In today’s the Star (excerpt):

IN just over two weeks, the Budget will again be presented to the people and like always, Malaysians will be wondering what goodies the Finance Minister will have in his briefcase for them…

…Realism, however, dictates that the giving will be hamstrung by the state of finances.

Dishing out more tax cuts, waivers or rebates could mean less tax collection in the future and with the Federal deficit expected to hit 5.4% this year and at around the 5% range for Budget 2012, the realism of public finance is that more money will need to come in before money is lavished elsewhere.

Another worrying trend is that over the past three years, tax revenue to the Government has stagnated at around RM159bil. Transposed against the disturbing reality that the Government is increasingly dependent on tax revenue from the oil and gas sector, which in itself is volatile to the gyrations in international oil prices, that would imply more uncertainty should demand for crude oil ease due to an expected global economic slowdown...

…But then the fiscal deficit is based on two parts of the ledger. The expenditure side of the Government, however, has shown no signs of abating since the turn of this millennium except for 2010, when overall expenditure dipped a meagre 0.5% compared with the RM206bil spent by the Government in 2009…

…Adding on a deficit rate of 5% in the medium term or any significant length of time when government revenue is stagnant will just increase its indebtedness.

Don’t look now Jagdev, your wish is already coming true – at least in the sense of putting government finances on a better footing.

For the first time since early 2007, the government managed to record a small overall surplus in 2Q 2011.

How this happened is easy enough to explain – 2010 was a decent year for corporations and individuals, which pushed the government’s revenue collection nearly back to trend (RM millions; sample 2000:1-2011:2):

Note the gaps between the trend line and realisation in 2009 and 2010 – that’s where the deficits have come from. But so far this year, revenue collection is very nearly back to normal. Growth rates flatter to deceive – annual revenue growth hit 32.5% in 1Q and 16.8% in 2Q in log terms – but that’s basically the impact of poor tax collection in 2010 based on 2009 performance.

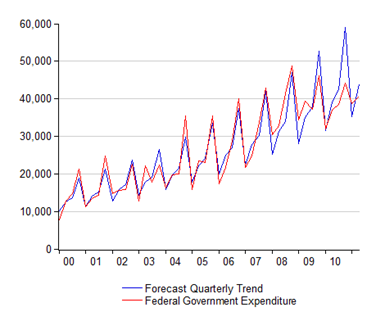

And on the expenditure front, the government hasn’t exactly been a spendthrift either (RM millions; sample 2000:1-2011:2):

You’ll see (modest) government support for the economy in 2008 and early 2009, but also basically a cutback in spending beginning the middle of 2009 that has lasted until now. Expenditure growth has lagged revenue growth for almost as long (log annual changes):

Notice as well the sharp cutback in development expenditure (nee subsidies).

Having said all of this, I’m not sure the government has quite the gumption to hold back on spending the full approved budget allocation this year…and maybe a bit more. I’m fairly certain the revenue forecast embedded in the budget will be far below actual (I haven’t checked), so there will be the temptation to spend the excess, especially since there’s already an accumulated war chest in their account with BNM which is at near record levels (RM millions):

Some of that’s probably earmarked for paying off maturing debt, but it’s still well above their usual cash position. All in all, not too bad. I’ll cover the debt position another day.

Technical Notes:

Federal Government Finance data from the July 2011 Monthly Statistical Bulletin published by BNM

No comments:

Post a Comment