I wrote about DS Anwar’s speech regarding the ETP a week ago, but my comments were based entirely on the coverage by the Malaysian Insider, and not the speech itself. I stumbled on that via JMD’s blog.

Just so you know, PEMANDU have issued a rebuttal (without naming names).

But what caught my eye in the original speech was this paragraph that wasn’t mentioned in the news coverage:

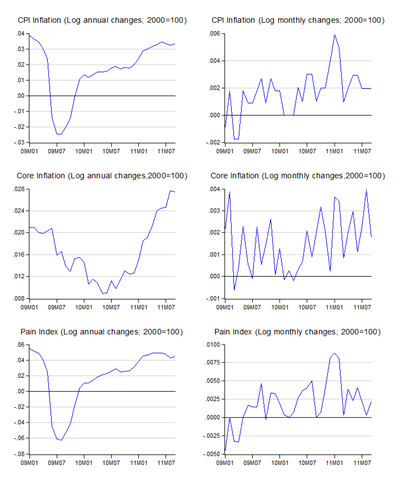

The average inflation between 2001 and 2005 is 4.8%, reflecting the first energy price shock of 2003 that saw average crude oil prices moving beyond the psychological US$30 per barrel mark. The average inflation between 2005 and 2009 is even higher at 6.6% as a result of the 2008 crude oil price rally that saw the energy prices sky-rocketing throughout the world.