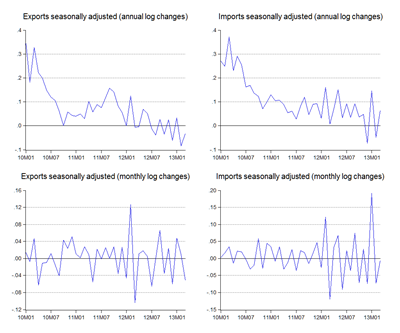

The growth numbers look pretty bad, but truth be told, exports are just in a holding pattern (log annual and monthly changes; seasonally adjusted):

Exports fell an annual 3,2% in log terms in March, and 5.2% from February. Imports were a little better, expanding 6.4% from last year and shrinking 0.6% from February.

Looking at the levels however, the growth – or rather the non-growth – in exports is just volatility around a steady value (RM millions):

There’s hardly any trend at all in exports, though imports have returned to the trend evident from 2010-2011.

Turning to the breakdowns, electrical and electronics exports continue to drift down, somewhat offset by non-E&E exports (log annual and monthly changes; seasonally adjusted):

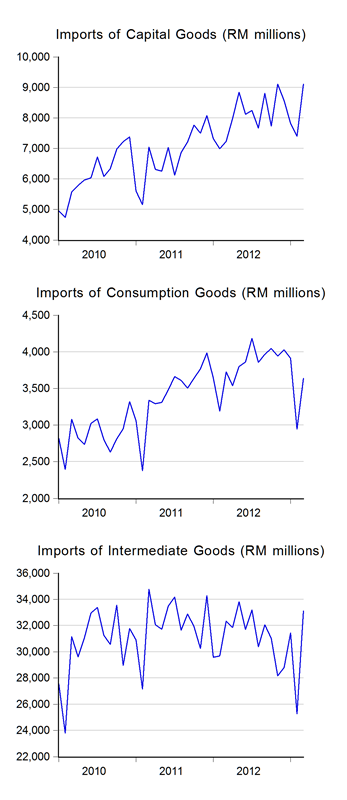

It’s not all bad news though, as oil & gas exports are turning up, and import trends portend some recovery in manufacturing output (RM millions):

Higher capital goods imports suggest the investment boom that has been driving Malaysian growth recently is continuing, while the rush of intermediate goods imports indicates a return of manufacturing activity, somewhere nearer to 2011 levels.

One thing that these numbers suggest though is that 1Q2013 GDP is going to look pretty strong, but be warned that this will largely be due to the base effect – 1Q2012 GDP wasn’t all that great.

Technical Notes:

March 2013 External Trade report from the MATRADE

I don't know, Hisham, trade balance for the quarter is down by like half, and production is pretty flat..

ReplyDeleteBarry, yup, it all looks bad.

DeleteOn the other hand, all our forecasts in the past year has been embarrassingly underestimating growth. We'll probably still be looking at some pretty strong investment numbers I think.