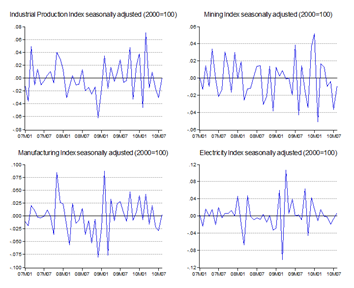

The August IPI report was released today, and like last week’s trade numbers, have been infected by the “holiday” spirit. Annual and monthly growth ticked up ever so slightly, driven mainly by higher electricity output (log annual and monthly changes; seasonally adjusted):

It’s the Ramadhan effect again (which my seasonal adjustment methodology doesn’t capture), so again, no need to read too much into the slowing growth story.

However, it’s interesting to note that the manufacturing index actually held up pretty well, helped in no small way by better electronics and electricals output (log annual and monthly changes; seasonally adjusted):

...which gives some grounds for optimism. There are some small signs that things are turning around in the US and Europe, so we’re on the look for green shoots again (remember last year?).

More immediately, two months of data give me enough to take a stab at forecasting 3Q real GDP:

I got a point forecast of RM142 billion and a 95% confidence range forecast of RM148.5-RM135.8 billion, which yields an annual growth number of 5.5% for the quarter, which isn’t too shabby all things considered.

Quarter on quarter growth (annualised and seasonally adjusted) won’t look so good however – I’m expecting essentially zero growth, followed by a 3.0% uptick in the last quarter of the year (3.6% y-o-y). But taken the stronger performance in the first half of the year, that gives an estimate of about 6.9% growth (y-o-y) for the year as a whole – better than the government’s still unadjusted forecast (watch for a revision on Friday), but a little worse than some of the optimists were looking at.

Technical Notes:

August 2010 Industrial Production report from the Department of Statistics

No comments:

Post a Comment