I was looking at liquidity conditions, and found something interesting, but I’ll get to that in a bit. M1 growth decelerated sharply in October, although M2 showed a slight uptick in growth (log annual and monthly changes; seasonally adjusted):

Part of that is slowing loan growth, which limits deposit growth and thus impacts the money supply (log annual and monthly changes):

In fact, looking at the monthly growth numbers, credit creation growth is coming off to a much lower level. This isn’t just about tighter credit conditions, but more a factor of declining credit demand:

This is despite historically low lending rates and what appears to be only marginally tighter credit standards. What this might say about economic activity this quarter, or for next year, I’m not going to venture to hazard a guess. Suffice to say, it’s one more indicator that things are softening a bit.

Here’s another one – the MGS yield curve is flattening:

The spread between the short and long end is now at the lowest level since the end of 2008:

Again, I’m unsure if too much could be read into this, as it could also be a sign of declining inflationary expectations (which itself would be a signpost for slowing growth).

Now moving on the interesting thing I was looking at the other day (RM billions):

What this shows is that BNM has been leeching liquidity out of the banking system lately – the latest jump began in September-October 2012, with net BNM Bills outstanding climbing a cool RM17 billion. Since February 2010 (the last trough), net bills issuance has taken off RM135 billion from the interbank system.

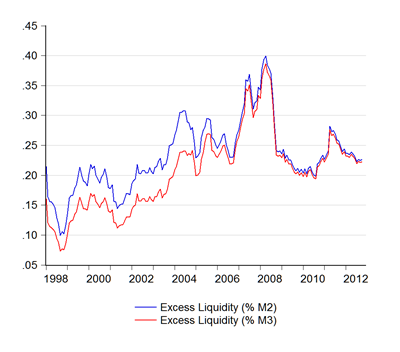

But what I wanted to really find out is how much excess liquidity there really was in the system, and how much the central bank is putting away. From memory, there’s no real agreement on what constitutes excess liquidity (I haven’t done any kind of literature search). So I’m taking a stab at my own, scaling it against broad money supply measures:

I’ve added here required and excess reserves to the numerator, while adding the bills figure to the denominator. The results above aren’t well behaved – there’s no obvious trigger point for central bank intervention in the interbank market (in practice, it’s probably more a factor of movement in the overnight right towards the policy rate intervention bands).

But…it does seem as though a “normal” level of excess liquidity appears to be around 20%-25% of M2 or M3, and that the recent action in bills has had only a minor impact on banking system liquidity or the monetary policy stance. One interesting implication here is that managing liquidity in Malaysia going forward is going to be an increasingly expensive proposition – 6 month bills had an indicative yield of 3.00% in October. The obvious corollary is that any tightening move next year will include a coordinated jump in the required reserve ratio, for which BNM needs to pay zip.

Technical Notes:

All data from the October 2012 Monthly Statistical Bulletin published by Bank Negara Malaysia

How do you explain the growth divergence between MB/M1 and M2/M3?

ReplyDeleteI tend to interpret it as robust economic activities especially from MB perspective. Deposits in fact grew faster despite loans growth slowdown.

There must have meant that there was greater money velocity this time around that the M3 could grow faster despite slower MB/M1 growth i.e. doing more with less.

ps - could possibly be some statistical noise only as well

I shouldn't use the term velocity. But all the same.

DeleteNo, velocity probably isn't the right term to use.

DeleteWhen money is endogenous, I don't think there's any dichotomy between divergent growth rates in monetary aggregates (bearing in mind I haven't really dug deep into the data).

That's not the case with loans and deposits though, which should grow the same in an endogenous system (in absolute terms anyway). And the answer here I think is simply forex deposits, which have been growing in excess of 30%. Forex is included under M2/M3 but not M1.

I looked at the aggegregate data again just now and you're right about forex. It did grow faster but it is so small that I'm inclined to dismiss it outright.

DeleteI know there's a theoretical connection between loans and deposit and money aggregate but is there any raw data where we can see that, especially ones that link loans to money aggregate?

I do keep track of loans (and yes, BNM does track lots of lending data) but it doesn't jive with M3. With the October statistics being the case in point.

Now you've piqued my curiosity...but I'm slapping my head right now, because I should have thought of this sooner:

Deletehttp://www.bnm.gov.my/files/publication/msb/2012/10/xls/1.3.2.xls

Look up Column K - foreign reserves represent liquidity taken out of the banking system and replaced with Ringgit, but forex is exogenous to the domestic monetary system. Hence the discrepancy. The numbers don't quite match, but its close enough for jazz.

The theoretical (actually, its practical) link between loans and deposits goes like this - the credit creation process (i.e. loan disbursement) involves both an asset and a liability entry on a bank's balance sheet. The loan liability of the borrower is an asset for the bank, but the money proceeds from the loan is an asset of the customer held at the bank. The act of lending therefore involves the simultaneous creation of loans and deposits at the same time.

Hence in a closed economy with no capital flows (and assuming no central bank intervention), any increase in loans must therefore equal increases in deposits in absolute terms, though obviously not necessarily in percentage terms (because of the existence of cash, which is a liability of the central bank and not the banking system).

Note that in this process, there's no need for an ex ante existing reserve of cash, as the required "reserve" is actually formed as part of the process of credit creation. Reserve management is only necessary ex post when there is more than one bank in the system, as loan/deposit proceeds flow from one bank to another.