Via the Malaysian Insider, Dr Dzulkefly Ahmad of opposition PAS talks about the property bubble (emphasis added):

Of Property Overhang and Mounting Household Debt

Property Overhang as reported by Napic (National Property Informational Centre) for the third quarter of last year was supposedly a cause for alarm. Then there was an overhang of 20,286 residential, 5,450 shop and 619 industrial units worth a whopping RM5.3 billion.

Of the 6,401 new residential units launched during the third quarter, which was a far cry from the 14,588 units launched in the previous corresponding quarter, only 20.2% found buyers…

…The Finance Ministry also reported another 44,954 residential, 4,605 shop and 794 industrial units were under construction as of the third quarter. Projects approved but yet to be implemented comprised another 14,993 residential, 1,011 shop and 872 industrial units…

…More recently, Napic’s Property Overhang reports show that unsold properties in Malaysia rose to 22.6 per cent of new launches in the second quarter of this year, from 19.5 per cent in the fourth quarter of last year. For Kuala Lumpur, unsold properties rose to 16.1 per cent from 15.8 per cent, while for Selangor it rose to 14.6 per cent from 12.4 per cent.

Quite ironically while a glut is emerging, prices of residential property have surged by as much as 35 per cent in the past year, far above income growth and giving rise to concerns that the market is becoming unsustainable.

Checks on developments completed this year also show that vacancy rates remain at 50 per cent or higher…

…On the back of the emerging property bubble, the revelation of a ballooning household debt, comprising mainly house mortgages, cars loans and personal financing such as credit cards, debit cards which stood at an all time high of RM560 billion as at Aug 31, 2010 from Bank Negara Malaysia data is surely a cause for alarm…

…It is worth noting that our household debt to GDP ratio shot up to 76% between 2004 and 2009 and is the highest in Asia, except for Japan. But as a reminder, Japan’s per capital income of US$32,700 or about RM8000 per month in 2009, while Malaysia’s average income per capital is less than RM2000 per month.

According to a note by CIMB Research, the ratio of household debt to personal disposal income hit 140.4 % in 2009- higher than Singapore 105.3% and the US 123.3%. This means Malaysians owe double the amount they earn…

…Since Malaysians tend to have short memories and have a penchant for the denial syndrome, it’s pertinent to remind our political leaders and planners of the costly deflation of the property bubble in the aftermath of the 1997/98 regional financial crisis.

When the property bubble burst, the banking system was left with RM51.8 billion worth of non-performing loans (NPLs), forcing the government of Tun Dr Mahathir Mohamad to form Danaharta Bhd to assume the NPLs and Danamodal to help recapitalise the banks.

…Going by the orgy of real estate developments in recent years, it is clear that both the regulators and the developers have forgotten the 1997/98 lessons or have not learnt much. Notably the government is discouraged to put a higher real property gains tax (RPGT) and restrictive loan-to-value (LTV) caps as it will be a deterrent to foreign direct investments and high net worth individuals. Besides, a higher LTV for second and third home buyers and in specific hotspots areas, of say 70:30, may not be complied with after all, by the financial institutions…

I wish more politicians would take the time to cut the data this way – even if it turns out they’re wrong, or mostly wrong as in this case.

Dr Dzul starts out with a thesis and proceeds to try and prove it, but it doesn’t quite hang together. It also resulted in this hilarious exchange in parliament:

Property prices rose only 3.3%

RESIDENTIAL property prices in the country rose only by 3.3% this year, said Deputy Housing and Local Government Minister Datuk Seri Lajim Ukin.

Citing a survey conducted by the Global Property Guide, Lajim said the price appreciation of residential properties in Malaysia was the fourth lowest in the Asian region.

“Among the Asian countries, Singapore recorded the highest increase of 38.1%, followed by Hong Kong at 24.53% and Taiwan at 12.74%,” he told Dr Dzulkefly Ahmad (PAS-Kuala Selangor).

However, Dr Dzulkefly felt the figure was not right.

“The statistics must be wrong. It does not make sense,” he told the deputy minister.

Lajim insisted his information was right and said: “It is not wrong. The Opposition is wrong. We are the Government, and these are the official figures”...

So on the one hand, Dr Dzulkefly is accepting the official statistics with respect to the property overhang, but doesn’t accept the price statistics (which actually come from the same source). As for the Honourable Deputy Minister, I’d refer him to Greece; government statistics; fraudulent. Saying that statistics must be correct because it comes from the government (bearing in mind that data can and have been revised extensively), is rather silly.

