Last week’s GDP report was a mixed bag. On the one hand it paints a picture of an economy slowing down, especially in terms of domestic demand. On the other hand, some of the indicators appear to have bottomed out.

The headline numbers aren’t appealing (log annual and SAAR quarterly changes; 2010=100):

Growth fell to 4.7% yoy, which is the fourth straight quarter growth has decelerated. Seasonally adjusted quarterly GDP appears to have picked up, but that could be from using a different seasonal adjustment method – DOS own seasonally adjusted series is also pointing down (log quarterly changes, SAAR: 2010=100):

On the demand side, it’s largely a story of domestic consumption (log annual changes; 2010=100):

…because you can see trade and investment are starting to pick up.

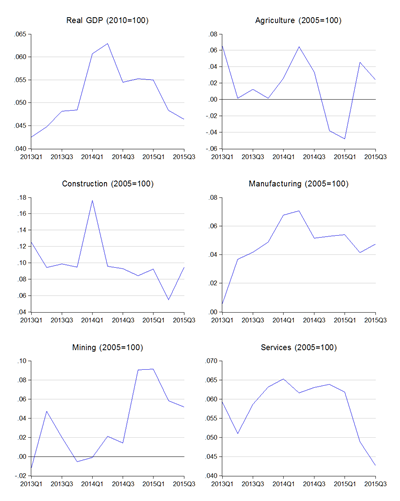

On the supply side, it’s fairly obvious who’s the big culprit (log annual changes; 2010=100):

Service sector growth basically tanked, to 4.3% from a peak of 6.4% in 4Q2014. I don’t think this is that big a surprise for anyone. Consumer sentiment took a hit with GST, and business sentiment has been growing steadily weaker.

At this stage, it’s hard to tell which way the economy will bounce. I’ve always been leery of taking on board the consensus view too much – it’s too tied into how the markets are doing, and the markets haven’t been great this year. To be fair, there’s been a lot of negative headwinds affecting the economy, from Greece, to GST, to Fed liftoff. The months-long haze problem can’t be overlooked either, nor can poor lending and money supply growth. The capital outflows due to the coming shift in global monetary policy has been tightening domestic liquidity, even before oil prices crashed.

Having said that, I’m not buying into all the negativity either – these are all survivable events, and the impact will dissipate with time. China appears to managing their slowdown – it’s a crash landing, but they’re doing everything they can to make it a controlled crash landing. As they say, any landing you can walk away from is a good one.

Japan is still struggling with growth, but given the demographic factor, this is nothing more than I expected anyway. The US and UK economies are doing fairly well, and Europe seems to be on the mend. Across the region, virtually every economy not named Vietnam are slowing down as well, but these have as much to do with structural factors as much as anything else. The key turnaround to me will come when (not if) the US Dollar trend starts turning.

Locally, I’m much more concerned with the medium term outlook than I am about 2016. I think we’ll do OK in 2016 – growth might not reach 5.0%, but that’s pretty good considering the circumstances. The big X-factor in my mind is the commercial property segment. We’re overbuilding, and there’s an awful lot of supply expected to hit the market between 2017 onwards. Luckily, this doesn’t appear to be credit-driven, which could precipitate a financial crisis, but it’s not something I have full confidence in.

Technical Notes:

3rd Quarter 2015 GDP report from the Department of Statistics

Did a bit of work on commercial properties and the glut might not be as bad as it looks, partly because there's shortage on top grade building. New office building supply is focused on these grades. The influx of top grade building should peak 2016-2019 IIRC from my earlier research, ignoring TRX (and possibly Menara Warisan/KL118), which is... that's another story.

ReplyDeleteThe problem will be with lower and older grade buildings. Those will suffer from the glut, assuming the migration to liquidity continues.

@Hafiz,

DeleteAgreed, it's Grade B, Grade C buildings that will suffer the most. Nevertheless, I think occupancy rates will be challenged across the board.