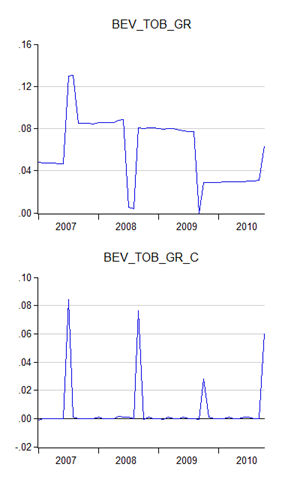

Last week’s report on consumer prices showed inflation jumping 1.9% in log terms (log annual and monthly changes; 2000=100):

In a reversal of the usual case, core prices (ex. food and transport) rose faster than the pain index (food and transport prices).

It’s not hard to explain why (log annual and monthly changes; 2000=100):

Even before the budget was announced in the middle of the month, the government hiked excise duties on cigarettes by 1 sen per stick effective October 1st, an increase of 5.6%. That almost exactly matches the increase in the tobacco price index above.

Apart from that, there’s hardly anything else of interest to report – the only other item showing a marked increase was in the “miscellaneous” category which rose 0.6% on the month, which I defy anyone to make sense of.

There’s still no impetus for any changes in the monetary policy stance – at least from the point of view of inflation. That will most likely come from other sources, such as capital flows or if the property bubble starts migrating to the periphery.

Technical Notes:

October 2010 Consumer Price Index Report from the Department of Statistics

Dear Hisham H,

ReplyDeleteI know its not related to CPI, but is it possible for you to give a laymans understanding of the 3 types of monetary intervention

(a) Capital controls

(b) Sterilization - partial and full

(c) Managed float vs. crawling peg

(d) Full free market

I have trawled the web and I see that yours is one of the best resources as you take the readers from 0 to a very deep level.

I know that you are busy managing this web, but if you could do one of this article in your time of course, it will very much appreciated

Oooh, don't ask for much do you? ;)

ReplyDeleteI've already done a post on forex intervention (here). Sterilisation is just open market operations (see this post) that fully or partially offsets intervention.

The choice between full and partial intervention depends on what time of regime the central bank is running to manage monetary conditions. Under BNM's current regime, it should in theory always be full sterilisation.

As for the rest, I don't think I can do a post on capital controls because it's really just a catch all term for a bunch of widely different administrative measures, which go all the way from having to report all forex transactions, to taxation, to limits on forex holdings, to an outright ban on forex trading. Hard to make sense of all this in the context of a blog post. But in essence, it's any measure used to control, or slow down, capital flows into or out of the country.

For the different forex regimes, you can try this post. The difference between a crawling peg and a managed float is that the former has an explicit fixed target based on a single currency or basket of currencies, while in a managed float, the central bank has more discretion. Which one is better (or whether you should go for a full free float) depends on the size of the economy, its exposure to trade, and its state of development.

Generally, the smaller a country, the greater its exposure to trade, or the less developed it is, the more you should err towards having a fixed, or relatively fixed exchange rate.

Thanks a lot Hisham H. I think I've just about finished my quota for 2010. Lucky its December :-)

ReplyDelete