I attending a talk on property today, which brought to mind the “evidence” that we have a budding property bubble. The consensus today is that there isn’t one, despite the anecdotal evidence – just a boom stemming from pent up demand. Prices haven’t zoomed as excessively high or are as volatile as they are in Singapore or Hong Kong.

But my focus is more on what systemic risk a potential bubble – or boom, as the case may be – might pose to the banking system. I already talked about this issue at the beginning of the month, which to my surprise was one of my more popular posts.

But I’ve got some further insight into the potential risks by looking at loan demand and supply, rather than just the movements in total residential property loans, which is worrying enough as it is (log annual and monthly changes):

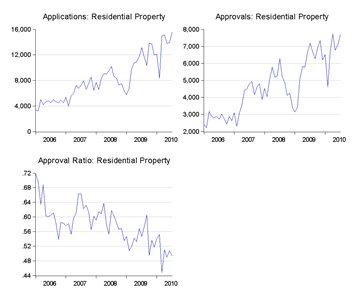

Loan demand has definitely risen, judging by the volume of loan applications:

What’s interesting is that demand is not being fully accommodated by the banking system – loan approvals from Jan 2009 has averaged just under 55%, compared to about 63% in 2007-2008.

Breaking down the numbers, the seeming sanity of the bankers is even starker when it comes to mortgages:

…where the comparable numbers are 52.8% and 59.7% respectively. This is despite some pretty fierce competition between banks for mortgage loans, including extremely low teaser rates and sub-base lending rate charges. In other words, credit officers aren’t necessarily diluting credit quality for the sake of loan growth, not just yet anyway.

But it looks pretty clear on what must have spooked BNM into starting the normalisation process in interest rates earlier this year (log annual changes):

Applications spiked up nearly 75% on the year in January, but falling off as interest rates started rising in response to the successive hikes in the OPR.

So at this stage, it looks as if BNM has headed off the temptation for Malaysian banks to go down the merry path to lower credit quality. That’s not having much effect on some of the frothier market segments in the greater KL area, but at least this proto-boom won’t raise systemic risk in the banking system.

Which suggests that the MPC will stay pat at this Wednesday’s Thursday’s meeting – I just don’t see any further justification for another OPR hike for the foreseeable future, not with the outlook for the external sector growing murkier by the day and slowing GDP numbers so far this year.

Went round some retail furniture shops recently in Klang Valley. Stocks few and old. Places semi unlit. Customers nil. Sellers dispirited. Selling by brochureware. Bigger ticket items are imported.

ReplyDelete