Property

But getting back to the issue at hand, there are a number of things going on, which I’ll try my best to explain such as why there’s a “glut” in the midst of a price “bubble”.

First the insight that is missing here is that the property “market” is really a collection of markets, with different demand and supply conditions and intrinsic characteristics. The aggregation of prices under the Malaysian House Price Index hides a lot of heterogeneity (Annual index numbers and log annual changes; 1988-2010; 2000=100):

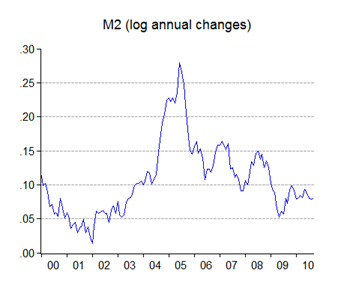

Prior to that date, BNM was intervening heavily in the foreign exchange market, and largely sterilising that intervention. In September however, Jaafar Hussein was replaced by Ahmad Don as Governor, and Anwar Ibrahim became Finance Minister. Intervention continued, but this time without sterilisation. As a result, money supply and loan growth exploded into the 20%+ range, feeding directly into real estate prices. Who you want to assign blame for 1997-98 depends on your point of view, but I for one am not blaming Soros and hedge funds.

In any case, nothing like that is happening now (log annual changes; 2000:01-2010:09):

As for current residential property prices, how to reconcile the overall slow rate of increase with the anecdotal evidence of double-digit price increases?

We know that most of the price increases have been confined to Kuala Lumpur and Penang and largely to prices of high rises. But since these are just a fraction of the overall property market, it should be no surprise that the overall price level isn’t fully reflecting the price bubbles in these markets (Quarterly MHPI indices; log annual changes; 2000=100):

Note that price increases peaked in 4Q 2009, and have decelerated since – a circumstance that better fits the observation of higher unsold property stocks. Even if prices double in say the Mont Kiara enclave, it’s not going to push prices across the entire market; you can’t meet the demand in KL by building supply in Perlis. That also helps to explain the concurrent observation of rising prices with higher stocks of unsold property – prices are rising in one area, but unsold stocks are higher in others, something the good Doctor notes but somehow fails to grasp the significance of.

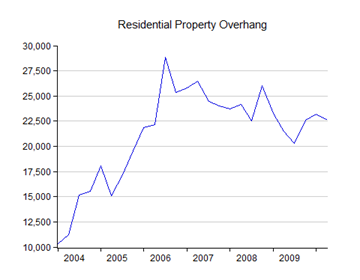

More to the point, we need to put the property overhang in its proper context. The growth numbers look bad – until you look at the actual time series (units completed but unsold; quarterly data; 2004:01-2010:02):

…and if you consider the unsold stock in proportion to the total stock (quarterly data; percentage terms; 2004:01-2010:02):

Current stocks of unsold property represent just 0.5% of the entire housing stock, and is slowly coming down in absolute terms. To me, the rise in unsold stocks over the past year look more like seasonal variation and the typical lags that affect residential development, rather than a structural change in the market.

Some more perspective (quarterly data; units; 2004:01-2010:02):

Note the left-hand scale: when completions and sales in any given quarter is in the tens of thousands, a one or two thousand change in unsold properties shouldn’t be unusual.

Just as important, the chart above would tend to disprove the contention that the doctor and some of others hold that property developers are indiscriminately launching new projects – if anything, they’ve been producing progressively less. That fits the anecdotal evidence that developers have become more selective in their project planning since the recession hit. And if you want further proof (quarterly data; log annual changes):

Growth in the total stock of housing has been falling continuously over the past decade. Part of the reason is that, right at this moment, the market at a whole appears to be saturated (quarterly data; ratio of housing units to total population):

There are a couple more things that need to be taken into account here:

First is that there is long term trend of migration from rural to urban areas – the ETP is forecasting the urbanisation ratio (the proportion of the population in urban areas) to rise from 70% to 75% by 2020. That will increase demand for housing in urban areas, while leaving rural areas with a glut of housing. This may be part of what we’re seeing now.

Secondly, there is the demographic transition. As the population ages, demand for housing will increase pretty dramatically as those currently in school enter the workforce. I haven’t formed an estimate of how much, but eventually it will lead to the pop/housing ratio to drop again.

