Another week, another multi-year low for the Ringgit. Since BNM appears to have stopped intervening, the Ringgit has continued to weaken against the USD, to what appears to be everyone’s consternation. There is this feeling that BNM should do something, anything, to halt the slide – cue: rumours over another Ringgit peg and capital controls.

To me, this is all a bit silly. Why should BNM lift a finger? Both economic theory and the empirical evidence is very clear – in the wake of a terms of trade shock, the real exchange rate should depreciate, even if it overshoots. NOT doing so would create a situation where the currency would be fundamentally overvalued, and we would therefore be risking another 1997-98 style crisis. Note the direction of causality here – it isn’t the weakening of the exchange rate that gave rise to the crisis, but rather the avoidance of the adjustment.

Pegging the currency under these circumstances would be spectacularly stupid. I’ll have more to say about this in my next post.

Be that as it may, two things I’m hearing these past weeks are: domestic inflation is going to accelerate from imported inflation (a mantra that’s been going on now for quite some time), and the sharp drop in international reserves raises risks of a Ringgit collapse.

Both sound plausible; both are wrong.

First, imported inflation. Econ 101 will tell you that, ceteris paribus, a decline in the exchange rate would raise the domestic price of imported goods i.e. imported inflation. The problem is that we’re not in a ceteris paribus world – the real world is actually pretty messy, and nothing stays the same.

Let’s put this into context. In this particular circumstance, we’re actually looking at two mutually reinforcing forces. First is that the pending tightening of Federal Reserve monetary policy (I’m ignoring the UK for the moment) relative to economic weakness in the rest of the world means a general shift away from other assets into USD assets. This translates into the USD appreciating against all other currencies, or at least those which are either floating or pretending to float. What does this mean for the price of imported goods elsewhere?

Unless you’re importing goods from the US (in which case, ouch), not much. Even if goods are generally invoiced in USD, that’s generally more for convenience than anything else. Real prices should not change if currency cross rates (i.e. anything but the USD) stay the same. The MYR NEER has dropped over the past year, but nowhere near as steeply as against the USD (index numbers; 2000=100):

The MYR has suffered a 20pt drop against the USD, but less than half that against the full basket our trade partners currencies. The impact on prices of imports should therefore be correspondingly less. By the same token, there won’t be a sudden boom in exports due to a “weaker” Ringgit, because the Ringgit hasn’t really dropped that much.

Even more important is the second factor – the drop in commodity prices (IMF All Commodity Index; 2005=100):

Aggregate commodity prices have dropped by a full third in the second half of 2014; a select few, like crude oil and iron ore, have dropped even further. What this means is that energy and raw material input prices for finished goods have dropped substantially. International producers can mostly afford to maintain local pricing for goods, because their profit margins have increased enough to offset the lower revenue (in USD terms). A few have taken advantage of the changes in terms of trade to try and have it both ways (higher retail prices + lower input costs), but most are content to maintain their margins.

Forget imported inflation – we’ve been importing deflation since last year (index numbers and log annual changes; 2005=100):

More formally, I’ve tested the impact of changes in USDMYR on import prices, using a data sample from the start of the float of the Ringgit in July 2005 to the present. There is a very weak correlation, but once you account for serial correlation (from import price persistence), the result is a big fat zero. Movements in the exchange rate are NOT driving changes in imported inflation, much less inflation as a whole.

Moving on to the role of international reserves. I’m continually bemused by the tendency of nearly everyone (local and abroad) to analyse the situation as if we still live in a Bretton Woods world. So let me make it clear – in a floating exchange rate regime, international reserves don’t matter. The choice of whether to utilise international reserves to support the currency is solely a matter of central bank discretion.

In the present circumstances, it’s not even clear why BNM should in fact intervene. You can make the argument that the Ringgit is fundamentally undervalued, and the FX market has overshot; but I have no idea why this is considered “bad”. If you want to live in a world of free capital flows, FX volatility is the price you pay.

