More expensive holidays overseas? Say it ain’t so (excerpt):

Little respite for the ringgit

PETALING JAYA: Cheap airfare is a boon for holidaymakers going overseas, but Malaysians can’t help but feel a little short-changed after a trip to money changers.

Take the Thai baht, which had advanced 13.2% over the past six months. At 8.93 last week, the baht is at its most expensive against the ringgit since 2007.

Jakarta would have been a cheaper destination, currency wise, as the rupiah performance was tempered by Bank Indonesia’s unexpected interest rate cut last Tuesday. At current exchange rate, you can get around 3,500 rupiah for one ringgit. Six months ago, one ringgit will buy you 3,650 rupiah.

Hong Kong, a favourite shopping destination for many Malaysian, has become 15% more expensive since August last year. The Hong Kong dollar is pegged to the US dollar, against which the ringgit had weakened to 3.647 on Wednesday, before the market closed for the Chinese New year holidays....

A couple of comments here:

- Foreign holidays that are more expensive are probably only a preoccupation for the top 20% of Malaysian income earners, maybe 30% if we’re generous. The median Malaysian salaried worker earns just around RM1600-Rm1700 a month – for the majority of Malaysians, I don’t think shopping holidays to Hong Kong are the norm. Preserving jobs and businesses by allowing the Ringgit to depreciate makes a lot more sense here;

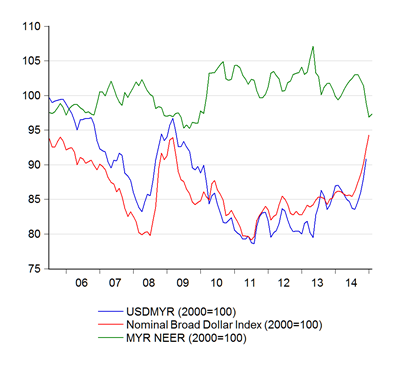

- If you decompose the Ringgit’s multilateral movement vis-a-vis its movements against the US Dollar’s and juxtapose with the US Dollar’s overall movements, about 3/4ths of the depreciation of the USDMYR can be explained by the strength of the USD alone rather than weakness in the MYR (index numbers; 2000=100):

If foreign holidays are really a concern, here’s some travel suggestions (cross rates; index numbers; 2000=100):

Yen/Ringgit hasn’t been this high in nearly a decade; Europe will get cheaper when QE begins in earnest next month; and the Aussie authorities are busy talking down their own currency. Despite the fact that the MYR has lately been a little weaker against the IDR, one Ringgit buys nearly a third more Rupiah than a decade ago.

If you’re looking further afield (and have the money to spare), you might want to try Mexico, Canada and Turkey. And for the seriously adventurous, there’s always Russia (50%+ down against the USD since the middle of last year).

Hi, Hisham. This is going off topic, but will you doing an analysis of the Singapore Budget 2015?

ReplyDeleteI note that the Singapore government is tiptoeing into budget deficits, including expected returns from Temasek Holdings to be included in the net investment returns framework and raising the personal income tax rates of top income earners from 2017.

@anon 1.24

DeleteI don't think I have a comfort level yet with Singapore's economy to make any intelligent analysis. So probably not. A couple of thoughts though:

1. Interesting though that they opted for a deficit budget in what's supposed to be a non-election year.

2. There's an obvious sensitivity to potential policy trade-offs in some of the measures proposed. For example, increasing the CPF contribution rate for the over-50s (effectively a tax on employing older workers) is partially offset by the Temporary Employment Credit.

Ermm.... From what the press and street are saying, it is soooo supposed to be an election year...

Delete@The Slug

Delete;D

And further to Anon @ 1.24's post, the Sing govt. is doing what you sort of said was the right thing to do (spend more, even in deficit) when the going get's tough right? I remember a few posts ago you said it was wrong for Malaysia to cut spending to contain the deficit as it would result in loss of economic dynamism?

ReplyDelete@The Slug

DeleteNot so much economic dynamism, but aggregate demand management. Faced with shocks to nominal incomes and given that nominal liabilities are fixed in the short term, fiscal and/or monetary policy should be used to counteract those shocks.

What that gobbledegook means:

Companies and households carry debt, and need to maintain a certain level of income to remain solvent. It's the job of the government and monetary authorities to insure that happens. Otherwise, shocks to nominal incomes would carry over into real economic activity (the economy would operate too far above or below the potential output path).

I note that this deficit budget comes after MAS eased monetary policy between meetings last month.

If I have a criticism, it's that these policy changes are bloody late. This should have been done last year, when the economy was very obviously slowing.

I don't know, Hisham. The Singgies, in their Budget 2015, seem to be pushing some right buttons.

DeleteI just wish that some of their long-term forward planning would rub off on Malaysian ministers, politicians and bureaucrats.

Like universal health insurance for all Malaysians (regardless of pre-existing medical conditions) for one.

Or the emphasis on lifelong learning, continuous re-skilling and re-training.

Or a determined effort to reduce dependence on cheap foreign labour and move higher up the value chain.

The Singapore Business Times paper today had an interesting table of how countries compare with respect to social expenditure as a percentage of GDP.

In 2014, the figure for Singapore was 6.7%. Other countries: Canada (17.0%), France (31.9%), Germany (25.8%), Italy (28.6%), UK (21.7%), US (19.2%), S Korea (10.4%), Ireland (21.0%).

What is the corresponding figure for Malaysia?

@anon

DeleteIt looks more like fire-fighting than forward looking to me.

I had a chat with a Singaporean economist the other day. If you look at the numbers in totality, this budget isn't even expansionary. The deficit figure comes before revenue from land sales and returns on investments. If you take either one of those into account, the budget is in surplus.

This is despite the fact that growth has been poor going on a year now. Labour markets are tight, but wages are not responding. Instead, companies are shifting their manufacturing bases outside the country. Going up the value chain appears to mean the hollowing out of Singaporean industry.

I note that the Singaporean government has been talking about raising productivity for the longest time - with precious little results. Most of the growth Singapore has experienced in the past decade has come from immigration and longer working hours, not improvements in productivity or value-added.

The determination might be there, but they've been singularly poor in making it happen.

Also, tweaking the CPF scheme smacks of desperation. The CPF needs a total revamp. Singapore has a demographic crisis RIGHT NOW, not 10-15 years in the future. Discussing this with my boss, his comment was: "I really wouldn't want to be a Singaporean". I'm sorry to say I fully agree.

Re: social expenditure

Singapore has the lowest social expenditure to GDP ratio in the OECD, and in fact spends lower than most developing countries. Malaysia spends approximately the same on health, and about twice as much on education.

One last point: the "servification" of the Singapore economy (aka moving up the value chain) implies a shift in the sources of inflation from tradeable goods to non-tradeable goods. Yet there are no signs that Singapore is even contemplating a shift in monetary policy regime from the exchange rate (inflation from external sources) to one targeting inflation or interest rates (inflation from internal sources). Services is already over 60% of the economy, but the policy regime remains solely focused on consumer trade goods. Not exactly forward looking.

"I really wouldn't want to be a Singaporean". I'm sorry to say I fully agree

DeleteOuch....Maybe gotta rent my Singapore place and then live in JB :)...

Thanks for sharing those travel advice!

ReplyDelete