But taking all these disparate numbers together, my opinion is that there’s very little fundamental reason for house prices to rise in aggregate over the short term. Foreign demand can only impact certain urban addresses, but we’re' not Singapore or Hong Kong. Malaysia’s property market is geographically larger, more diverse, and less vulnerable to isolated short term demand spikes.

Which also implies that BNM’s selected measures is a better policy move than a general rise in interest rates, which would be too blunt an instrument for the purpose.

Household Debt

On this issue, I don’t know where Dr Dulkefly is getting his data. Based on BNM data, household borrowing from the banking system is just RM475 billion, not RM560 billion:

Is it increasing? Yes. Is it a problem? Potentially, but not yet. Again I don’t know where Dr Dzul got his figures, but they don’t fit the official data (annual data; 1996-2009):

You’ll only approximate Dr Dzul’s figure of 76% if you make the tyro’s mistake of using real GDP instead of nominal GDP. Now there’s no doubt the ratio has increased, but this is a little misleading, as nominal (and real) GDP crashed in 2009. Data for this year indicates that the ratio has flattened out (quarterly data; 2001:01-2010:03):

Again, this looks like a non-issue to me. The numbers of bankruptcies and people seeking debt counselling have increased in absolute terms, but as a proportion to the banking systems total loan portfolio, there hasn’t been a big increase.

Going back to the demographic story, given the low median age of Malaysia’s population, a rise in debt should in fact be expected. You’d really only see the debt ratio falling once the median age passes 40, which isn’t expected to happen until after 2050.

So to sum up:

- There’s been no overall increase in residential market prices, except in certain areas;

- The property overhang is larger this year compared to last year, but the trend is still firmly down;

- Sales and project launches are coming down as well, not going up;

- The market is saturated, and this won’t change for a few years;

- Household debt has risen, but not out of hand.

Technical Notes:

- Property stock and price data from NAPIC

- Loan data from BNM’s Monthly Statistical Bulletin

Dear Hisham H,

ReplyDeleteGreat post. I was thinking about that too this morning. I however am of the persuasion that the function of price of property is related to the a) Minksy hypothesis b) the ability of banks to continue to lend to this sector.

The Minsky hypothesis contends that the prices today are set at the margin. And the marginal player is the speculator, and not the genuine home buyer. So price gets propped up a) as some speculators cash out b) others plough back their gains into the same sector

As we all know, bubbles pop. And this bubble will pop once the latter 3-4 yr vintages start to turn bad as people cannot service the debt. So far this has yet to happen, I think prices can go up another 30% before we have this sort of boom and bust

Malaysian household debt (per GDP) is Asia 2nd highest after Japan, even accelerating more this year. And you're saying our situation is not out of hand?

ReplyDeleteSteps must be taken by Malaysia before it's too late.

Recently move on 70% loan on third house is a good start & more should be done.

Sadly, the government is now even considering the 100% loan guarantee for first house buyer from initial 220k (announced Oct 10) to 350k. This is putting petrol on the fire.

don't take date without first digesting it properly.

ReplyDelete1. overhang is unsold figure from developer to gov.

What about the sold unit but left empty? take a look at around klcc, mont kiara at night. most unit is obtained CF more than a year!!

2. price increase by 3.3% is low. well, if you buy house since 2009, you will know it's not true. most buyer have difficulty to get valuation, simply because valuer can't even catch up with the rapid price increase going on in the market! remember, gov take number on year to year basis. property price at Klang valley, penang & JB change by monthly basis. don't believe? ask property agents or bankers.

in US before sub-prime crisis, there're so call experts giving assurance one after another that the market was alright. none of them hold true. don't take gov official stats and data literally.

common sense rules! go down to the field, see and ask people. get real!

@Wenger

ReplyDeleteYes I was actually thinking much the same, but over a longer time span. If my hypothesis is correct, there will build up a generalised glut right now. This will invoke - actually already HAS invoked - a supply response, if the completion and sales numbers are correct.

That in turn will mean (along with the demographic changes I'm seeing) that somewhere along the line (maybe 10-15 years from now), there will be a structural push up in prices, that will induce a real, generalised bubble in prices which will pop - it seems each generation has to relearn this lesson.

But that's not what I'm seeing now.

@anon 10.13

ReplyDeleteI cannot reconcile Dr Dzul's stats with the actual numbers I'm seeing - unless I see the source and its provenance, I cannot take it as accurate.

Because the data I have from official sources (and using the correct denominator) is showing much lower debt/GDP ratios than Dr Dzul is quoting.