The vast majority of the population will not be affected – the ones who are, are mostly in the upper tier of the income distribution and can presumably take their shopping elsewhere (I’m buying stuff off EBay Germany these days). Concerns over imported “inflation” hitting the man on the street (or businesses for that matter) are overdone, as I’ve demonstrated above. Multinationals who dominate Malaysia’s manufacturing sector don’t care – both their outputs and inputs are denominated in USD, and the decline in the exchange rate just improves their domestic profit margins. The capital markets are obviously affected by capital outflows, but then Malaysia’s equity and bond markets were pricey anyway, and amazingly still are relative to the rest of the region. All the doom and gloom on the markets appears to have glossed over the fact that Malaysian market valuations are just coming down to the regional average.

Again, to put all this into context, Malaysia’s latest numbers puts reserve cover at 7.6 months retained imports, and 1.1 times short term external debt, versus the international benchmark of 3 months and 1 times. Malaysia is at about par for the rest of the region, apart from outliers like Singapore and Japan.

Australia and France on the other hand, have just two months import cover, while the US, Canada and Germany keep just one month. You might argue that since these are advanced economies, there’s little concern over their international reserves. I would argue that that viewpoint is totally bogus. Debt defaults and currency crises were just as common in advanced economies under the Bretton Woods system. The lesson here is more about commitment to floating rather than the level of reserves. One can’t help but see the double standards involved here.

Also missing in the commentary is the cost of accumulating and maintaining international reserves. Since buying reserves is inflationary and thus needs to be sterilised, and because the interest rate differential is typically positive between domestic and reserve currency rates, international reserves typically involve a net loss to the central bank and the country (unless you’re willing to take some risks). {The opposite is also true – utilising reserves to support the currency is deflationary, and thus undermines the economy through tighter monetary conditions. I really wonder why people think “stabilising” the exchange rate is such a good idea].

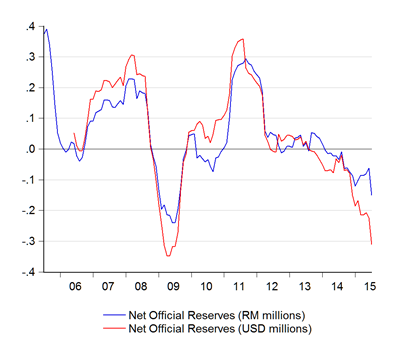

Another big issue is the habit of quoting reserves in USD terms. In a world where the USD is appreciating against nearly all other currencies, movements in international reserves are artificially exacerbated, as nobody keeps all their international reserves in a single currency. This habit can cause some embarrassment for the analysts involved, as in this smackdown by Singapore’s MAS earlier this year. BNM really ought to issue a similar statement (log annual changes; 2005-2015):

Note that reserves in USD terms is far more volatile than in MYR terms. People will of course look at the steep drop in reserves since 2014. To which my response would be: so what? I repeat: we’re not living in a Bretton Woods world of fixed exchange rates. BNM can, and in my view should, stop intervening, until and unless the banking system itself is running short of USD.

Speaking of which (RM millions; 2005-2015):

Looks pretty healthy to me. The banking system were under greater stress after the the “taper tantrum” in 2013.

All in all, this alarmism betrays a lack of general economic knowledge in Malaysia, even among people who should know better. Or maybe I’m being too harsh – it’s really a lack of knowledge of international macro and monetary economics.

I recently met an Australian trade delegation, who were smugly proud the Aussie dollar has crashed. The only reason why the Ringgit is the worst performing currency in Asia, is because nobody considers Australia as being Asian (which must frustrate the Aussie government no end).

The Bank of Canada, the Reserve Bank of Australia, and the Reserve Bank of New Zealand, have all aggressively cut interest rates and talked down their own currencies – it’s the right thing to do in the face of a commodity price crash. BNM on the other hand has to walk and talk softly, softly, because Malaysians seem to think the Ringgit ought to defy economic laws.

