Industrial output appears to be moderating a little (log annual and monthly changes; seasonally adjusted):

Growth has fallen off considerably on an annual basis, no thanks to continued contraction in mining output. The drop in electricity production growth is also a concern, as that’s a good indicator for private consumption.

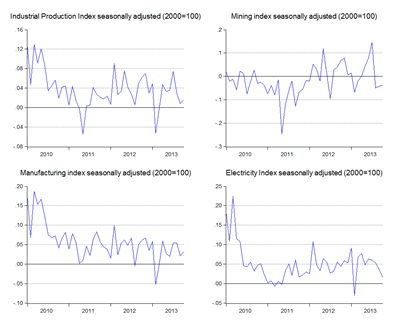

Viewing the indexes themselves, a slightly different picture emerges (index numbers; seasonally adjusted):

Mining appears to have bottomed out, while manufacturing output has been steadily climbing over the past three years. But the slowdown in electricity production is much more pronounced.

Overall however, there’s a more than decent chance we’re going to see much stronger GDP growth in 4Q2013 (log annual changes):

Current quarter GDP (based on Ocotber IPI), implies GDP growth of 5.8% (± 2.2%), well above the 5.0% recorded for 3Q2013 and similar to the jump in growth in 4Q2012. My weighted average forecast is a lot milder, at between 4.9%-5.4% (±1.2%), which would give a full year growth number of 4.6%-4.8%, which more or less in line with BNM’s latest expectations.

US recovery is gaining some strength, but both Japan and especially Europe are faltering again. Other regional economies appear to be picking up (notably Korea), so the overall external picture is the healthiest it has been in more than two years. I think that argues for risks in these forecasts to be on the upside.

Technical Notes:

October 2013 Industrial Production Index report from the Department of Statistics (warning: pdf link)

Hi, Hisham. Why not u try to dissect, analyse or review the recent post of GFI on illicit outflow of Malaysia. Thank you.

ReplyDelete@anon

DeleteBeen there, done that. There's not much to say beyond what I already said last year.

Hi Hisham,

ReplyDeleteThe link provided below is for american income distribution. Can you make an analysis for malaysian context? would be interesting to see how the result turn out.

http://www.businessinsider.com/income-and-taxes-in-america-2013-12?op=1

Salam Dzul

DeleteUnfortunately, the detailed data for Malaysia is not public and falls under the OSA, so I'm afraid it can't be done.

Hi, would it be right to say that the top left chart is the data for non-seasonally adjusted IPI?

ReplyDeleteamir,

DeleteAll the data for the charts in this post have been seasonally adjusted.