Marty Feldstein thinks the US Dollar will weaken…and that’s a good thing:

Feldstein Says Dollar to Weaken, Boosting Exports

Oct. 7 (Bloomberg) -- Martin Feldstein, a Harvard University professor who was chief economic adviser to President Ronald Reagan, predicted the dollar will weaken, boosting exports and strengthening the U.S. economy.

“Dollar weakness will be one of the few things that will improve our trade balance, and that will strengthen our exports,” Feldstein said in a Bloomberg Television interview today on “Surveillance Midday” with Tom Keene. “It will cause Americans to shift from imported goods into domestic services. All of that will strengthen the economy.”

Fund managers with large pools of dollars were converting the currency into euros before “all hell broke loose” during the European debt crisis, Feldstein said. As they resume trading dollars for euros, and the U.S. trade deficit remains high, the dollar will depreciate, he said…

…Feldstein, a member of President Barack Obama’s Economic Recovery Advisory Board, told Obama on Oct. 4 that extending income tax cuts for two years would stimulate demand and boost the recovery. He is a former president of the National Bureau of Economic Research and a member of the NBER committee that last month declared the worst U.S. recession since the Great Depression ended in June 2009...

...“You can only invest what you save or what you get from the rest of the world, and we have been living on funds from the rest of the world,” Feldstein said. “At some point, that line of credit is going to run out.”

The U.S. needs to “build up our savings here so that we can finance our own investment,” he said. “If we don’t do that, the capital stock doesn’t keep up with the growing labor force.”

Feldstein is right…and wrong. In theory, if the exchange rate depreciates, exports become relatively cheaper for other countries to buy and imports more expensive for US residents. Demand should rise for the former and fall for the latter, which should push up the trade balance for goods and services. But that’s not what the data is showing.

I think pressure will remain on the USD for years to come, but the problem is whether the weaker Dollar will have much impact on the US trade deficit. US exports have definitely benefitted from the weaker dollar, but imports have largely kept pace (log annual changes; seasonally adjusted):

…with the result that the trade deficit hasn’t really responded to dollar movements (USD millions):

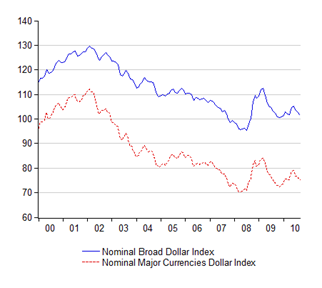

Now compare the chart above against actual USD movements:

The USD’s long term decline began in early 2002, and is down a little less than 30% in trade weighted terms against US trade partners and about a third against major currencies. But the trade balance has approximated movements in the dollar index – depreciation of the dollar brought about a worsening of the trade deficit, not an improvement. The collapse of global trade in late 2008-early 2009 saw demand increase for the USD (it went up), and an improvement in the trade balance.

In other words, changes in relative prices haven’t brought about changes in internal demand. That suggests in turn that the trade deficit is a consequence of structural demand (volumes aren’t changing), and movements in the trade deficit are a consequence of changes in USD denominated goods prices (i.e. the terms of trade). Reality has only (barely) begun following theoretical predictions just recently in 2010…which is not enough to declare that the long term structural influences on the US trade balance have dissipated.

In terms of policy, that means concern over undervaluation of the CNY and other Asian currencies are way overblown. Unless policies in both creditor and debtor nations are geared toward changing the structural dynamics behind global imbalances, a weaker USD won’t have the effects that orthodox economic theory might predict.

Technical Notes:

- US trade data from the Bureau of Economic Analysis

- US dollar indexes from the Federal Reserve

No comments:

Post a Comment