Was it coincidence that the July CPI report was released on the same day as GDP? Last month’s surprise cuts in sugar subsidies and hike in petrol prices have already taken effect on inflation in July (log annual and monthly changes; 2000=100):

Again, this is mainly a food and transport cost increase – the pain index is up 2.6% on the year, compared to core inflation of 1.2% – but there’s also been some pass-through into other prices (furniture and other household items, for some strange reason).

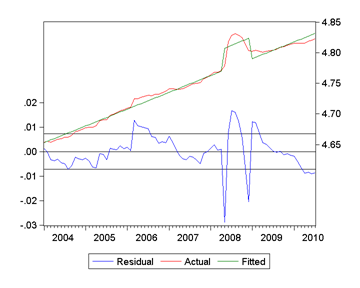

Inflation as a whole is still running below trend and may continue to do so going forward, especially if subsidy cuts continue to be implemented in a gradual fashion:

But perceptions of inflation will continue to rise, as the pain index components are already running ahead of income increases (index numbers; 2000=100):

Technical Notes:

July 2010 CPI report from the Department of Statistics

No comments:

Post a Comment