Malaysian money supply growth accelerated through the quarter ended September, helped by a nice dose of extra fixed deposits and forex deposits (log annual and monthly changes; seasonally adjusted):

Even as cash left the system (BNM destroying old notes after Ramadhan), deposits jumped 2.4% on the month.

September of course is when flight to safety ruled global markets, and that’s clear from the data:

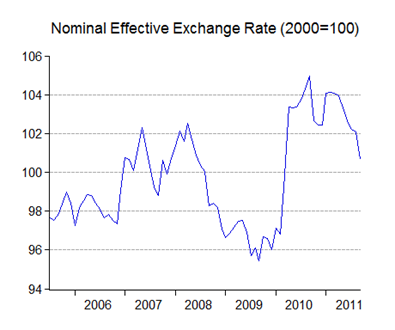

Lots of people getting out for “safer” climes, which dropped demand for Malaysian securities. Interest rates as a result generally rose slightly, particularly at the longer end:

Still, we’re not seeing any real reassessment of the economy by the market – the yield curve is still pretty flat:

MGS spreads in September were as low as in the third quarter last year, when we had the last global recession scare.

Borrowers and lenders on the other hand, appear to be living in a different world (log annual and monthly changes):

Loan growth held up pretty well through the last couple of months of the quarter. More importantly, it’s mainly business borrowing, as household borrowing has been decelerating for most of the year. And after diving in the middle of the year, loan demand has started to tick up (log annual and monthly changes; seasonally adjusted):

We’re little more than 10 days away from the next Monetary Policy Committee meeting, which is due on the 11th of November. From the data, it’s hard to make a case for anything other than keeping the OPR at the current level of 3%. Even as foreign investors started leaving Malaysian markets, there’s still an impressive amount of excess liquidity in the banking system. And even if global growth slows, core inflation remains at uncomfortably high levels. That’s a tight balancing act that the MPC has to achieve.

No comments:

Post a Comment