I was really concerned when I first heard the news last week. After having a peek at the data, I’m don’t feel much better (log annual and monthly changes):

M2 growth is pretty weak at a tad over 6%, even after taking into account CNY effects. Overall, money supply growth has been below 8% for the last eight months. That’s uncomfortably low – lower than I’d like it to be. It implies either slower growth, or disinflationary pressure.

Anybody following inflation news these days might think I’ve gone off the deep end, but the inflation rate we’re experiencing now is largely policy induced (supply side), as opposed to underlying inflationary pressure, which is demand side.

Loan growth looks a little better, as its been picking up lately (log annual and monthly changes):

Monthly growth has fallen off steeply, but that’s likely the fallout from CNY and the big jump in loans disbursed in December. Loan applications and approvals indicate loan growth will still be relatively healthy, but it’s likely to level off.

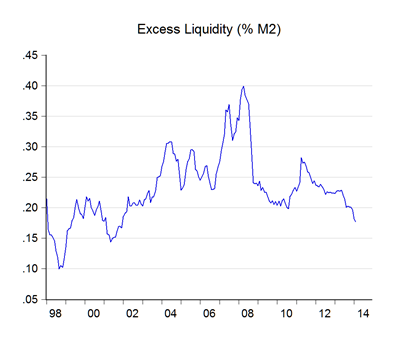

My preferred liquidity measure (deposits at BNM + BNM bills over BNM Bills + M2) is at its lowest level since 2001:

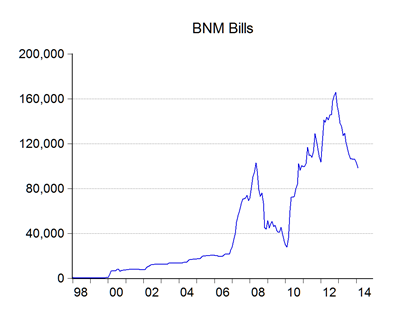

…while BNM Bills outstanding are at a 3 year low (RM millions):

Yield spreads across the MGS term structure narrowed slightly in February, but are far wider than last year, and at the widest since mid-2010:

In short, this looks like a tightening of liquidity within the financial system. Not exactly the thing you want to see when you’re hoping for growth.

The temptation is to put all this down to the Federal Reserve’s steady withdrawal of quantitative easing. I’d say that’s probably a factor with respect to interest rate spreads, although there’s been an impact on the banking system’s forex net foreign asset position as well (net increase of about RM10b less drop in BNM FX reserves of about RM17b in the last four months).

But the specific drop in February 2014 is something a lot more prosaic and an almost purely CNY effect – a big spike then withdrawal of cash in January and February (RM billions):

The quantum of the increase and withdrawal is unusual, but I suspect it’s BNM taking the opportunity to replace old notes and coins with the newer series. It’s playing havoc with the growth numbers, and I don’t know if the change in definition of the monetary aggregates were a factor either, but it’s a lot less alarming than it looks.

Nevertheless, while I’m happier than I was last week, liquidity is still tightening and bears watching.

Technical Notes

Data from the February 2014 Monthly Statistical Bulletin from Bank Negara Malaysia

I think BN is caught between 2 rocks - whether to keep the interest rate "friendly" or to gradually strengthen the ringgit.

ReplyDeleteIf the Fed really pulls the brake on QE, there will be a net reversal back into US dollar paper and assets.

How this will impact the Malaysian economy is open to question.

But, for sure, economic reforms and full-blown subsidies "rationalization" can't be put on the back burner any further.

Newer notes as in replacing it with the newer design? but what about this news? http://www.thestar.com.my/News/Nation/2014/01/16/Bank-Negara-Use-near-new-notes-for-CNY-ang-pows/

ReplyDeleteLooking at http://www.bnm.gov.my/files/publication/msb/2014/2/xls/1.3.2.xls, the claims on the private sector seems to be doing better. It's been improving for some time now, contributing to the expansion of M3.

ReplyDeleteIt's that "Other influence" that is causing the slowdown in M3, which I donno what it is. Do you know what is inside of it?