This question has been coming out a bit lately, so let me try heading off any more of this nonsense before it gets any more steam.

With the Ringgit declining, some of the those with long enough memories remember what happened in 1997-1998. In September 1998, Malaysia imposed “drastic measures” – we fixed the value of the Ringgit at RM3.80 to the USD and instituted capital controls. That halted the downward spiral of the Ringgit, and allowed BNM to regain control of domestic monetary policy. So people wonder, why not peg again?

Here’s the problem with that narrative.

When a currency is pegged to another, a central bank unconditionally commits to buy and sell foreign currency at the pegged rate. When the domestic currency is appreciating, that means the central bank buys foreign exchange on the open market by supplying domestic currency. When the domestic currency is depreciating, the central bank has to do the opposite – supply foreign exchange in return for domestic currency.

Given that a central bank has the power to issue domestic currency ad infinitum (with the exception of central banks in currency unions like in the Eurozone), keeping the domestic currency from appreciating isn’t a big problem – I’m glossing over here issues of over-expanding the domestic monetary base and the costs of sterilisation.

However, given that the ability to keep a currency from depreciating depends on the supply of foreign currency available to the central bank, pegging as a way to stabilise the exchange rate is far more problematical. If the FX market is pressing down the exchange rate, the level of international reserves become a hard limit for the central bank’s ability to intervene. Or to put it more simply, pegging a currency to stop it from depreciating guarantees a loss of foreign exchange reserves, and your ability to keep the peg runs out when your foreign exchange reserves run out.

The way around this difficulty is to impose capital controls – you don’t allow people to bring capital in or out willy-nilly. But that brings in a whole host of other issues, which I won’t get into. Another way around this would be to jack up domestic interest rates, but this can be punitively punishing for the domestic economy.

To go back to the historical example, here’s the USDMYR movements between 1997 and 1999:

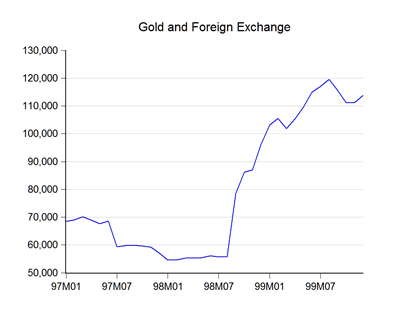

Note that in the early part of 1997, the exchange rate was almost flat, evidence of a soft peg of the Ringgit with the USD at around RM2.50 to the USD with a band of about 2 sen -3 sen around the central target. Beginning early July 1997, BNM ceased intervening in the market and let the Ringgit float. How can you tell? From the movements in reserves:

There was some pressure on the Ringgit in April-June 1997, but the heavy pressure came in late-June to early-July 1997. In that period, BNM lost nearly RM10 billion Ringgit in reserves. That’s not much in today’s terms, but back then it was 13.5% of the total in a matter of days.

There was a further spate of intervention in December 1997-January 1998, when a further RM4.7 billion was spent on trying to halt another round of heavy selling. From RM3.325 at the end of October, the Ringgit hit RM4.00 to the USD on December 5. Crunch time was in early January 1998, when the real crash came, with the Ringgit hitting RM4.73 on the 8th. For the month, the average exchange rate was RM4.3756.

Here’s what happened to the overnight rate:

The above are monthly averages – it actually hit 27% in May 1997 and a staggering 50% in early July. As you can see, in the 1997-1998 episode BNM tried both the interest rate defence and the intervention route, to not much avail. But high interest rates had bad consequences for the economy – that’s when corporations started going bust, and workers put on the streets.

So how come the later September peg “worked”? At that point, the market had largely settled down to about RM4.20. The peg at RM3.80 was at a premium to the market, which suggests that BNM should have lost more reserves in attempting to defend it. Instead, reserves began to climb, very sharply.

The key was capital controls – BNM suspended offshore convertibility of the Ringgit, and put a moratorium on portfolio outflows. It also helped that the trigger for the overvaluation of ASEAN currencies – China’s January 1994 devaluation – was full reversed by that time:

The combination of capital controls and a return to competitive parity with China (and competitive undervaluation against the USD. IMF estimates at the time suggest something like 10%-15%) helped fuel an export boom:

Thus were the origins of Malaysia’s persistent current account surplus that we enjoy to this day. That consistent trade surplus, combined with a suspension of capital flows (i.e. no portfolio outflows), meant a constant inflow of foreign exchange that BNM could use to rebuild its reserves (and then some). Domestic interest rates were gradually lowered to more normal levels, which helped the economy to recover.

