With the change in the base year to 2005, GDP numbers for the last 6 years have been substantially revised. Since I lack the time to do a comprehensive analysis of the data as before, this post will be a quick and dirty look at the salient numbers for 1Q 2012. Further analysis will have to wait on when I can reconcile the 2005 and 2000 numbers.

Be that as it may, the growth figures haven’t changed much, even if the absolute figures have (annual log changes versus quarterly log changes, seasonally adjusted and annualised):

There’s been little difference in growth measurement over the last year or so, whether you’re using year on year, or quarter on quarter annualised. I haven’t added a comparison with the GDP growth under the old 2000 base year numbers in the chart, as for all intents and purposes the line is identical to that under the 2005 base year. Real GDP growth of 4.7% is pretty much around what we figured growth in 1Q would be (though the IPI numbers indicate it should have been higher).

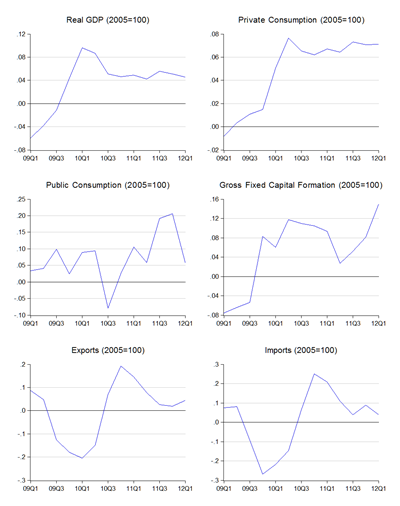

On the demand side, it’s mainly a story of sustained private consumption and zooming investment, both public and private (log annual changes):

From what we were told just now, it’s not just ETP related, as there’s been a considerable pickup in residential and non-residential construction as well.

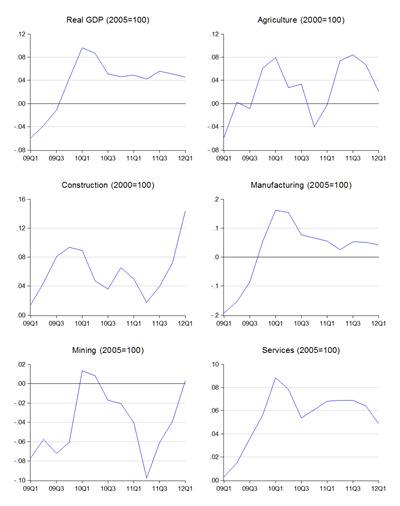

On the supply side, its strong construction growth, and the absence of drag from mining (log annual changes):

Manufacturing is still doing ok, though slowing services growth is a bit of a worry.

Just a few notes from the DOS briefing today on the change in base year:

- The increase in the size of GDP (e.g. 3.4% for 2011) is apparently normal for base year changes. Similar exercises in other countries have also resulted in higher GDP (e.g. Korea +6.8%, Singapore +3.4%, US +1.7%). The cumulative change in the real growth rate is however pretty minor at about –0.3%.

- The next rebasing exercise will take place in 2015, using 2010 as the base year.

- The 2005 series will incorporate some of the recommendations under the 2008 System of National Accounts (SNA) manual. Full compliance is due in 2015 during the next rebasing exercise.

- Structural changes are significant between 2000 and 2005 – agriculture and mining are larger, manufacturing and services smaller.

- There have also been considerable changes in the sub-sector sizes, with E&E and transport manufacturing and financial services downgraded, just to name the bigger ones.

- On the demand side, the size of private and public consumption have been reduced while investment increased. Some of this is due to re-categorisation of items under the 2008 SNA.

Technical Notes:

1Q 2012 National Accounts report from the Department of Statistics

Hey Hisham,

ReplyDeleteA bit of trawling around on the DOS website and I found the GDP by income components. Its not as updated as we would like it to be, but it's there.

http://www.statistics.gov.my/portal/index.php?option=com_content&view=article&id=1568&Itemid=111&lang=en

Bottom half of the page for this other link.

http://www.statistics.gov.my/portal/index.php?option=com_content&view=article&id=347%3Afinal-national-accounts-statistics-2005-updated-09062010&catid=99%3Afinal-national-accounts-statistics&lang=en

But you're right, DOS should publish this data more frequently

Cool, thanks! Nice find.

ReplyDeleteFascinating stuff in that second link. Household savings is about 2% of gross (really?); wages and salaries are dropping as a proportion of national income but household income ratio to national income is stable (higher property and mixed income?).