There’s lots of things to talk about this month, but I haven’t much time to go into detail just yet. So this will be short and sweet, until I can go over the numbers fully.

First news is that BNM has revamped the presentation of the Monthly Statistical Bulletin – there are a few new things in there such as extended coverage of the banking system, and a few losses like the full breakdown of the money supply aggregates.

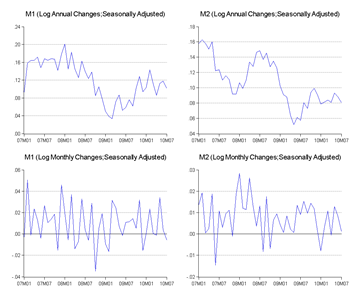

But as far as the monetary numbers are concerned, what I’m seeing is basically a continuation of some of the trends we’ve been seeing in the past few months. Money supply growth has held steady in July (log annual and monthly changes; seasonally adjusted):

Note that both M1 and M2 are essentially flat compared to June.

On the interest rate front, the interbank market is full reflecting the raising of the OPR:

…while MGS yields continue to converge:

I’ll cover developments in the banking sector in another post, and there’s also new 2Q numbers on Government finance to look at as well.

But at the moment, I don’t think there’s anything here to justify a further increase in the OPR – the Monetary Policy Committee is due to meet this Wednesday Thursday.

No comments:

Post a Comment