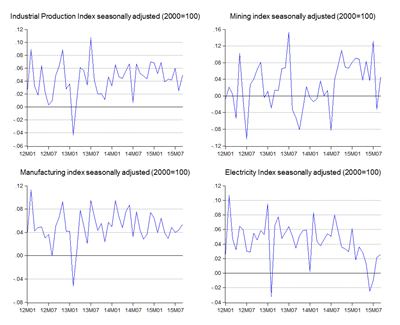

Monday’s industrial production figures paint a picture of recovery (log annual and monthly changes; seasonally adjusted; 2000=100):

Manufacturing output has been steady for most of the year, but mining output (read: oil & gas) had been on a downtrend. More worrying to me was the sharp drop off in electricity generation – that pointed to underlying weakness in both business and consumer demand. Unless this was a dead cat bounce, September’s figures suggests whatever malaise hitting both sectors is now over.

You can see that more clearly in the actual index numbers (rebased to 2000):

Mining is notoriously volatile, but electricity output has tended to be pretty steady – until lately that is. But whatever the reason for the drop, it appears to have passed, for now.

Be that as it may, the IPI is pretty rosy on the prospects of 3Q2015 growth (log annual changes; 2010=100):

My IPI model is “suggesting” the economy will grow by 5.7%. That’s probably wildly optimistic, largely because the subcomponents of the IPI account for maybe 30%-35% of the economy. The services sector, which takes up half, isn’t doing near so well – the latest data shows services expanded just 4.1% in the 3Q2015. That puts real GDP growth somewhere in between – take the average, and you’ll get about 4.8%-4.9%, or a little below what we got in 2Q2015. We’ll find out for sure in two days time.

On the upside, I think the quarter on quarter growth rate will show growth bottoming out in 2Q, which suffered from a high base in 2Q2014. My thinking is we’re probably past the worse in terms of the adjustment to the oil price decline, as well as the impact of GST implementation.

That’s barring another shock to the economy coming from elsewhere, which we can never rule out. The external environment is just as iffy as it was six months ago – US recovery may slow if the Fed raises rates as expected in December, Europe and Japan are a work in progress, and China’s growth is in secular decline. “Recovery” is going to be a relative word this year and next year.

Technical Notes:

September 2015 Industrial Production Index report from the Department of Statistics

No comments:

Post a Comment