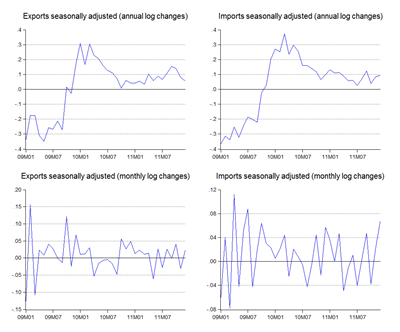

Like industrial production (see my previous post), Malaysia’s trade numbers came in higher than expected (log annual and monthly changes; seasonally adjusted):

Both on a seasonally adjusted and non-seasonally adjusted basis, exports came in at around RM2 billion more than my forecast models predicted, though that’s still only about 0.4 standard deviations from the point forecast.

What makes December’s numbers a little unusual are a couple of factors - a slight rebound in E&E exports for one (log annual and monthly changes; seasonally adjusted):

The share of exports of E&E products actually began rising again:

I don’t know if this will last, or if this is a signal that the relative decline of electronics manufacturing has bottomed out. Something to keep an eye on in the coming months.

The other unusual thing is that December imports were pretty strong (RM millions; sample 2000-2012):

Consumption imports jumped to an all time high in terms of value (breaking away from a 10-year trend); more importantly so did capital goods imports. Intermediate goods imports on the other hand held steady at around 2007-2008 levels. What this suggests to me is that private consumption is getting stronger, and the private sector is expanding capacity – both good signs for the coming quarter.

This might not be reflected in stronger exports going forward, but it might be a signal that domestic demand has enough juice to sustain the economy if global growth does indeed slow down.

In any case, higher exports are implied for seasonally adjusted exports for January 2012, though on a month to month basis, exports should be flat:

Seasonally adjusted model

Point forecast:RM51,424m (11.3% yoy, 1.1% mom)

Range forecast:RM69,181m-53,668m

Seasonal difference model

Point forecast:RM59,098m (7.5% yoy, -2.7% mom)

Range forecast:RM67,568m-50,628m

Technical Notes:

December 2011 External Trade Report from MATRADE.

No comments:

Post a Comment