Note that neither the Thais nor the Koreans (I unfortunately don’t have the daily Rupiah series) saw fit to put in either capital controls or a currency peg in that time, yet saw their exchange rates eventually settle down and gradually strengthen:

So the lesson here is that a currency peg, on its own, will not stop market pressure for devaluation/depreciation. You need to plug the capital account to have any meaningful policy traction.

But capital controls have costs of their own – the undervaluation of the Ringgit was negative for consumer welfare (you could buy less imports with your Ringgit), and stunted the development of the financial sector and the equity market for half a decade, never mind that it also pissed off portfolio investors who had kept faith with Malaysia even as the Ringgit crashed. You can even trace the growth of household debt from that era, as banks shifted away from corporates in favour of mortgage, credit card and auto lending.

The other lesson here is that it wasn’t the pressure on the currency that caused the ensuing recession – it was the punitively high interest rates BNM used to try to defend the overvalued Ringgit.

To summarise:

- A currency peg won’t stop a depreciating currency, at least not for very long;

- A currency depreciation won’t cause the economy to tank; that’s something that should be attributed to the interest rate defence

Technical Notes:

- Exchange rate data from the Federal Reserve

- All other data from various issues of BNM’s Monthly Statistical Bulletin

Talking about the interest rate defense, one recent example involving defending the currency via rate hike was Russia. That turned out awesomely bad.

ReplyDeleteBut while I know the reason why it's easier to fight off appreciation through a peg, I never really understand why the Swiss decided to give up. It could have gone on forever without much problem. It seems all political (the hyperinflation crowd being crazy and all waiting for the inflation Godot)

will the ringgit depreciate to 3.8 against usd? what happens when it reaches 3.8?

ReplyDelete@anon 7.30

DeleteI don't know, and I don't think anybody else does either

let it be at rm5 to 1 usd. and instruct all glc to sell overseas investment at the rate and repartriate the money back to Malaysia. Pnb. Epf and Tabung Haji overseas investment comes to more than Usd340 billion

ReplyDelete@anon 7.58

DeleteNo, not even a fifth of that. PNB, EPF and LUTH total assets (RM + overseas) don't exceed that amount.

I agree with you on this one, Hishamh. Currency pegging and capital controls are no panacea for the nation's economic developmental hiccups in the long-run much as steroids that work in the short-term are positively HARMFUL to the patient over the long-run. Sometimes we just have to bite the bullet and let the economy crash and then it will eventually recover strongly with the reallocation of resources which is both natural and sustainable

ReplyDeleteAre the forex symbols on the charts inverted? From the narrative, shouldn't the charts title be MYRCNY, USDKRW & USDTHB instead?

ReplyDeleteSorry, I'm not nitpicking, I just want to make sure that my comprehension is correct.

-- Jack W

@Jack W

DeleteOoops, thanks for catching that Jack. Fixed now. Yeah, I usually invert the series, but not for this post.

any idea why RM decline when Monetary Authority Singapore announce easing?

ReplyDelete@rahimrabbani

DeleteMAS targets the exchange rate between the SGD and an (undisclosed) basket of currencies, but the Ringgit is certainly one of them. A lower pace of policy appreciation for the SGD means less buying of foreign exchange by MAS. By rights, this should cause the Ringgit to be supported.

So no, the market reaction doesn't make sense.

It's all about perceptions, Hisham.

DeleteAnd now much of the "market" has lousy perceptions about Malaysia.

The "market" is still not convinced that the government has got it's act together and is willing to make the hard choices to restructure the Malaysian economy.

There is a perception that the "risk factors" for Malaysia are gaining more prominence and that the country's risk profile is being skewed to the negative.

I would say that the government hasn't got it's PR (and that's "public relations", not "Pakatan Rakyat"!) act together....

This comment has been removed by the author.

DeleteOff topic but I guess the chatter will quieten down though that's not a triple A certainty :

ReplyDeletehttp://www.themalaysianinsider.com/business/article/moodys-affirms-malaysias-bond-issuer-ratings-at-a3-with-positive-outlook

Warrior 231

Dear Mr Hisham,

ReplyDeleteforgive me for going off topic. I have a pressing question to ask, and it's concerning economic articles published in leading journals such as Econometrica or NBER. In most of them, I see mathematical formulation whenever the author presented his/her argument. I was wondering if the knowledge of high level mathematics is a must before one goes on to write technical papers, (like building the maths from scratch) or is it just one of many ways of articulating a theory or an idea. Do we learn the higher level maths only at phD level?

I myself am an undergrad major in econs who just started his first semester. You're illumination is deeply appreciated. Thank you sir.

-Hal20-

@Hal20

DeleteYou won't need much of advanced math in undergrad, though it would be an advantage. But if you want to have a career as an economist, be it in academia or the private sector, it's absolutely necessary as a grounding.

Most of the training for it occurs at graduate level (Masters), not PhD.

Best of luck