With most of August falling within the month of Ramadhan, an uptick in the money supply is to be expected – much like for Chinese New Year, BNM makes available newly printed money (the physical kind) for “duit raya” and “ang pow”.

On that basis, an acceleration in M1 growth is normal (log annual and monthly changes; seasonally adjusted):

My seasonal adjustment program doesn’t fully account for either Ramadhan or Chinese New Year, something I’m still working on rectifying (details here, point number 5). But aside from the possible bias that probably introduces in the time series, we’re probably looking at a couple of effects here in August. First is the currency injection of about RM1.8 billion (by comparison BNM added RM3.0 billion for CNY this year, and RM2.5 billion for 2009 end-of-year holiday season), and we’ll probably see some spill-over into September as Eid fell on the second week of last month. Secondly, BNM is also still leaching away liquidity from the interbank market due to capital inflows and to maintain their higher OPR target of 2.75% (RM millions; details on BNM’s monetary management here):

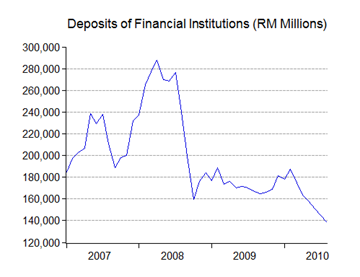

The banking systems’ reserves have now fallen half way down from their peak in 2008 (Deposits of FIs at BNM, RM millions):

…which also cuts into the effective reserve ratio (statutory plus excess reserves as a percentage of loans):

Bottom line: there’s no shortage of monetary ammunition for loan growth (log annual and monthly changes):

Note that sequential growth has fallen off, though not to the extent that it will ease anybody’s worries over incipient asset price bubbles, especially with mortgages loans still going great guns (log annual and monthly changes):

While there’s still some talk over increasing loan to value ratios, nothing concrete has been done as yet.

On the interest rate front, BNM’s increase of the OPR has been compressing loan interest margins, even as they held pat in the last Monetary Policy Committee meeting:

Interbank rates are up, but the increase slowed in August:

…but convergence in MGS yields (i.e. the yield curve flattening), has accelerated:

Technical Notes:

Data from BNM’s August 2010 Monthly Statistical Bulletin

"More evidence of capital inflows, and that there’s more interest in debt instruments as opposed to equity."

ReplyDeletebro hishamh

is this flow predominantly into the govvies sector?

if so r u seeing that a major currency play being executed?

I can't tell from the numbers if its more MGS than PDS - but knowing the Malaysian market, can you see foreigners buying anything less than AAA?

ReplyDeleteMGS trade volume has increased though (about 10% higher than last year).

And yeah, I think it's more a currency play than anything else - the yields aren't that good, and the stock market is near historical limits of PE.

Is the same thing happening in Indonesia?

ade sikit2 now mostly genuine equity flows....

ReplyDeleteBTW have u seen this

http://www.gapminder.org/data/

cool bubble charts

Cool stuff, thanks. Hog heaven, snort.

ReplyDelete