Fascinating things going on in the monetary side of the economy, though you won’t know it from the money supply data (log annual and monthly changes; seasonally adjusted):

There’s been a pick up in monthly M2 growth, but not to levels I’d be overly concerned about. It’s mainly a reflection of slightly higher monthly loan growth, which is a little higher than average but still within a “normal” range (log annual and monthly changes):

I’ll cover what’s going on in the banking system in another post – some long term trends need explaining, and I want to concentrate on short term monetary conditions in this post.

The interesting stuff is happening as usual in prices, not quantums. I wouldn’t say I’ve got a complete handle on what’s going on, so you should look at the following as an informed guess, rather than anything definitive.

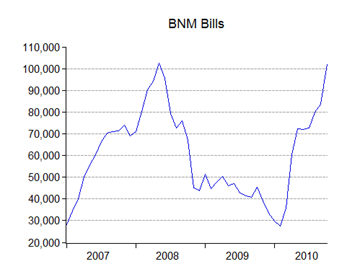

There were some upticks in the interbank market and in the discount rates for TBills and BNM Bills. That last is not too surprising given the higher OPR and especially the sterilisation of BNM’s forex intervention, which requires the issuance of securities to mop up the additional Ringgit created. In fact, October’s net issuance of BNM Bills established an all time record of RM18.6 billion (RM millions):

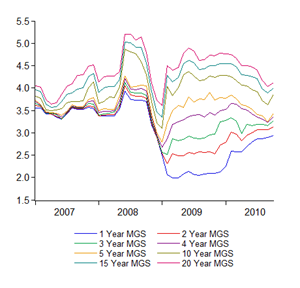

Together with more than RM6.6 billion of MGS issuance, that meant the capital and interbank markets were heavily tapped for funds in October. Which brings me to MGS yields (percent):

Yields rose across the board in October, quite against the trend over the past year, but mainly at the medium tenures. I’m inclined to attribute this to an increase in supply rather than weakening demand – with the massive increase in BNM bills and two tranches of MGS issuance (2nd highest month this year), there’s more than enough reason for dealers to want to be compensated for bidding with higher yields.

Certainly foreigners aren’t too picky about picking up Malaysian debt securities (RM millions):

About half the net increase in BNM Bills and two-thirds of the net increase in MGS were picked up by foreign investors (private debt securities form a little over a tenth of the total in the chart above).

Now, this obviously adds quite a bit of risk to the bond markets, especially if the global economy runs into more trouble. As we’ve seen over the past month, any threat to global economic growth or financial market stability triggers risk aversion, which benefits the USD and could undermine asset prices in emerging markets. While the local market is deep enough to manage an outflow of foreign capital, it does mean that yields might spike which would make borrowing more expensive – not just for the government but everybody else.

On the other hand, we are starting from a low base – while not quite at historical lows, medium-to-long terms yields are below their pre-recession levels. I’ll try to cover this topic in more detail in a future post.

Technical Notes:

Data are from BNM’s Oct 2010 Monthly Statistical Bulletin

Time to call a short on Malaysia corporate bonds maturing in 2015/2016? Two triggers : foreign debt investors taking a trip back to USA and Convergence of GLC related fixed income circa 2013/2014. And of course , Idris Jala projects will be out in markets raising debt circa same period. In terms of acceleration of foreign investors mopping up msian fixed incomes : it's amazing over that time base. It's a no brainer really. Borrow from Bernanke at 25bps and Buy near sovereign Malaysian glc notes at 450bps....nice trade.

ReplyDeletePlus currency appreciation...I imagine the carry trade logic applies for quite a few countries in this region.

ReplyDeleteReally hard to short corporate securities though - there's not a whole lot of liquidity in that market.

There isn't need to create liquidity via default swaps and sell some insurance. Bcos when it gets to the stage of tanking big time......bond investors will gang up and write a cry baby letter to the PM......

ReplyDeleteWe are seeing this right now with the H2O bonds...

Why shud free market capitalists such as Great Eastern and CIMB Principal be bailed out by tax payers !!!!

Perhaps we must write a CDS ticket on Idris Jala ETP...and EPP..

On a serious note , there is a real risk of USD spiking up within 12 mths.

There are just too many shorts out there on the greenback.

Be interesting to watch how BNM cope with the outflows when this flight to Bernanke gets going.

GDP growth has improved in the emerging economies with a surge of capital inflows from the advanced economies. Real GDP growth is expected to average over 7 percent for the main emerging economies—China, India, Brazil and Russia.

ReplyDeleteGlobal economic update

@anon 3.15

ReplyDeleteI'm not sure there's a case for a spike - but pause or a pullback is definitely probable. In any case, the MYRUSD rate has been on hold for nearly three months now.

You might be interested in looking at BNM's balance sheet movements for 2008, and juxtapose that with movements of capital and the exchange rate - you'll see what they had to do for both massive inflows and massive outflows.

@Parag

ReplyDeletePls don't spam - first and last warning.

Hi Hisham H,

ReplyDeleteI like the point raised by Bond Investor that basically yields are going to spike up. However, I would warn against thinking of a carry trade strategy. The reason being that there other markets like Australia that can offer a 200 bps spread on the repo rate without the added risk of dodgy government policies (i.e. capital control) and limited liquidity.

But I at least I am not alone in thinking that the yield curve will spike to the sky. Whilst I see there has been a cogent argument as to the merits of BNM's inflation index, this is disconnected in reality from the consumer side of things. And if consumption represents a large % of our economy, we really have to think that whilst BNM's Inflation number is accurate (in the sense of how it is calculated), but is it useful as a predictor of yields and currency ?

The last point relates to the refinancing of a lot of Government paper over the next 3 years. I am not so sure about the refi for the Corporates, but for example, if the markets for fixed income tank world wide during that period, wouldn't it mean that there is excess supply and limited demand, i.e. yields will rise?

But love the point on the crybaby letter.. yeah lets all sell CDS... But in theory, letter or no letter, those h20 bonds are in default right now

ReplyDelete@Wenger

ReplyDeleteOne of the things that comforts me is that, as much talk as there has been about foreign capital flows, it's actually been quite limited in Malaysia relative to our peers. So I don't see a spike in MGS yields on the cards in the event of a global selldown - more a gentle and consistent rise up about 50-100bps to get closer to the MGS long term average. We're still a fair bit below that right now. In other words, I'd view the current yield curve a little on the low side relative to the fundamentals.

For the same reason, I think capital controls are highly unlikely, as there's simply no call for them in Malaysia yet - and BNM under Zeti has a lot more credibility than Abul Hassan.

On CPI inflation - good luck finding a relationship with yields or interest rates, I haven't found any. That indicates that what's more important is the risk premium, not the real return differential. Also, in technical terms, inflation and interest rates can only have an impact on the rate of change in the exchange rate, not on its level.

Last, I don't think refinancing would be a problem, it's the marginal increase that's more important.