Well, I’m back from my break, recharged but thoroughly unrested

But on to last week’s monetary data release from BNM. I haven’t done one of these for a while, as (1) little substantive has changed; and (2) while I’ve been updating the data, I’ve lacked the time to publish a review in a timely manner. Old news is stale news as they say.

Nevertheless, things are heating up (metaphorically) in a monetary sense. With Europe back in the news, China showing signs of a slowdown, and US recovery losing steam, it’s back to global risk aversion again. And that means global capital outflows into US treasuries (notice that gold hasn’t budged).

We’re only seeing a few signs of this locally though, as money supply growth is pretty stable (log annual and monthly changes; seasonally adjusted):

M2 growth has fallen off a fraction, but it’s still holding steady above 14%; the last time it was consistently growing this fast was in mid 2008, when commodity prices started bubbling. About half the marginal increase in April over March came from time deposits, indicating higher corporate savings.

But looking forward, we’re unlikely to see a continuation as commodity market prices have dropped in May, which means deteriorating terms of trade (translation: less export receipts), and capital outflows have accelerated, if the downtrend in the Ringgit is any indication.

Still, the banking system has some buffers against further outflows – forex deposits are only a little off the all time peak of RM80.2 billion seen in February and the banking system’s net foreign asset position is strongly in the black (RM billions):

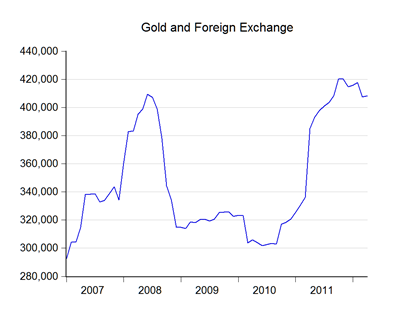

BNM’s international reserves position is in pretty good shape too (RM billions):

In fact, at least up to April, BNM has been pretty busy leaching excess cash out of the system (RM billions):

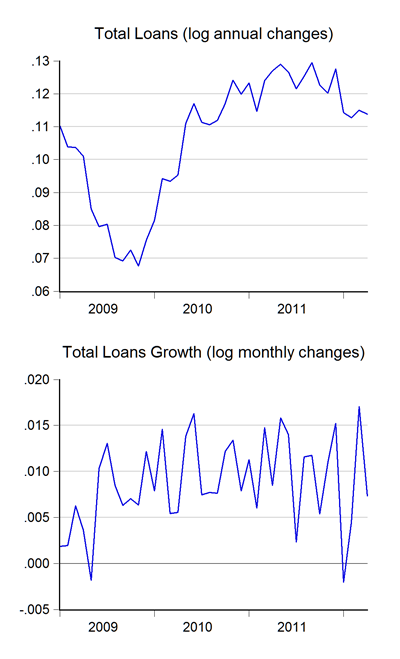

And the reason why is that despite the prudential guidelines on lending which were enforced in January, loan growth hasn’t fallen off by much (log annual and monthly changes):

Apart from the downward spike in January, it looks like business as usual to me – the lower annual growth for this year is more a base effect from higher loan growth at the beginning of last year.

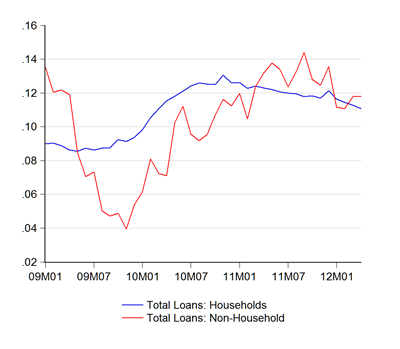

If there is a substantive difference, it’s mainly from a continued deterioration in lending to households as opposed to companies (log annual changes):

Given the different characteristics of the two debt markets, I think what we’ll see going forward is that loan growth will sustain at a pretty high level, but there’s going to be more volatility month to month. Application and approval data indicate that credit standards have tightened, but higher credit demand is partially offsetting this as far as loan growth is concerned.

Moving on to the interest rate front, average lending rates moved up in April, but are still near historical lows (%):

More interesting (pun intended) things are going on in the government debt markets. T-bill rates, which cover short term (<1 year) government borrowing, are now near their highest levels since the Great Recession (%):

Rates on BNM bills, used for monetary policy open market operations, have also been trending up – understandable given the volume of issuance (%):

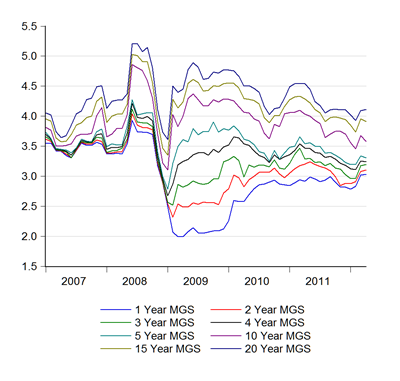

The MGS yield curve is flattening, especially at the long end (%):

While there’s been a 20-30bp increase in the indicative yields since January at the short end, the long end has come back down to December levels (except for the 20yr MGS – a new issue of RM3 billion in April explains that). For April, there’s been little sign of net foreign selling (RM millions):

…so the likelihood is that issuance dominated by shorter maturities explains the movement in yields. Nearly RM20 billion in MGS and GII were issued in March-April, with over 80% at the short end (<5 years maturity). So, it’s not as yet a market signal that investors are seeing slower growth and/or lower inflation, just a readjustment based on the supply of government securities.

Put all these together, and I would say that if you hadn’t known the external situation or what’s happening in the real economy, things look hunky-dory.

Personally, I don’t see any reason for a change in monetary policy settings over the near term, as despite the slowing growth numbers and the weakening outlook overseas, there’s little slack in the economy, credit growth is still strong, and borrowing is still cheap in historical terms. Things could change pretty dramatically over the next few months, if business and consumer confidence turns really sour, but there’s nothing in the data right now that should compel a policy change.

UPDATE: The chart for average lending rates has been amended to reflect revised data.

Technical Notes:

Monetary and banking data from the April 2012 Monthly Statistical Bulletin from Bank Negara Malaysia

You might want to revise the average lending rate data. I had mine like that (big drop in March) last month until I realized, the rates have been revised.

ReplyDeleteThe new one should show a slight drop in March, and recovery to February level in April.

But that makes me wonder, what happened in March to the rates?

At first, I thought it was just fiercer competition but the one-off drop and immediate recovery proved I was wrong. So, I find the one-off drop and subsequent recovery is weird.

You're right, thanks. Chart amended.

ReplyDeleteI found it more interesting that rates were much lower over 2010-2011 than the original data showed. But it does look a little strange.