There’s been a dearth of posts on this blog for the past couple of weeks, mainly for two reasons: first, I had some deadlines to meet last week, and second, I took my year end holiday a little early – four days exploring the Forbidden City and climbing the Great Wall of China, among other things. No email, no twitter, no calls from the office…bliss.

Now its back to covering the Malaysian economy, though things will be a little slow as I catch up on data releases, news developments and the backlog of messages and posted comments. My view of 3Q2013 GDP should be out tomorrow (it was released last Friday), but first up is something a little easier to look at.

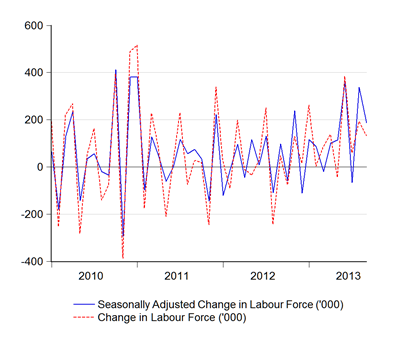

September data on employment was released today, and there’s something funny going on (‘000):

The Malaysian economy added 131k jobs in September (208k seasonally adjusted), while the 6-mth moving average rose to 142.9k. These are the kind of numbers we haven’t seen since 2010-2011, when the post-recession recovery phase was at its height and before Europe’s debt crisis started affecting global growth. This serves to underscore (and partly explains) the acceleration in GDP growth in 3Q2013.

Unemployment, too, is trending down (% labour force):

It’s still a little elevated relative to recent lows, but that’s largely due to accelerating growth in the labour force (‘000):

Part of that is a new foreign labour registration exercise, which began in September.

Here’s the unusual bit:

The red line is the actual LFPR, while the blue line is the trendline from 2009 to 2012.

I first noticed this divergence a month back, prepping for a presentation on the impact of a minimum wage(details of that to be published soon). The labour force participation rate has been generally trending up over the length of this monthly employment series, which begins in 2009. But sometime in 2Q2013, it suddenly started to shoot up. What had previously taken a year or two in terms of the economy absorbing excess labour, suddenly was covered in a month.

A couple of things come to mind. First is that businesses are more confident that the current growth phase has legs, in particular that stemming from external demand. Having ongoing big infrastructure projects certainly doesn’t hurt. Second, this could be due to the implementation of the minimum wage as higher incomes increase domestic demand, as well as entice more workers to enter the formal labour force. I’ll have more to say on this subject next week.

Technical Notes:

September 2013 Employment report from the Department of Statistics

Howdy mate, glad you are back rather than trapped in some ancient gaudy contraption that looked like some infernal Oriental lego set of structures all crazily contrived to fan the vanity of silly little mortals…..hahahahahaha.

ReplyDeleteI dunno why but simply couldn’t resist that …wink wink..

Anyway how did it feel like to walk through them portals like the Gate of Heavenly Peace (Tiananmen), or the Meridian Gate (Wumen), or exited via the Gate of the Divine Warrior (Shenwumen). And I am sure you ancient genes must have been besotted with all those ugly tacky structures bearing strange names like the Hall of Supreme Harmony, the Hall of Middle Harmony (Zhonghedian), the Hall of Preserving Harmony (Baohedian). Not to mention the Hall of Clocks and Watches (Zhongbiaoguan). And as you get closer to the core, you must have been stimulated by the dragon in your veins, to flare your nostrils and take in the sights of the Hall of Heavenly Purity (Qianqinggong) the Hall of Union and Peace (Jiaotaidian) and the Palace of Earthly Peace (Kunninggong) where the Sons and Daughters of heaven had their earthly fuck …..hahahahahahaaha