You have sound text book economic knowledge i must say. However you failed to point out the very fact that political uncertainties is playing a huge role in influencing the exchange rate at the moment. Investors confidence lies largely on political stability and the general economic conditions. Behavioral economics would give you a little more insight to how investors would react to non-economic news that will eventually hurt a countries economy

ReplyDelete@anon

DeleteThe problem with the "political uncertainties" argument is that the empirical evidence says the impact is at best minor. The Ringgit's trading level has not deviated from the international benchmarks I'm using (CAD, AUD, MXP).

That is unless you're arguing that there's a 1CanDB, 1AusDB and 1MexDB, and all those governments are equally shaky.

You mean to say that The Bank of Canada, the Reserve Bank of Australia, and the Reserve Bank of New Zealand, have all aggressively cut interest rates and let their currencies decline because of political uncertainties and investors confidence? _ Phlogiston_

Delete@anon 11.13 (who ever u r)

DeleteJust to quote some of Hisham's paragraphs:

Para 6: "The problem is that we’re not in a ceteris paribus world – the real world is actually pretty messy, and nothing stays the same."

Para 15: "If you want to live in a world of free capital flows, FX volatility is the price you pay."

I think that pretty much sums up that Hisham is well aware and knowledgeable in behavioral economics/finance. His argument in debunking the 2 fallacies was pretty much spot. Intervention by BNM, i.e. pegging Ringgit to USD again, is economically and politically stupid. If the Ringgit weaknesses is PURELY caused by political reasons, solve the political problems!

Fung

Stupid as it sounds, i'm in favour of re-imposing capital controls because the currency sharks are now circling and targeting the Ringgit, probably taking short positions on the Ringgit. Re-pegging the Ringgit will give certainty and stability which will be a boon to businesses. As for political uncertainties, well, we have 3 years to go now, haven't we?

ReplyDelete@dukuhead

DeleteIt's not easy to short the Ringgit these days, because all you have is the NDF market in Singapore (you can't do it onshore).

Also, it's not the Ringgit that's being targeted. Most currencies are down vis-a-vis the USD.

I cannot agree BNM has no business intervening in foreign currency markets. Of course a prudent central Bank has a legitimate interest in maintaining orderly markets. Whether their interventions have been well-managed is a matter for debate. Clearly political uncertainty played a significant part in the initial stages of the ringgit's fall. None of the evidence you have produced refutes that fact. Malaysia's economic fundamentals are stronger than the countries chosen for your comparison. To take one example, Australia has recently posted a record monthly trade deficit and its economy has grown, and is growing, far slower than Malaysia.

ReplyDelete@Stephen

Delete1. Political uncertainties played NO part in the initial stages of the Ringgit's depreciation. The trend began in July 2014 with the decline in Brent and WTI prices. 1MDB did not come into the picture until February 2015, and the WSJ article was in June.

2. Fundamental based valuation would be very different from what I've done here, but it would also be much less useful, since market deviations from fundamental valuations are i) very common, ii) very persistant and iii) last for years. A fundamental based model (including those used by the IMF), will give you an idea of an exchange rates under or over valuation. It will not tell why the market exchange rate is where it is.

Hi Hisham,

ReplyDeleteI did share your article in my Whatsapp group. And I received mix reaction from them (who some are investment bankers). One of the comment attract my attention and sounds logic. I will share the comment here and if you are free, hope to get feedback from you. Thanks.

"Economist view the real market view is as 2 different scenario. He seems to be positive on myr depreciation are partially true as it will benefited the net exporter countries like Malaysia. but too much of something is not good too. Malaysia remain committed to maintain high GDP and internal projects such as Pan Borneo Highway, HSR, MRT etc largely contributes to Malaysian economy to sustain targeted GDP.

