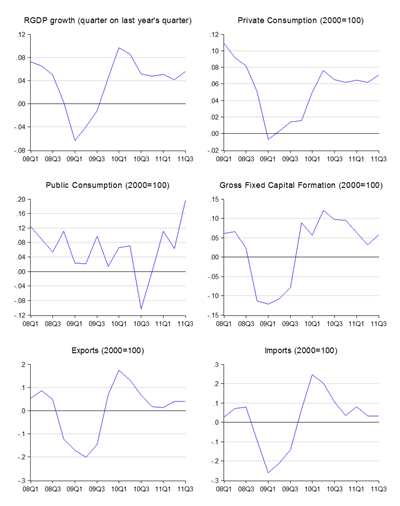

Despite a lot of evidence, seems nobody could quite believe that Malaysia’s economy could keep growing – the consensus growth forecast for 3Q2011 was just 4.8%. Consider this some proof that there’s some fire with that smoke (log annual changes; log quarterly changes, seasonally adjusted and annualised):

On an annual basis, the economy grew 5.8%, a full point above the forecast. But from my point of view, the more important stat is seasonally adjusted quarter on quarter annualised – which is the international standard of measuring GDP growth. That measurement shows the economy grew 3.8%, above the 2.4% hit in 2Q 2011.

Interestingly enough, DOS has also revised upwards growth for the first half of the year as well, as much as 0.3% y-o-y for both quarters.

So where did this growth come from?

Actually, it’s probably more correct to say what didn’t grow – on the demand side, contributions came from pretty much across the board. Private consumption and investment stayed strong, public consumption picked up, and while trade fell off, imports dropped more than exports.

On the supply side, it’s a little different story, with a jump in construction and a recovery in manufacturing and mining (log annual changes; log quarterly changes, seasonally adjusted and annualised):

One clear story emerging from this is that the economy is slowly rebalancing towards domestic consumption and investment. Nevertheless, Malaysia remains one of the countries most highly exposed to external trade, as combined trade remains well over 200% of real GDP.

So we get into the question of how sustainable is this growth?

The key point here is that Malaysia’s trade is increasingly tied to the fortunes of the region as our direct exposure to the US and Europe has fallen to about 20% of total trade. While there’s little basis for the decoupling thesis, we’re less vulnerable than we were a short five years ago.

China’s 2009-2010 credit stimulus can be given the credit for pulling Malaysia and the rest of East Asia out of recession, but the troubling news of financial sector fragility coming out of there is probably of far more significance – if grabbing less headlines – than debt restructuring and fiscal austerity in Europe.

On that basis it’s difficult to say how accurate the government’s 2012 GDP forecast will turn out to be, though I think I’m probably alone in thinking we could possibly hit the higher end of that growth range. We just know too little about the true state of China’s credit bubble and bank exposure to real estate. Over the medium term, China also has to deal with a looming demographic crisis which could severely dampen growth.

For the rest of this year, I think hitting the middle of the 5%-5.5% government forecast is probably in sight. We’ll have a better idea when the October numbers start coming out, but my feeling is 5.2%-5.3% is probably going to be it.

Technical Notes:

3Q 2011 National Accounts from the Department of Statistics

No comments:

Post a Comment