If you can let me know where Dr Dzul got his numbers from, I'll be more than happy to check them out.

@anon 10.24

ReplyDelete1. Whether the sold units are actually occupied is irrelevant. So too is the fact that there is a bubble in some parts of KL - I'm disputing neither.

2. My source data is actually quarterly, and in index form NOT growth numbers i.e. its the geometric average of actual prices relative to the year 2000. You can calculate growth numbers yourself directly from there.

Prices are up for KL, Penang and the Iskandar region, but not so much for the nation as a whole.

3. If you look at the actual price data for the US, there was a general rise in prices across the board, not in select areas like we're seeing here.

From the point of view of systemic risk to the economy and the financial system - which is all I really care about - a crash in prices in these areas will only hurt the speculators and legitimate buyers who bought at the same time.

But it won't represent a big risk to the banking system, and thus to the rest of the economy. The crux of the problem in the US was not housing per se (default rates of sub-prime borrowers was actually no higher than in the last recession in 2000-2001), but the securitisation of these assets into the shadow banking system. BNM does not allow our banks to sell structured products e.g. the Lehman mini-bonds that caught out investors in Singapore and Hong Kong.

Again, I'm not disputing that a bubble exists in the metropolitan areas, but I think the risk is limited to those markets only and not to the economy as a whole.

And that's why I think Dr Dzul's post was off base. It's too alarmist, and based on a shaky interpretation of the numbers.

The way I see it, the Govt has to do something about the inability of many working adults in their late-20s to mid-30s being "priced out" of the housing market especially in Klang Valley.

ReplyDeleteI bought my current double storey terrace house in Bandar Kinrara for RM230K in 2000 when I was 31 years old. Our net household income then was about RM6K and I pay around RM1.6K for my monthly instalment (25% of our net household income).

Based on my quick survey of my younger colleagues in my office (early 30s to mid-30s), their current net household income is around RM8K but the same house in Bandar Kinrara that I bought in 2000 now cost around RM400K. Assuming the same loan is taken at current rate with similar loan percentage and repayment period, the monthly instalment will be around RM2.8K. (35% of net household income)

My point is the price of houses have gone up at a much faster rate than the salaries in the past 10 years. If this continues, our new graduates will see a much lower quality of life as they will have to stay at least 30-40KM from their work place and have almost no savings due to the high monthly instalment and higher cost of living.

Dear Hisham H,

ReplyDeleteThanks for your insightful article. Have always enjoy reading your analysis.

I am a part-time property investor so i would just give some comments from a retail investor point of view.

1) Agreed with the above. Overall house price increase is small but selected locations in KV & Penang are getting very bubblish.

2) We must always remember that property is an asset class that is highly subject to its location-specific factors. That is why overall increase of 3% p.a. does not mean 10-15% annual growth in certain areas is such a rarity.

Based on my opinion, the key factors that will eventually determine the sustainability of the house price include LOCATION (e.g. PJ), accessibility (e.g. close to LDP), convenience (e.g. distance to a prominent shopping mall), concept & design (e.g. greenery, Gated & Guarded) and alternative substitute (e.g. limited empty land in established areas like Cheras, PJ, kepong). Of course the above factors are subject to supportive govt policy and favourable demographic trend (which Malaysia is having both now).

3) Therefore, on the medium term outlook, i think the property bubble (in KV & Penang) may continue with a gradual uptrend but not a dramatic crash due to the following:

(i) Government policy suppport - I think government is going to use property as a sector to "activate" the economy and as the key driver to achive the 2020 high-income status. Reason is this is a fast & easy solution to keep building & buidling to achive growth (not without adverse side effects) hence the adequate policy support can be expected. We all are seeing the early signs such as Sg. Buloh Rubber Research Land, Sg Besi Army Base Property Project, 100-tower project, MRCB-IJMLand merger, UEMLand-Sunrise merger, MRT projects (this is actually very beneficial to the economy though) and other upcoming mega projects.

(ii) Lack of alternative investment - I think the investment opportunity for businessmen in this country is getting more & more limited in recent years as the economy faces the "middle-income" trap yet still very slow in the structural transformation (e.g. HR development, value chain upgrade). Combined that with competitions from GLC and low-cost neighbouring countries, plus the rising cost of doing business, i think most businessmen have difficultiy in re-investing their past captial gain back into business so they rather choose the safe & easy property investment (unlike the super volatile stock market). This is why you see the high-end property prices keep going up.

