I haven’t done one of these in a while (in fact, very nearly a year), and there’s been a lot of movement on the Ringgit front in the meantime, even if the controversies over its valuation have somewhat died down.

I thought a few months back that the Ringgit’s appreciation would be contained over the near term, and so it has (index numbers; 2000=100):

On a real trade-weighted basis, the MYR is almost back to its pre-crisis heights, and it’s remained there for the last three months. But that recovery hides an awful lot of extreme volatility in the underlying exchange rates with our major trade partners.

The big five according to trade weights are Singapore and China (more or less neck and neck), Japan, US and Europe, in that order, making up about 2/3rds of Malaysia’s total trade. The trends for each currency pair has been remarkably diverse (log change since 2005:07; nominal indexes; 2000:100):

Since the float of the Ringgit in July 2005, the MYR has been generally rising against the USD and marginally falling against the SGD. The other three currencies have seen some pretty extreme volatility – up, then down (25%!) against the Yen; down, then up against the Euro; and stable, then down against the CNY.

Against the currencies of our other trade partners, the general trend has been up (log change since 2005:07; nominal indexes; 2000:100):

Again, there have been some pretty big movements in currency pairs – 30%+ against the Pound, Korean Won (KRW), and Vietnamese Dong (VND) since July 2005.

At this stage, I think the long term appreciation of the Ringgit will probably slow, and volatility will increase. The general trend of the MYR is still up, but we’re probably right now very close to the equilibrium level dictated by economic fundamentals, after falling well below that during the recession.

I’d also like to touch on the (somewhat incorrect) idea that the MYR is tracking CNY – the data doesn’t really support it, despite the strange coincidence (*ahem*) that BNM floated the Ringgit the afternoon of the day that China did the same, back in 2005. Part of the reason is China’s suspension of the Yuan dirty float against the USD in 2008, another is BNM’s intervention in the forex market in early-mid 2008, and again in late 2008.

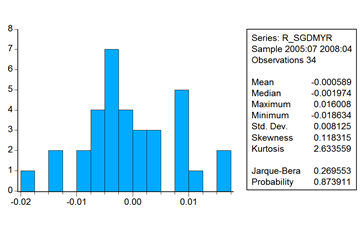

But looking at the volatility of the MYR cross-rates, CNY is at best 2nd among Malaysia’s trade partners (sample:2005:7-2008:4):

The relevant stat to look at is the standard deviation, as the closer that is to zero the more likely you’re seeing the existence of a pegged rate (zero standard deviation indicates a hard peg). The top currency in that stat for the relevant period is, and for the most part has always been, the SGD (sample:2005:7-2008:4):

The USD, if you’re interested, is fourth (sample:2005:7-2008:4):

Going forward, the general movement of the CNY and the MYR should be in the same direction after the refloat of the Yuan, but that would be true of most East Asian currencies – that says less about the mirroring of each other’s currency and more of the fundamental driving factor in global currency movements, which is weakness in the USD and EUR.

One last point – the relative closeness of SGD and MYR is primarily a function of the different approaches to monetary policy. Malaysia follows an interest rate target regime (which in theory ignores the exchange rate), whereas Singapore uses its exchange rate as the primary instrument of policy. Just as Singapore is Malaysia’s biggest trading partner, so is Malaysia Singapore’s largest trading partner. That implies a large weighting for the MYR in Singapore’s exchange rate target – hence the low volatility.

This comment has been removed by a blog administrator.

ReplyDelete[SPAM post removed]

ReplyDelete