I read this over the weekend:

Applying the brakes – made for the short term – can be dangerous

FOOD FOR THOUGHT

By DATUK ALAN TONG...Recently there has been a proposal to raise the floor price of properties for foreigners from RM500,000 to RM1mil to curb or control the prices of houses from increasing too fast. This proposal is on top of the other “cooling off” measures such as the 70% housing loan policy for purchase of a third property, the increase of real property gains tax from 5% to 10% imposed on properties sold within two years of the sale and purchase agreement, and the new ruling on housing loan limits based on net income rather than gross.

There is no doubt that the introduced “cooling off” measures have reduced the buying spree of properties. However, the intended objective of these measures to control the price of properties has yet to be seen. Introducing measures without critically identifying the root cause of the increasing property prices may instead create situations that would not be beneficial to the industry as explained by the theory of Risk Homeostasis.

So, what determines rising prices?

We need to find the root cause of the issue in order to identify a long term solution. The basis for rising property prices now is largely due to the direct and indirect impacts of quantitative easing programmes i.e. the increase of money supply, carried out by governments around the world since the start of the global financial crisis…

…When there is too much money chasing too few goods, prices will increase but not necessarily value. In reality, we are facing a situation where there is too much money in the system, causing a decrease in the real value of money and pushing up prices of goods and services including construction materials.

For example, in early to mid 2000, a condominium in Mont'Kiara which was sold around RM500,000 would now cost us about RM800,000, equal to a 60% increase. But measured in a different “currency”, that condominium would have cost us 8kg to 10kg of gold in early to mid 2000 and today, only worth about 5kg of gold. This is a sharp decline of 38% to 50% and is an illustration of how prices are going up due to the drop of currency value because of worldwide inflation and pump-priming policies.

However, if the property prices are not allowed to rise, it is not possible for developers to build below costs when the construction costs are constantly rising. This will cause a shortage of supply which will further push up prices in five to 10 years time.

So, what happens if you base a “long-term solution” on the wrong root cause?

Both rounds of QE in the US and the UK has so far done little more than to replace the money destroyed by deleveraging households and corporations. In Europe, financial system support through asset purchases has been “sterilised”, essentially replacing private sector debt obligations with ECB debt obligations – the extra money created has gone back to the ECB and doesn’t circulate.

Also bear in mind that much of the money “printed” under QE by the Fed and the BOE are still on their balance sheets in the form of excess reserves – those funds aren’t being used to buy anything at all. At this point, somebody’s going to say “Ah-ha, but the more reserves banks have, the more they can lend!” But that’s a complete misunderstanding of the modern credit process, as banks don’t actually need reserves to make loans. In any case, endogenous money creation via credit growth is no better than it was pre-crisis, so there’s no excess cash being generated from that source either.

And comparing property prices to gold :rolleyes:

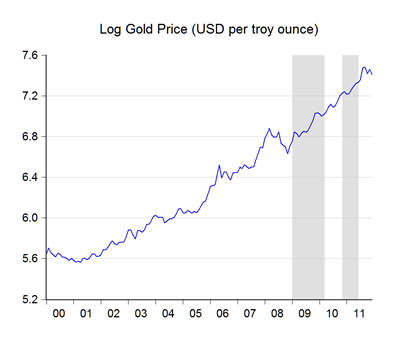

Here’s the natural log-transformed time series of gold prices since 2000 (USD per troy ounce; London morning fixing; average monthly prices; source: Bundesbank):

Natural log transformation changes a series from an exponential line to a largely straight one – the slope of the line is the percentage increase in the price. I’ve shaded the periods coinciding with the Federal Reserve’s QE1 and QE2 programs.

See any change in the rate of increase in the price of Gold during the period of QE? Neither do I. More interestingly, the price of gold fell at the start of each QE program, before eventually rebounding. So at bottom, QE isn’t the reason for gold prices going up – and by extension, for property prices to go up.

In fact, try almost any commodity against the gold price, and you’ll find that the same pattern as against property, for example “black gold” – you could get a barrel of WTI oil with 0.1 ounces of gold at the end of 2000, but the price now is about 0.07 ounces (an increase of around 30%).

That suggests that it’s not all about currencies losing their value over time through excess money creation (and inflation), but rather that the price of gold is fundamentally outrunning everything else.