(iii) Cheap funding from banks - The bank are extremely willing to lend money to the property buyers these days. You just go to the market and ask around you will know how attractive the terms (including interest rate) are. Hishamh, i do not understand the rationale on why are banks flushed with abundant liquidity now. Why and will this cheap funding sustain for a few more years? Appreciate your advice here.

DISCLAIMER: The above are just my personal views. Property investment, like any investment, is still a very risky financial commitment especially in the current environment where some greedy developer are pricing their new launches at ridiculous prices. The other risks are oversupply risk as the occupancy rate in the condo in KLCC and Mont Kiara are 40-50% and 50-60% respectively. The rental yields are very low now (3-5% for condo and 1-2% for landed) so investor can only HOPE on the capital appreciation in the future. In fact, i suspect that there are only 10% of the properties out there that can actually make money for investors.

Dear Hisham H,

ReplyDeleteThanks for your insightful article. Have always enjoy reading your analysis. I am a part-time property investor so i would just give some comments from a retail investor point of view.

1) Agreed with the above. Overall house price increase is small but selected locations in KV & Penang are getting very bubblish.

2) We must always remember that property is an asset class that is highly subject to its location-specific factors. That is why overall increase of 3% p.a. does not mean 10-15% annual growth in certain areas is such a rarity.

Based on my opinion, the key factors that will eventually determine the sustainability of the house price include LOCATION (e.g. PJ), accessibility (e.g. close to LDP), convenience (e.g. distance to a prominent shopping mall), concept & design (e.g. greenery, Gated & Guarded) and alternative substitute (e.g. limited empty land in established areas like Cheras, PJ, kepong). Of course the above factors are subject to supportive govt policy and favourable demographic trend (which Malaysia is having both now).

3) Therefore, on the medium term outlook, i think the property bubble (in KV & Penang) may continue with a gradual uptrend but not a dramatic crash due to the following:

TO BE CONT'D

(i) Government policy suppport - I think government is going to use property as a sector to "activate" the economy and as the key driver to achive the 2020 high-income status. Reason is this is a fast & easy solution to keep building & buidling to achive growth (not without adverse side effects) hence the adequate policy support can be expected. We all are seeing the early signs such as Sg. Buloh Rubber Research Land, Sg Besi Army Base Property Project, 100-tower project, MRCB-IJMLand merger, UEMLand-Sunrise merger, MRT projects (this is actually very beneficial to the economy though) and other upcoming mega projects.

ReplyDelete(ii) Lack of alternative investment - I think the investment opportunity for businessmen in this country is getting more & more limited in recent years as the economy faces the "middle-income" trap yet still very slow in the structural transformation (e.g. HR development, value chain upgrade). Combined that with competitions from GLC and low-cost neighbouring countries, plus the rising cost of doing business, i think most businessmen have difficultiy in re-investing their past captial gain back into business so they rather choose the safe & easy property investment (unlike the super volatile stock market). This is why you see the high-end property prices keep going up.

(iii) Cheap funding from banks - The bank are extremely willing to lend money to the property buyers these days. You just go to the market and ask around you will know how attractive the terms (including interest rate) are. Hishamh, i do not understand the rationale on why are banks flushed with abundant liquidity now. Why and will this cheap funding sustain for a few more years? Appreciate your advice here.

DISCLAIMER: The above are just my personal views. Property investment, like any investment, is still a very risky financial commitment especially in the current environment where some greedy developer are pricing their new launches at ridiculous prices. The other risks are oversupply risk as the occupancy rate in the condo in KLCC and Mont Kiara are 40-50% and 50-60% respectively. The rental yields are very low now (3-5% for condo and 1-2% for landed) so investor can only HOPE on the capital appreciation in the future. In fact, i suspect that there are only 10% of the properties out there that can actually make money for investors.

(i) Government policy suppport - I think government is going to use property as a sector to "activate" the economy and as the key driver to achive the 2020 high-income status. It is a fast & easy solution to keep building & buidling to achive growth (not without adverse side effects) hence adequate policy support can be expected. We all are seeing the early signs such as Sg. Buloh RR Land project, Sg Besi Army Base project, 100-tower project, MRCB-IJMLand merger, UEMLand-Sunrise merger, MRT projects (this is actually very beneficial to the economy though) and other upcoming mega projects.

