over-reporting input costs.

Cayalah! Thanks for the explanation. :-)

ReplyDeleteIs it possible for the following reasons:

ReplyDelete- Direct exports VS indirect exports? i.e.exports from Johor Port to LA Port (US) via China/HK (repack) for example, VS Exports from Johor Port direct to LA Port.

- Last time I noticed exports from East Malaysia (Sabah/Sarawak), esp wood, petroleum, LNG are recorded differently from exports from Peninsular Ports. Is it still the same scenario?

Shahrul,

Delete1. The discrepancy in trade data still exists at the aggregate level, so indirect vs direct is not a good explanation.

2. Honestly? I don't know. But the explanation for differences in trade data cannot be entirely local. Most East Asian economies (except I think Japan) have large discrepancies between recorded exports and imports.

I see. Thanks again for the explanation. Will keep in touch.

ReplyDelete