Prices in January rose 0.3% compared to December 2011, even as the annual growth turned down (log annual and monthly changes; 2000=100):

Headline inflation declined from 2.9% to 2.6% in log terms, while the core (ex-transport, ex-food) and pain (food + transport) measures dropped 0.3% and 0.4%.

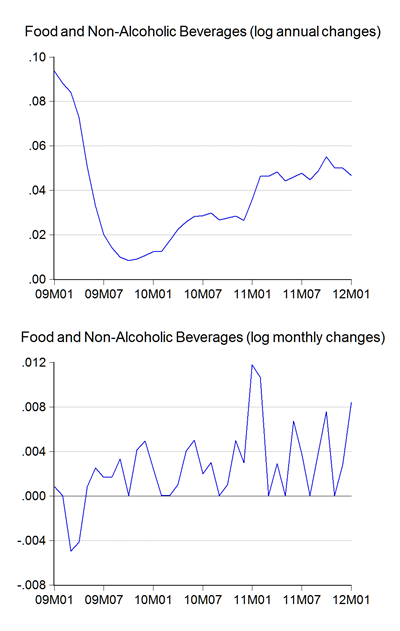

Considering that prices actually rose pretty sharply in January, those numbers will be little consolation. All of the increase in the Pain index came from that perennial culprit food, which zoomed up 0.8% in log terms (log annual and monthly changes; 2000=100):

This should be temporary I hope, as CNY fell really early this year and people had money in their wallets (for once).

Core prices increased more slowly, inching up a more sedate 0.1%, which is a relief to me, because the August and September 2011 peak were uncomfortably high for my peace of mind. The January price increases came almost entirely from Housing and utilities, furnishings and from education.

If you’re wondering what the price level looks like now, here they are (index numbers; 2000=100):

Food and transport prices are now nearly 45% higher than in 2000, while all other prices are only about 17% higher. Bear in mind that house prices aren’t included in the CPI, as they’re not consumption items (though rent is).

Going forward, I’d expect to see inflation moderate further, if for no other reason than the base effect of high prices early to mid last year. Global growth prospects through the first part of this year should dampen any increases in commodity prices, which should limit inflation somewhat.

That’ll give some room for BNM to cut interest rates if global growth falters, though I admit to being more concerned over monetary conditions which seem a little too loose to me. Loan growth shows little sign of abating, unemployment a little too low, and capacity utilisation on the high side.

Even if a slowdown in global trade hits Malaysia, I’m not sure that a rate cut would be warranted, because it would signal not just a further easing of monetary conditions, but a commitment to ease further in the future – you can’t stop at just one change in the OPR.

Then again, what would I know? BNM will do what they think is best regardless.

Technical Notes:

January 2012 Consumer Price Index report from the Department of Statistics

No comments:

Post a Comment