However the cost of these projects will be more expensive assuming that we still have to import large quantitiy of construction materials and expertise from overseas (note that it will be offset by lower commodities).

writer also mentioned that imported inflation are not a concern as USD seems to appreciate against all other currencies too. Personally i feel that MYR depreciated even more due to politcal instability and speculation on the USDMYR NDF market which BNM do not have a control. Although our economy strenght remain solid, but the real financial market where demand and supply take place are in negative and will determine short course of our currency and interest rate course. It is crucial for BNM to use their power to maintain smooth operating market and to thwart any forms of speculation and attack. Higher USDMYR level can lead to bond routs and that could lead to higher cost of rollover and new internal govt debt."

Mohamed

you seem to think that 'investment bankers' know economics. that's kills the entire credibility of your post.

Delete@Mohamed

DeleteA couple of points here:

1. Given that import prices have not moved, the proposition that projects will become more expensive is likely mistaken. In fact, if you look at the costs of building materials, they are down quite substantially from a few years ago. On a year to year basis, DOS produces a building materials cost index for the government's reference: You'll note that price changes have been relatively minor, with as many categories going down as up.

2. The problem I see with BNM intervention is that in occasionally preventing the exchange rate from depreciating, the subsequent market movements after they stop has been even more volatile. This could conceivably cause even more panic than if they just allowed the exchange rate to decline on its own. The only point when intervention will be effective is when the currency is close to the bottom. I met an ex-Governor of the RBA last year - RBA policy is to let the currency adjust to where it thinks the market has overshot, and then go in very big, very loudly. That minimises the expectation risk, and announces to the market enough is enough. I don't think we're quite there yet with the Ringgit.

Anon 9.01 pm,

DeleteI've never said investment bankers know economics. I'm just sharing their opinion on Hisham's article. So you have Hisham view as analyst where I can also compare this with investment bankers view.

Anyway, thanks hisham for the reply. Really appreciate it.

Mohamed

"The only point when intervention will be effective is when the currency is close to the bottom."

DeleteHishamh, whats the bottom level of ringgit?

@Lizarazu

DeleteJust been discussing that this morning. None of the technical indicators will work, because we're literally in uncharted territory. My guess would be above RM4.20, but it might never get that far.

Saw the BCI index, I am not familiar with this indicator, but the immediate question that comes to my mind is how much of the materials listed in the list are actually sourced internationally. Also, raw materials are not the only costs that goes into building high tech, I would wager that a lot of specialised parts like cables and engines go into the construction, and these costs will definitely increase with the MYR depreciation. In general I am siding with the investment banker that the said projects will be negatively affected, most likely because foreign materials form significant chunk of the cost.

DeleteAnd as of today, ringgit went above 4.2; it will most likely continue to increase given further weakness in the Chinese market which would further encourage flow of funds away from emerging economies.

And whoever said not to listen to investment bankers because investment bankers don't know economics, is being unnecessarily judgmental and ignorant. Economists don't have a monopoly of knowledge in economic development, and even if you think they do, the general consensus among economists, if any at all, has been proven wrong many times.

Typed the previous message in a fly, notice several sentence structure errors, sorry for that.

DeleteAlso an interesting point to note, I said economists don't have a monopoly in economic knowledge, because the Nobel prize in Economics, the highest honor in economic science, has previously been awarded to political scientists and even psychologists.

@anon

DeleteThis article suggests the impact will largely be minimal. In any case, all complex materials are composed of more basic raw materials. The impact of exchange rate movements will only largely be reflected through local value added (e.g. the MYRTHB rate is only relevant for Thai local value added).

Insofar as the MYR depreciation is concurrent with the commodity price drop, I see nothing "definite" about costs increasing, whether here in Malaysia or elsewhere. The latest PPI (Check out Table III) shows price pressures are near normal (2%-3%), despite the 20%+ drop in the USDMYR exchange rate.

Absolutely the economics profession has been enriched by the contributions of experts in other fields - and vice versa.

