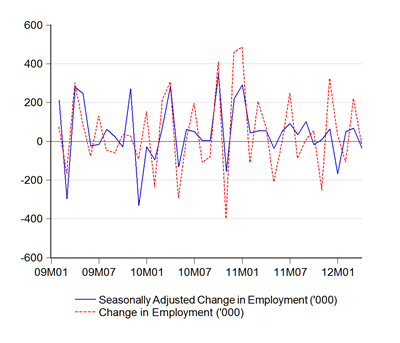

The latest employment numbers from DOS shows the economy shedding about 15k jobs in April:

With both labour force and employment growth slowing, the unemployment rate has increased somewhat to about 3.0%:

There’s little more to add to that, apart from noting that we’re still looking at unemployment well below the NAIRU, if BNM is to be believed. That continues to suggest that monetary policy is unlikely to be loosened this year, especially since inflation is also on the decline.

Technical Notes:

April 2012 Employment report from the Department of Statistics (warning: pdf link)

Two questions:

ReplyDelete1) How do you know that the unemployment rate is below NAIRU?

2) Why does BNM think the economy is operating above its potential?

I remembered that explained why BNM thought the economy was operating above potential but I couldn't find that post.

Anyway, if unemployment rate is below NAIRU, inflation should accelerate but it's decelerating so far. So, the signals are murky to me.

If I were to work this backward by looking at the decelerating inflation and potential downward risk to growth, I'd be inclined to think unemployment was above NAIRU.

I think I broadly concur with Hafiz. Except that I'm seeing some underlying demand pull pressure in the CPI.

ReplyDeleteThe services price index (not directly affected by inflation) has been accelerating. There's also a distinct divergence between the food at home and food away from home price sub-indices.

Again my 2 cents, I might be interpreting this a bit wrong. So it's a bit hard to say just from the inflation numbers. Then again, it's also hard to comprehend Malaysia's NAIRU. Personally, I just look at capacity utilization rates and just hope for the best with regards to correlation.

Anyone else thinks that DOS needs to review their seasonally adjustment figure, btw?

@Hafiz

ReplyDeleteIt was mentioned in passing during the BNM Annual Report briefing that they considered 4% as full employment. While I'm not going to take that on faith, I think that's a fair estimate based on employment trends over the years.

@Jason

Seeing the same thing buddy. Non-food inflation isn't decelerating quite so fast. Inflation in 2010-2011 was mainly supply-side driven, but lower food and commodity prices will dampen the headline rate for the year.

CAPU is at what? Near 80%? Isn't that effectively full capacity?