So much for trade continuing to be depressed. How much of this is simply trade orders pushed back because of CNY, I don’t know, but based on Tuesday’s external trade report, things are perking up on the external front (log annual and monthly changes; seasonally adjusted):

On the face of it and taken along with other trade developments in the region, this is an emphatic denial that there is any slowdown in global growth. Month on month, those are the sharpest growth numbers since the deeps of the recession, lo these 3 years agone.

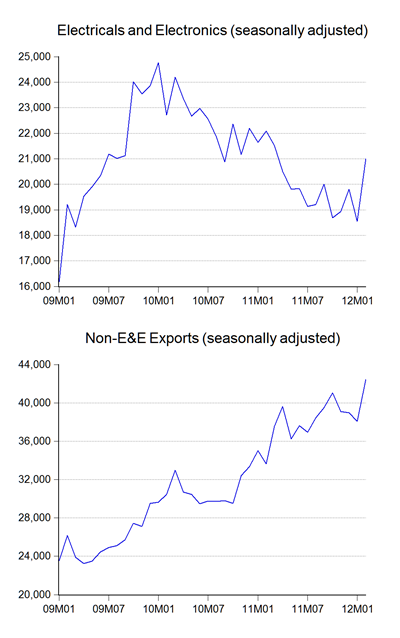

More importantly, the increase was pretty broad based (log annual and monthly changes; seasonally adjusted):

Year on year electronics and electricals export growth is still negative, but it’s still pretty sharply up on a month-to-month basis. Overall, E&E exports are still more than 10% below post recession peaks (RM millions; seasonally adjusted):

Non-E&E exports have continued to climb though – rising commodity prices? Possibly, though the concurrent increase in the volume index suggests otherwise (reported on here; warning: pdf link).

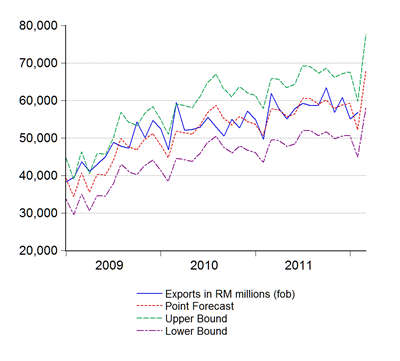

The prognosis for next month is that exports will continue to climb in March:

Seasonally adjusted model

Point forecast:RM67,572m (8.8% yoy, 17.2% mom)

Range forecast:RM76,189m-58,955m

Seasonal difference model

Point forecast:RM67,825m (9.2% yoy, 17.6% mom)

Range forecast:RM77,566m-58,084m

Technical Notes

February 2012 External Trade Report from MATRADE

No comments:

Post a Comment