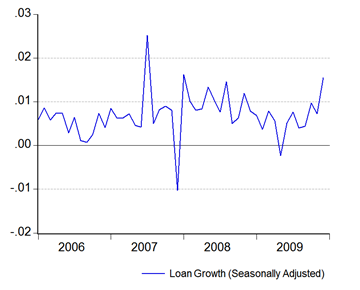

The big news on the economic front this week is of course this Thursday’s Monetary Policy Committee meeting, where I think there’s a 50-50 chance of a 25bp rise in the Official Policy Rate. There’s also some speculation over a rise in the statutory reserve requirement, but I don’t think a hike in the SRR will have much impact – I expect BNM in that event to simply pump the equivalent amount of liquidity back into the interbank market. This isn’t China – we don’t have the excessive loan growth the PBOC has to contend with. An SRR hike will be more of an administrative move, rather than a shift towards real tightening.

Nor are we dealing with excessive money supply growth – in fact just the opposite (log annual and monthly changes; seasonally adjusted M1 & M2):

On the interest rate front, yields on BNM bills and T-bills fell marginally in January but have gone up about 20bp since. MGS yields on the other hand have continued to steepen at the short end, although we don’t have the big jump that we had in December:

The latest indicative yields (end-Feb) indicative a further steepening in the 3-year benchmark maturities, but some softening at the long end. Unlike in the past, the government’s primarily borrowing at 3yr and 5yr maturities to fund the deficit – the actual bulk of outstanding debt is at 5yr and 10yr maturities. Either we’re looking at stricter fiscal consolidation over the short term, or they’re simply taking advantage of the lower rates at the short end.

Interbank rates haven’t and won’t move much of course, until BNM actually changes the OPR…for which we await Thursday’s announcement with bated breath.

Technical Notes:

Data from Bank Negara’s Jan 2010 Monthly Statistical Bulletin

No comments:

Post a Comment