The report for this October’s industrial production indexes gives grounds for some optimism. You’re not going to see it from the annual growth percentages though (log annual changes; seasonally adjusted):

The IPI and its component indexes have all turned down from the peaks seen in late 2009 and early 2010. This is highly misleading however, and largely due to the high base effect from the sharp recovery following the recession.

The monthly growth metrics look better (log monthly changes; seasonally adjusted):

Both manufacturing and electricity production increased, and the latter portends faster private consumption growth as well. I’d tend to dismiss the fallback in mining production as that’s usually highly volatile, and is probably related to gains in prices.

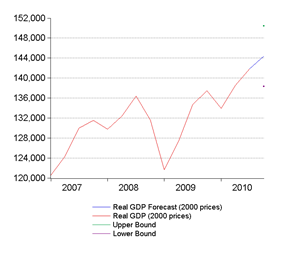

Admittedly, this “growth” doesn’t look like much, but based on October’s output alone, GDP growth for the 4Q will be at least a full percentage point higher than it would otherwise have been:

We’re now looking at around 5.0% annual growth for 4Q 2010, higher than the 3.6% I forecast a couple of months back. That also puts full year 2010 growth at around 7.2%, a little better than the government’s forecast.

Looking ahead over the next couple of months, I’m fully expecting industrial production to continue seeing gains as recovery in the US and sustained growth in the region helps drive manufactured and commodity exports; it’s certainly not domestic production that’s driving growth right now (index numbers; seasonally adjusted; 2000=100):

Technical Notes:

October 2010 Industrial Production report from the Department of Statistics

No comments:

Post a Comment