Turning to the main point of the article, the author suggests that restricting credit for property might reduce property supply over the long term, creating conditions for an asset bubble. But credit is the primary source of new money creation in an economy – almost the very same thing he identifies as the “root cause” of property prices going up recently.

You can’t have it both ways.

Personally, its a bit odd that he would use gold as a proxy for cost of construction - although if he's right, property prices should have also grown exponentially (could be true to some extent).

ReplyDeleteThere's also some serious sample bias. Mont Kiara is in no way representative of entire KL much less Malaysia.

Another nonsensical point. The ringgit did evolve a fair bit since 2000 so Gold is really really not a good proxy.

Check out Bloomberg data for local developers NPAT margins are always in the double digits :)

Its a little bit hard to justify that they can't absorb a structural change to ensure their industry's sustainable growth.

First of all, I'm a new reader of your blog so... Hello! I'm a recent Game Design graduate jumping on to the field of finance because it has been of late; extremely fun to study.

ReplyDeleteJust some opinions of mine:

Yes, Quantitative Easing isn't the cause of the economic turmoil in Europe and the US and the rising prices of commodities; it merely serves as a what a liver would to a human - the government purging toxic assets by buying them from the bankers to ease the pressure of them and to provide them incentive to loan out the money at low rates to stimulate the economy again. It remains to be seen when the money hits the public, but as of right now it hasn't so it cannot be used as an explanation to the rising prices of gold.

Gold (and Silver) is an investment trend in its bull market cycle right now because it is the negative correlation to the people losing faith in fiat money. The loud noises on what is happening in the financial world (MF Global, Lehmann Brothers, price manipulation by JP Morgan and the reputation of Goldman Sachs) are pushing these prices up.

The financial crisis the EU and US are facing right now is really because of the failure of implementing a proper internal control on our finances. While Fiat money has its flaws, it isn't the root of the problem because history has shown that the system has been proven to work... with a strong internal control. Base case study to refer to was the Split tally system by King Henry I around 1100 AD and the coins used by the Roman Republic (not Roman Empire under Caesar).

These derivatives market trading, bad securities, credit default swaps, insider trading, rehypothecation, shadow banking, and other financial frauds these "too big to fail" banks have been conducting for years to fleece the public has grown terminal to the economy at large. There is a clear lack of internal control and accounting required (we've never really learnt from Enron) for these banks and they can get away with abusing the flaws of our debt based monetary system and fiat money. All these credit restrictions and quantitative easing are merely balms to the symptom and this problem isn't going away until people begin to really probe how deep the river of dirty money flowing in the world of high finance really is before we can rectify it.

So awkward that we study accounting principles, auditing, and corporate governance and yet we can allow financial institutes like JP Morgan tamper with the commodities market by leveraging ounces and ounces of paper gold claiming only 1 ounce.

We can look back into history and see the cycle always repeats for itself - the Roman Republic implemented a successful fiat money system with a strong internal control before Caesar and the emergence of the Roman Empire which eventually debased the money and destroyed the system. China implemented a fiat money system which ended in failure because of the abuse by the authority that debased the value of its currency. As mentioned, King Henry I implemented a successful fiat money system which lasted for 700 years before the war and its external debt cost the country's economic downfall with the establishment of the Bank of England to finance its debt and the abolishing of the split tally system in favor of the fractional reserve banking. The Vietnam War which forced the US off the Brenton Woods system, and during World War 2 which nearly bankrupted the US prompting them to start the Bond Run. (War is another costly event that is extremely profitable to bankers but that I'll digress)

Whether we go back to the Gold Standard or establish a new Fiat Money system (which is my preference over the Gold Standard in the long run); we really need to start looking into a stronger and better internal control or we will only repeat our mistakes.

@Jason,

ReplyDeleteAs far as house prices are concerned, it's true to some extent but overall growth has fallen off to more "normal" levels since mid-2011. It "looks" like a correlation with QE, but given that the property market is generally illiquid, it's not going to take much in the way of transactions to move the market price. House price movements don't really require exotic explanations.

@Jun Xian

Welcome. I'm certainly in favour of greater regulation of banking, but I don't think another currency system is really necessary. For all its flaws, the current system has some attractive features. I think the biggest lesson in those terms of this past crisis is really about the use of leverage. Leverage ratios 30x-60x the capital base is ludicrously dangerous.