Much like the upside surprise in trade, the IPI also showed some surprising strength (log annual and monthly changes; seasonally adjusted):

For the first time in a long, long while (17 months to be precise), the mining index showed positive annual growth. The rest though are simply zooming up. All this is pretty unusual, especially with the CNY effect and the shorter number of working days in February.

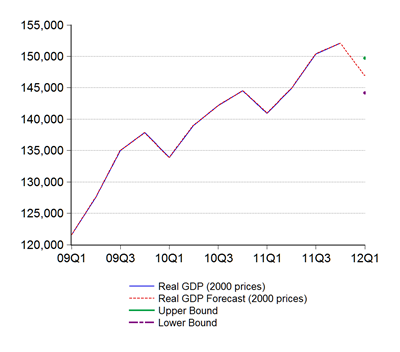

I’d expect some mean reversion for March, but in the meantime, it looks as if 1Q2012 will see some decent (though not terribly strong) GDP growth numbers:

The point forecast suggests 1Q2012 GDP to be up 4.3% (about 4.0% on an SAAR q-o-q basis). That puts a solid floor under GDP growth this year, and close to the centre point of the official forecast of 4%-5% for 2012.

Technical Notes:

February 2012 Industrial Production report from the Department of Statistics (warning: pdf link)

Regarding to your analysis, i found that you are using base year 2000.But when refer to the DOSM website, the IPI already use 2005 as a base year.

ReplyDeleteThe reason's very simple.

ReplyDeleteIf you use the 2005 base year, you only have about 7 years worth of data. By linking the series (and converting the base year to 2000), I've got a long continuous IPI series going back to before 2000. With a bit more effort, the linking methodology allows me to go back past previous changes of base years as well (the past two base years for the monthly series are 1993 and 1988, with the data going all the way back to 1984). That allows for a far greater historical view of the data, and more rigorous econometric analysis. I do the same thing for the CPI, and for forex indexes.

Why 2000? It's the international base year for cross country comparison.