And I am sure you might have traipsed through the former living quarters of concubines, eunuchs, and servants before stumbling upon the Hall of Mental Cultivation (Yangxindian) before trudging through the boredom of The Gallery of Treasures (Zhenbaoguan), cheapskate trinkets that would do Jinjang South proud…..And surely you would have rested your sore feet after cursing all those goosesteps at Gate of Earthly Tranquility before venturing into the Imperial Gardens (Yuhuayuan), including its strange Hill of Accumulated Elegance or should that Inelegance……Well how come me knowing all that? Well lets say it was by accident actually, I was stranded somewhere nearby and feeling an urge to relieve myself bought me a ticket and entered the grounds to leave a few droppings of myself somewhere in that infernal place……………. Bet too the ghost of Chin Shih Huang must have stalked you as you meandered through his crazy maze of a walland did you see his terra cotta gonzos. Hope too that your mind and thoughts dint get walled in like what has happened to an accursed ethnic…get my drift….. hahahaha.

So a penny of anyone’s thoughts about this:

http://www.thestar.com.my/Business/Business-News/2013/11/21/Moodys-upgrades-Msia-sovereign-credit-outlook.aspx

After all the din was deafening when Fitch did the reverse not so long ago……….

Warrior 231

Warrior,

DeleteUnfortunately, we had to rush through that part of the trip, so we're planning to go back eventually and take a more leisurely and contemplative tour. I'd actually prefer the Summer Palace, but it was closed for the winter (natch).

On Moody's, the silence from the blogosphere has been equally as deafening as the ruckus over Fitch. I take both with reservations. A change in the outlook isn't after all a change in the rating itself.

I reckon you are right about the external demand thingy. About the same time the LFPR shot up dramatically, the Eurozone economy was picking up plus Japan was experiencing a post Abe fillip and China regained its mocha somewhat. But the latest data indicates French, German growth have returned to anaemia while Japan's is beginning to flag ever so slightly. I would rather think also the minimum wage spin off is rather overstated. Enticement of workers into the formal labour force is largely dependant on another thing as well i.e whether a rise in wages offsets a rise in the cost of living. In other words, whether it is worth it? i would rather opine that demand is driven by inflationary expectations in the near future i.e., people are bringing forward spending in anticipation of the perceived increase in prices from the GST.

ReplyDeleteI wager that once that spending tapers off as GST approaches and if the economies I mentioned above retreat into a funk, things will not be cheery anymore.

Warrior 231

Warrior,

DeleteA few things here:

1. I expected employment to pick up, but not necessarily the LFPR. That's certainly what happened in the last expansion phase (2010-2011). So something structural must have changed, and the nearest candidate is the minimum wage.

2. Wage growth is currently pretty strong, but not unusually so. And there's this interesting discontinuity in wage levels - again, something I'm keeping for next week.

3. The GST/VAT effect on consumption tends to only occur in the few months just prior to implementation, not a full year and a half before. Can I also point out that the LFPR began jumping up at the end of the first quarter, six months before GST was even announced?

Morning all,

ReplyDeleteMaybe the labour in Malaysia have heard of the SWISS referendum this Sunday on the 1:12 initiative.... http://www.theglobalist.com/executive-compensation-swiss-rebellion/

This will help reduce inequality.

The other initiative that was voted in - "Rip-off" should also be considered here.

Have a nice weekend.

Zuo De

Warrior, the entire problem with your suppositions boils down to this:

ReplyDelete"The numbers can surge at the blink of an eye or a twinkle of a star"

1. The LFPR doesn't "surge", it shouldn't and never has. In the past thirty years, the LFPR has meandered in a tight range between 62% and 66%.

And yet, it's risen sharply in the past half year. This is highly unusual, and statistically significant.

For example, changing the age range shouldn't change the LFPR much, because you'd be increasing both the numerator and the denominator, leading to status quo ante.

Second, your point about companies changing the structure of employment due to the MW doesn't make much sense in the context of the LFPR either, because that should only change the balance between employed and unemployed, not the growth of the labour force as a whole. In any case, you're presuming that the MW has only disemployment effects, which from the data is not true. I've found that it has in fact both.

Third, a rise in pensioners and women seeking employment because of higher costs of living, doesn't make sense either when inflation has been pretty low (i.e. there's been little change over the past year), even if you include house price increases.

