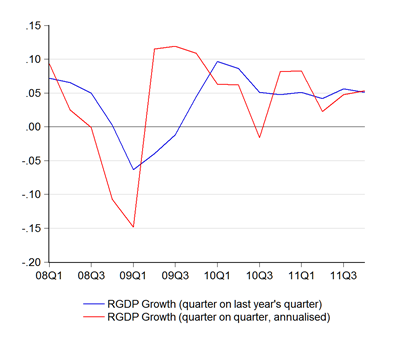

As I thought it might, 4Q GDP pushed the full year 2011 GDP growth above 5%, hitting 5.2% in percentage terms and raising full year growth to 5.1%. Even as external conditions weakened, domestic demand held steady while investment zoomed (log annual and quarterly changes; quarterly changes are seasonally adjusted and annualised):

You’ll note that the two different basis of growth calculation are saying different things: annual growth slowed, but quarterly growth picked up. But the two measures are close enough that we could take it as more of just steady growth rather than any indication of changes in momentum. The following comments are based on quarterly changes, as its the internationally accepted standard – if you want the annual view, there’s always the papers.

On the demand side, it’s all about consumption and investment (log quarterly changes; seasonally adjusted and annualised):

Private consumption decelerated to 4.3% in log terms, but this was offset by a big jump in government spending, which zoomed 33.4% over the already spiffing 3Q2011 growth of 17.3%. Investment continued to increase at double digit rates, hitting 18.3%. Both exports and imports posted solid gains, though import demand was the stronger – I’ll have more to say about this at the bottom of the post.

On the supply side, manufacturing and mining both posted recoveries, while services growth picked up (log quarterly changes; seasonally adjusted and annualised):

Agriculture production declined, but construction growth continued to hit double digit rates. What with even more construction projects under the ETP set to kick off this year, I suspect this might continue well into this year.

What does all this say about growth this year? Nothing really. Last year, manufacturing and trade were hit by a trifecta of shocks – Japan’s earthquake and tsunami in March, and the Euro debt crisis and the flooding in Thailand in the second half of the year. The crisis in Europe is ongoing, but the regional supply chain disruptions are healing. We’ve also got a plethora of big ticket projects kicking off this year, which should give a boost to investment and private spending, whatever external conditions turn out to be.

The only problem is I’m not sure that necessarily translates into higher growth. I do think that the government’s 5%-6% forecast for 2012 is achievable, but it’s going to come with a price tag. One thing I’m leery of is putting too much faith in growth multipliers from construction, which for all its purported linkages to the rest of the economy, has a lot of leakages – foreign workers, a partial reliance on imported raw materials, as well as (for the bigger projects) requiring capital goods and services imports.

So I see a number of countervailing effects that might offset investment growth such as higher raw materials costs (PPI inflation), crowding out of other construction investment both from higher costs and supply bottlenecks (like residential housing), higher imports (which reduces the contribution of exports), and downward pressure on the Ringgit (which cuts our progress towards high income status).

We have to take into consideration too that at present the economy’s output gap is pretty much closed – higher spending usually translates into higher inflation not higher growth, especially when the spending is concentrated in a relatively small part of the economy.

There’ll be benefits down the road – investment in infrastructure is always a long term positive – but the short term impact might not be as great as you’d might expect. Given our circumstances, I wouldn’t be surprised to see investment spending this year to be completely offset by the factors I mentioned i.e. a multiplier of zero.

Case in point, if you look at the contribution to GDP growth for 2011, on the demand side gross fixed capital formation provided a quarter of the 5.1% growth total, but was completely offset by an equivalent drop in net exports (exports minus imports). On the supply side, manufacturing provided about a quarter of growth, while the other three quarters were provided by services; construction contributed all of 2.2%.

Technical Notes:

4Q2011 National Product and Expenditure Accounts from the Department of Statistics

I am really puzzled by Idris Jala's statement that the 5.7% drop in oil output hv reduced growth by 1 to 1.4% for 2011.

ReplyDeletehttp://www.themalaysianinsider.com/business/article/growth-despite-decline-in-oil-shows-economic-resilience-says-idris/

Firstly I believe O&G contributes less than 10% to GDP.Secondly oil prices maybe 20% higher in 2011 compared to 2010 thus offsetting the reduced output.

Hope you can shed some light.Its not good to doubt a Minister who is guiding our future growth..but its even worse if what he says is not true.

Thanks

The reported GDP numbers (GDP in constant prices) removes changes in prices, so he may well be right. I haven't looked at growth contribution from the supply side - give me a couple of days to work on it.

ReplyDelete30% drop in oil output and growth negative?Thats pretty heavy dependence on one sector?And definitely indicative of lack of diversification.

ReplyDeleteNo sure what you're talking about? Mining is fairly small relative to the economy (a little over 6%) and mining output has been declining since at least 2004.

ReplyDelete@anonymous 7.16

ReplyDeleteTurns out I'd already done the numbers, just never looked at them too closely.

Top to bottom, contribution to GDP growth (not GDP itself, just the growth for 2011):

Services: +76.3%

Manufacturing: +24.4%

Agriculture: +7.9%

Construction: +2.2%

Mining: -7.8%

Don't worry if it doesn't add up to 100%, there's a couple of other items (import duties and bank charges) that round them up to the total.

In terms of actual quantum, the drop in mining output works out to about -0.4% of real GDP. He might be referring to nominal GDP (which includes changes in prices), but I haven't done the numbers on those.

In case anyone's interested, share of total GDP (2011):

Services: 58.6%

Manufacturing: 27.5%

Agriculture: 7.3%

Mining: 6.3%

Construction: 3.2%

Timely indeed...compared share of GDP real n nominal for Mining...and its 6% and 12%.Can't understand why its different.On nominal Mining actually was a positive,

ReplyDeleteHope you can help..u hv knack for simplifying stuff for us non economist

TQ

The difference between real and nominal GDP is prices.

ReplyDeleteFor example, let's say you produced 200 widgets at RM10 last year. That's an output of RM2000.

Let's say this year you hike the price of each widget to RM25, but you only produce 100. Your nominal output will be RM2500, an increase of 25%.

But your real output will be calculated on last year's price = 100 x RM10 = RM1000, or a 50% drop.

So you can have a increase in nominal output (25%) together with a decrease in real output (-50%).

Our current base year for calculating real GDP (following international practice) is 2000. Average oil prices in 2000 was about US$30 a barrel. Average prices in 2011 was US$95. You can get a 50% drop in real O&G output, yet still show overall nominal growth.

Thanks..this is good.Always thot the discount factor is inflation.

ReplyDeleteThus to reduce ETP 2020 nominal GNI to real 2009..its not correct to discount by the 2.8% inflation rate assumed?Each sub sector will hv different deflators.

Btw...IJ's statement is thus incorrect n misleading.Its really bad form for a Minister entrusted with econ devt to make such errors.

Tq

Got it in one - assuming global commodity and export prices continue to trend up, the inflation rate would understate the discount factor (and vice-versa).

ReplyDeleteRef: DS IJ's pronouncements - it depends on the quality of his advisers. He's a sales and management guy, not an economist. It's not really his job to do the thinking part, just the doing part.

I do wish he'd stop trying to sell people on the concepts behind the ETP, rather than what's actually being achieved, because it's too easy to poke holes in his arguments.