ReplyDelete(ii) Lack of alternative investment - I suspect the investment opportunity for businessmen in Malaysia is getting more limited in recent years as the economy faces the "middle-income" trap yet still slow in the structural transformation (e.g. HR development, value chain upgrade). Combined that with competitions from GLC & low-cost neighbouring countries, plus the rising cost of doing business, i think most businessmen have difficultiy in re-investing their past captial gain back into their business so they rather choose the safe & easy property investment (unlike the super volatile stock market).

(iii) Cheap funding from banks - The bank are extremely willing to lend money to the property buyers these days. You just go to the market and ask around you will know this. Hishamh, i do not understand the rationale on why are banks flushed with abundant liquidity now. Why and will this cheap funding sustain for a few more years? Appreciate your advice here.

Disclaimer: The above are just my personal views. Property investment, like any investment, is still a very risky financial commitment especially in the current environment where some greedy developer are pricing their new launches at ridiculous prices. The other risks are oversupply risk as the occupancy rate in the condo in KLCC and Mont Kiara are 40-50% and 50-60% respectively. The rental yields are very low now (3-5% for condo and 1-2% for landed) so investor can only HOPE on the capital appreciation in the future. In fact, i suspect that there are only 10% of the properties out there that can actually make money for investors.

I think the doctor got the household debt figure of 76% of GDP from Citi Investment Research and Analysis paper. If I recall there was an article in The Edge Weekly which covered household debt where this figure was bandied about, along with its comparison to other countries' household debt as well.

ReplyDelete@Anon 12.17

ReplyDeleteI'm not sure that this is something that the government can actually do anything constructive about - most of the measures that have been tried have historically failed (e.g. rent controls).

Anything done to limit house price increases is tantamount to a subsidy for housing, which isn't something I'm in favour of. You'll just build up price pressures on the one hand, and limit supply on the other.

Another part of the problem is developers now have too much capacity in terms of construction resources relative to market demand. That's why you're seeing a shakeout in the market right now, with developers merging or looking for JV partners.

In any case, sadly, I think what you're seeing right now is inevitable - we're looking at a structural change in labour immigration from rural to urban areas, which puts pressure on urban housing prices (and holds it down elsewhere). It will get worse, as Malaysian incomes rise. If you look at most developed countries, you'll see the same thing - increasing urbanisation means people have to accept a lower quality of life (expensive housing, congestion) than their elders.

My parents had great foresight (or were incredibly lucky) when they bought our house 40 years ago - big plot, great location (SS1) in a quiet neighbourhood, yet close enough to the city. But I could never afford something like that myself now. I've noticed that detached houses like these are so far out of reach of most people, that only businesses can afford to buy them.

But the urbanisation process will eventually reverse - slightly - as costs force people to move further away from urban centres for decent housing and facilities. That's why a good transportation system (read: MRT) is so critical, as it helps alleviate some of the welfare loss from agglomeration.

I'd been wanting to do a post on this issue for some time now, but haven't yet found the time (with this article as the focus). The whole thrust of the Greater KL section of the ETP is specifically to deal with this issue, of which housing is just one aspect.

@Wiun Kiat

ReplyDeleteNice analysis! Nothing I would quibble with - you've obviously done your homework on the subject.

For the liquidity issue, this is actually a structural change and an interesting story in itself. It has to do with the development of the bond market (we have the biggest in SEA). As corporates started tapping the bond market more and more for funding (beginning in the aftermath of the 1997-98 crisis) , they have borrowed less and less from the banking system.

To compensate for the loss of income earning assets, banks did two things - started investing in corporate bonds themselves (where they have to compete with other funds e.g. EPF), and shifted lending priority to the household sector. They've also begun putting more and more emphasis on services that don't leverage on the balance sheet e.g. wealth management, fund management, corporate advisory etc.

This is still an ongoing process, and we won't see the end of it for some time. That's part of the reason why I'm not overly uptight about rising household debt at this juncture - it's partly demographic, and partly due to changes in the structure of the financial system.

As for housing prices, I think we're right at the low point in terms of yield - as I pointed out in the post, the ratio of housing to the population is at near saturation level.

But I'm not sure I would hazard a guess as to whether they will go up again. On the one hand, as the population ages, there will be more demand for housing as youngsters start looking for their own homes. On the other hand, marriage (if it still remains in fashion) would probably limit any increases. On balance I'd say the former, but only in urban areas.

@anon 6.43

ReplyDeleteThanks, I'll look it up.

Thanks to all contributors. Very useful discussion.

ReplyDelete