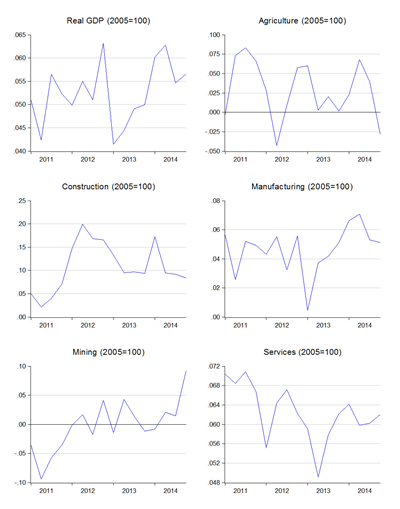

From last week’s 4Q2014 GDP report, it looks like the IPI was more than just a harbinger, it was spot on (log annual and quarterly SAAR changes; 2005=100):

The official numbers were 5.8% yoy growth and 8.0%(!) qoq (seasonally adjusted and annualised). Not bad numbers at all, given the expectations. Even the most optimistic analysts pegged GDP growth lower. It certainly beat my forecasts – at the beginning of the year, I was thinking sub-5.0%.

Where’s the growth coming from? On the demand side, it was private consumption holding up much better than expected, and import compression (log annual changes; 2005=100):

Exports didn’t do that well, but mostly due to the very high base established last year. But import growth also came down, not quite so much to maintain the level of the current account surplus, but enough that net trade didn’t put too much of a drag on growth. Private consumption growth however was amazing.

Is this a pre-GST spending spree? Hard to tell. Anecdotal evidence suggests poor sales in the retail sector, but that was disproved by the distributive trade survey (warning: pdf link). The only way I can square these seemingly contradictory signals is that same store sales was probably poor, but there was a large expansion in retail space – we won’t know for sure until NAPIC releases the property stock numbers in a few months.

On the supply side, the big surprise for everybody (though I’d expected it) was the big surge in mining output (log annual changes; 2005=100):

Agriculture crashed, no thanks to the flooding in December, while growth in construction and manufacturing stabilised. Services accelerated a little and posted decent growth.

But to explain mining, I need to talk about the difference between nominal and real GDP numbers. A lot of people (including some who should know better) were expecting poor growth due to the fall in oil and other commodity prices in the last half of the year.

But that’s nonsense from a real GDP perspective, because real GDP is an indicator of volume, not an indicator of volume and prices. There’s a reason why the notation says “Constant 2005 Prices”. Under real GDP (2005=100), all the output that takes place in the economy at current market prices is adjusted to 2005 average prices. Oil prices zooming to USD140 per barrel? No direct impact on real GDP. Oil crashes 50% to USD45 per barrel? Again, no direct impact on real GDP. The only thing that is reflected in real GDP is changes in volume of production, not current market income.

To illustrate, let’s take an extreme example. I produced 100 apples and sold them for RM5 each in 2005. Less input costs of RM2 each, that gives me a “GDP” of RM300. These are now my baseline for both production and prices.

In 2006, I produced 105 apples with an input cost of RM2.10, and sold them for RM8 each. That gives me a nominal “GDP” of [105 x (8.00-2.10)] = RM619.50, giving me a nominal GDP growth of 106.5% (I said it was extreme). But real GDP uses 2005 prices, so my real GDP growth is [105 x (5.00-2.00)] = RM315, for a real GDP growth rate of 5.0%. Big difference there.

Let’s say the next year (2007), my costs stay the same (RM2.10) and I produce 110 apples, but the price I can sell my apples at falls sharply to RM3. Nominal GDP is RM99, for a nominal GDP collapse of –84% from 2006. But real GDP would still be using 2005 prices, so my real GDP would be [110 x (3.00-2.00)] = RM330, for a real GDP growth rate of 4.8%. Under real GDP, only increases (or decreases) of production really matter, not prices.

So what happened in mining in 4Q2014? Two words: Gumusut-Kakap.

Apropos, here’s what happened to nominal GDP in 4Q2014 (log annual and quarterly SAAR changes):

Here we see the data more closely fitting the “growth is slowing” narrative – year on year growth decelerated to 5.3% in log terms from 7.6% in 3Q2014 and 10.3% in 2Q2014. Quarterly growth is slightly faster over 3Q, helped no doubt by the greater production volume as captured under the real GDP statistics. But there’s no question that the economy has been slowing in 2014 in a way that matters most to people – income based on current market prices.

To illustrate this more starkly, here’s what happened to the GDP deflator (log annual and quarterly SAAR changes):

Both on a yoy and qoq basis, deflator growth has turned negative. Given the way prices have moved this quarter it might actually turn back up again, but whichever way you look at it, income growth is going to be tough for a while.

The way prices enter into real GDP will be through indirect, rather than direct, means. Real GDP growth won’t be affected by the drop in oil prices, but it will be affected by the decisions people take in light of low oil prices. The most significant will be the cuts in employment and capital expenditure that the oil and gas companies are instituting in response. This will impact private consumption and investment, which will be a volume, not price, effect.

Technical Notes:

4Q2014 GDP report from the Department of Statistics (warning: pdf link)

Dear Hisham, how did you deduce the impact of Gumusut Kakap? Can the start of production of Gumusut deepwater platform make such a big difference?

ReplyDelete@w33k33

DeleteThe short version:

1. Our in-house oil & gas analyst clued us in.

2. Yes

Dear En Hisham, can u explain to us on the street how that iMDB can or cannot effect the economy of the country if it collapses.tq. So con fusing

ReplyDelete@rossab

DeleteBecause of where I work, I do not comment on the investments or operations of any GLIC. Sorry.