I’ve been out of commission for much of the past week or so due to an infection, hence the lack of posts. But since I’m hopefully on the mend, I should be resuming blogging more regularly from today. There’s a lot to catch up on, so I’ll be spacing out the posts over the next few days.

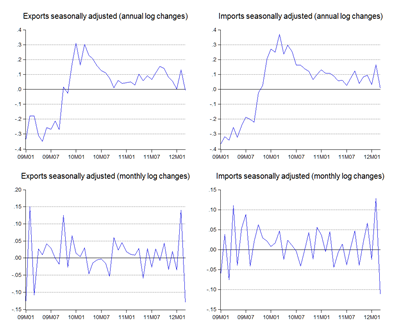

Now on to the latest data release. March 2012 external trade numbers shows that the February trade was an aberration or largely a factor of CNY. They're certainly well below what I predicted last month (log annual and monthly changes; seasonally adjusted):

Exports in March was essentially flat compared to last year, but 8.3% down in log terms over February (13.0% seasonally adjusted). It’s not a factor of my bog-standard seasonal adjustment either – the DOS numbers are very similar. If this is a CNY effect, nobody seems to be quite accounting fully for the seasonal factor.

Nevertheless, it’s not exactly encouraging news, though Malaysian trade is still up over last year for the quarter as a whole.

Breaking it down, what’s more worrying still is the sharp drop in non-E&E exports, with annual growth falling to the lowest level since November 2009 (annual and monthly log changes; seasonally adjusted):

Electronics and electrical exports have continued to consolidate, but that’s more or less expected. Falling exports of the rest of Malaysia’s offerings is more worrying. Hopefully, if this is an aftereffect of CNY, then volumes and growth should return to some normality in April (fingers crossed).

In the meantime, prospects for next month’s numbers based on import volume suggest that there won’t actually be much improvement:

Seasonally Adjusted Model

Point forecast:RM60,779m (5.0% yoy, -1.6% mom) Range forecast:RM68,447m-53,111m

Seasonal Difference Model

Point forecast:RM58,316m (0.9% yoy, -5.8% mom) Range forecast:RM66,620m-50,013m

Technical Notes

March 2012 External Trade Report from Matrade

No comments:

Post a Comment