Today’s external trade report from Matrade suggests that all the weirdness from the beginning of the year has finally settled down and we’re finally seeing some true trends. Unfortunately, the trend doesn’t look very good (log annual and monthly changes; seasonally adjusted):

Export growth was essentially flat on the year, and imports were little better. The trade balance has fallen to its lowest level in two years (RM millions):

Not a good start to the second quarter. Out of curiosity, since the trade balance can be subject to changes in the terms of trade, I normalised the numbers against exports:

This is, if you like, our margin of “profit” on trade. The period surrounding the Great Recession is nicely mirrored with the experience pre- and post- the dotcom bubble in 2001 – a period of higher earnings followed by a period of lower earnings, with recession demarcating the different periods. I don’t think there will be as happy an end result this time, because the circumstances have changed…but one can always hope.

In any case, the “margin” for the first four months of 2012 are well below the average since 1998, but around the ballpark for post-2009. Not great, and the March/April numbers fall in the lower end of the range, but not a total disaster either.

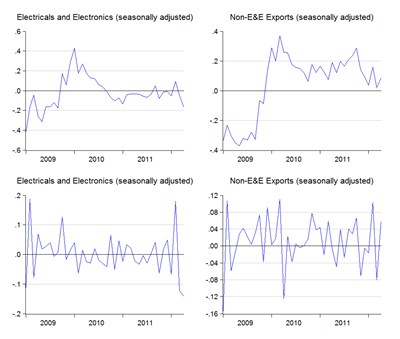

Breaking it down, electrical & electronics exports have given up the stability they’ve had in 2011 (log annual and monthly changes; seasonally adjusted):

We’re looking at depths not seen since the middle of the 2009 recession (RM millions):

This may be a possible one-off aberration, so the situation bears watching.

For May, the softening in commodity markets suggests that gross export growth won’t be terribly impressive either, but the incoming import trend suggests a bounce-back. As a result, May exports could turn out to be a little more encouraging – the SD model shows a 8.6% y-o-y increase for May:

Seasonally Adjusted Model

Point forecast:RM62,081m (11.9% yoy, 7.5% mom) Range forecast:RM70,120m-54,042m

Seasonal Difference Model

Point forecast:RM60,014m (8.6% yoy, 3.9% mom) Range forecast:RM68,685m-51,342m

Technical Notes:

April 2012 External Trade Report from Matrade

Think there's a lot of commodity price noise.

ReplyDeleteThe differential between last year (even month) oil prices are substantial.