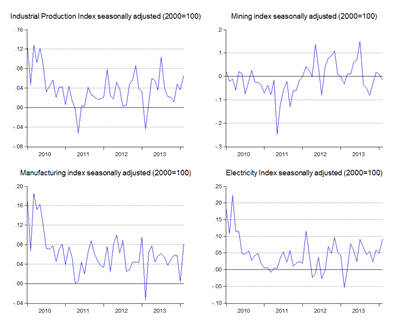

Last week’s IPI numbers gave me a headache – it’s part of another rebasing exercise, this time to 2010, which required a bit of work to splice – but things are looking up (log annual and monthly changes; seasonally adjusted; 2000=100):

Mining was totally flat, but both manufacturing and electricity output were pretty solid. Not fantastic, because output wasn’t too much better than January or December, but solid. The main thing to keep in mind though is that 1Q2013 was a really bad quarter. A REALLY bad quarter, where output contracted even after accounting for seasonal adjustment.

So what we’re going to see for 1Q2014 is going to be growth coming off a low base (log annual changes; 2005=100):

The GDP forecast based on IPI suggests 4.9% (±1.0% for one standard error), but my weighted average combined forecasts are between 5.9% and 6.5% (±0.5% and 0.6%% for one standard error) – some indicators are forecasting above 7.0%.

So I’m expecting so very strong numbers for 1Q2014, with the momentum of the economy more or less intact, and I’d be disappointed with anything less than 5.0%. Just bear in mind that this is partly due to a low base.

Technical Notes:

February 2014 Industrial Production Index Report from the Department of Statistics (warning: pdf link)

No comments:

Post a Comment