In fact, my funny bone is being tickled by the fact that our investment banker friend is taking a stand straight out of an economics textbook, while I the professional economist am saying that the theory is wrong (or at least, needs to be substantially qualified).

Hisham..Pengenalan GST ni mengurangkan keberngantungan kerajaan pada sektor Komoditi Oil n Gas.. adakah ia bakal membantu utk mengurangkan Undervalued Ringgit M'sia???

ReplyDelete@Living Seed

DeleteDoubt it. The impact of commodity prices will be felt across the whole economy, not just the government. GST won't change the income mix for anybody else.

Sir Hishamh,

ReplyDeleteI've came across one BNM article on how RM appreciayion would tend to lower the consumer price by only 0.15%, which indicates a very low impact of ringgit appreciation. And it also shows how our consumer prices highly dependent on domestic demand situation.

Will it also be the same in the case of RM depreciation?

Thanks

@Group 8

DeleteThat's exactly what the data I showed above is indicating - Ringgit depreciation is not having an impact on import prices.

I do agree that the currency must not be defended but certainly something must be done to protect the purchase power of the consumers..you are just another text book economist

ReplyDeleteWell am afraid he's not. The impact of consumer prices is minimal. If anything, it would have been for the GST, the 'wave' just got started.

Delete@Anon 8.13

DeleteSir, this text book economist thinks protecting domestic jobs and incomes is more important than protecting consumer purchasing power.

Which in turn protects consumer purchasing power in the long run, methinks!

DeleteWe can reduce the gst rate lower

Deletefix the pump petrol price

reduce employee epf contribution to boost domestic consumption...money to defend the exchange rate will be better used..

And surprisingly i think our gst rate wont reduced as the deflator for the next 5 years is at 3%, compared to the 2% deflator for the past 5 years.

Delete@anon 1.22

DeleteThat only benefits those who keep their jobs, and will be biased towards the upper end of the income distribution. All three (GST, petrol, EPF contributions) are primarily paid by those in the upper half of the labour force.

Still does not explain why a Sunglo yogurt drink price increased from RM7 in 2014 to RM10 today.

ReplyDeleteMaybe you are more expert than theStar in economics. See front page of today's Star, 13th Aug 2015.

@einnos

DeleteIf you look at the detailed price statistics (both imports and consumer prices), food and beverage prices (both domestic and imported) are going up, but this was true even before the Ringgit's depreciation. This has more to do with the changing demand/supply situation in global markets than with exchange rate movements.

I honestly can't remember when was the last time I read a physical newspaper. Just point me to the article online.

@einnos

DeleteOh, I should add that some vendors have been taking advantage of the situation to profiteer. I would suggest reporting them to KPDNKK.

hi hishamh i really appreciate your thoughts.

ReplyDeletecan we let's forget politics for a while. what do you think of the very long term depreciation of the ringgit against let's say the SGD, the USD and so on and the sentiment that this generation can't afford to buy their own houses, cars etc? is that consistent with your view that the long term weakness in ringgit doesn't cause imported inflation?

@anon 5.11

DeleteOn the SGD, please read this.

As far as the USD is concerned, the exchange rate isn't really that big of a factor in determining relative living standards. Despite the long term drop in the Ringgit's value, Malaysians are steadily gaining on US living standards,

The housing issue is more related to demographics and supply constraints than anything else.

Hi Hishamh,

ReplyDeleteA few MGS are also maturing end September. And most of them are foreign holders. What impact do you think if would affect the MYR.

Do you also think BNM would raise rate too?

Thanks

@Sam

DeleteProbably negative, but not as much as people think. Real money investors will still buy Malaysian bonds.

As far as the OPR is concerned, I'd think the bias would be more towards easing than raising interest rates.

Why the bias towards a lower interest rate?

ReplyDeleteBased on our current Governor previous tendency, theres a high chance that she'll be keeping it steady. No?