Last week’s industrial production numbers points to a still resilient domestic economy (log annual and monthly changes; seasonally adjusted):

Mining output was up – I’m told because a new field has just started producing – but growth in both manufacturing and electricity output slowed. Neither of the latter two are a concern, as month on month growth was also up. It’s more a result of the base effect from last year than any real slowdown.

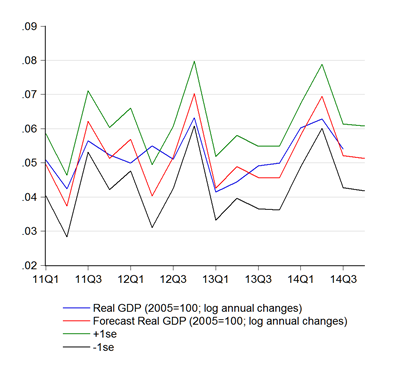

More interestingly, these numbers suggest growth will still be fairly strong on 4Q2014 (log annual changes):

The IPI based forecast suggests 5.1% in log terms (3Q: 5.2%), which is well above where I originally expected it to be. The weighted average forecasts (I have a couple based on linear regressions) are less optimistic at between 4.4%-4.7%, which is more in line with my original thinking, while the VAR based averaged forecasts are also around 5.1%.

I don’t know which will be more accurate, though to be honest, I don’t think a 0.5% difference really matters one way or another. The outlook for next year is a lot more bearish, going by sentiment on the ground. Neither consumer confidence or business confidence are very high at the moment.

In fact, it’s too bearish – people have oil prices on the brain. I’m still expecting a little above 5.0% growth in 2015. I just saw the figures for Malaysia’s crude oil trade balance. The trend has been unequivocally negative over the past few years, and we were in the red in 2014 (up to November). Two implications: 1) Malaysia being a net oil exporter is rapidly becoming a myth and 2) the government cut petrol and diesel subsidies just in time.

Technical Notes:

November 2014 Industrial Production Index report from the Department of Statistics

No comments:

Post a Comment