2. You'll remember I'm sure what I said earlier this year about measuring productivity. I should also add that Malaysia is only slightly behind Korea in terms of productivity growth.

More to the point, we have had a divergence between productivity growth (revenue per worker) and worker compensation (average wages) since 1998, very specifically in the manufacturing sector. Worker compensation as of 2010 was about 30% lower than it should have been relative to historical norms. Among services, engineering firms are showing the same productivity-wage gap - engineers were approximately 60% underpaid in 2009 relative to historical norms. Certain other professions are showing similar trends (surveyors, private schools), though the gaps are not quite as large. Other sectors show the opposite - wages are increasing faster than productivity, but this is largely in "closed", highly skilled professions such as doctors.

As a general rule however, productivity-wage gaps have been growing in low-skilled professions (e.g. road haulage), but closing in high-skilled professions (lawyers, accountants). The exception has been for manufacturing and trade related professions, where its been unambiguously increasing.

So pardon me if I thumb my nose at the whole "productivity growth before minimum wage" argument. Productivity has been increasing, but workers are not generally being paid for it.

1. I admit the assumption regarding furloughs and LFPRR was wrong and offer no excuses for that.

ReplyDelete2. However, apart from that false assumption, the rest of my contentions stand. By definition, the LFPR encompasses both the employed, and the unemployed ACTIVELY seeking jobs. A litany of simple questions arises out of sheer curiosity (hic): if the age floor was held constant at 18 but the age ceiling raised to say 65 from 55, wouldn’t that have an impact on the numbers? And wouldn’t raising the mandatory retirement age for government keep the LFPR healthy since the top is maintained even as the floor expands, right/wrong? And just for curio sake: is the LFPR sectionalized according to gender in Malaysia or age cohorts?

As an aside, given the furloughing going on as reflected in the Star reports I mentioned, wouldn’t that be reflected in the unemployment figures ( though as admitted in (1) it wouldn’t have any impact on the LFPR). Of course the expected rejoinder would be ,its the net jobs that count i.e new jobs outstripping redundant ones. Nevertheless, a core issue remains i.e., do the unemployment or employment figures distinguish between temps and perms.

And ancillary to that, given the Star’s revelations, are we in stage 1 of evolving into freeters and neets:

http://www.japanfocus.org/-kosugi-reiko/2022

3. The cost of living argument hinges on which inflation figures we seize upon. I wont say anything on the official figures but I leave it to everyone’s imagination to figure out their respective figure, suffice to say for figures churned in parallel universes, the twain shalt never meet ; D.

Just for the road, the LFPR in the USA spiked in the mid 1970s after a 25 year benign trend. The reason for that being more women entering the workforce precisely when the cost of living surged in the aftermath of the first oil shock and the dawn of another.

Hence, the underlying assumption that there are more previously uninterested being now compelled to look for work due to a higher cost of living in Malaysia does have a gunny sackful grain of truth to it if one looks at it objectively that is.

http://www.washingtonpost.com/blogs/wonkblog/files/2013/09/BTexuIhIAAAMhiY.png

4.Productivity- as early as 2001, this paper, albeit uni-sectoral, found that wages outstripping productivity growth invariably increased unit labour costs.

http://myais.fsktm.um.edu.my/4122/ (gated)

Another paper in 2009 using a more robust tri-variate method merely reaffirms the findings of Ho and Yap:

http://mpra.ub.uni-muenchen.de/18095/1/MPRA_paper_18095.pdf

And in fact the World Bank data on productivity (page 76 below) further lends credence to the findings.

Although sectoral wise there were discrepancies, for instance, in the manufacturing subsector productivity gains post 1998 were largely stagnant:

http://documents.worldbank.org/curated/en/2010/04/15760391/malaysia-economic-monitor-growth-through-innovation

I tend to agree with our respected statesman, Tun Dr M (may Allah bless him with a speedy recovery) that productivity gains should precede wage increases otherwise we are down the slippery slope of a high wage high cost of living society vicious circle, but that is another issue altogether.

Warrior 231