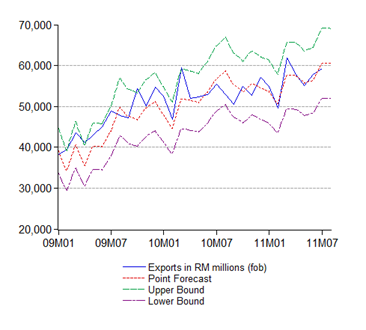

July’s trade report shows realisation almost exactly hitting last month’s forecasts. None of its good news though (log annual and monthly changes; seasonally adjusted):

Although the unadjusted series showed month on month growth over June, that’s misleading – July numbers are almost always higher than June’s. As the chart above shows, seasonally adjusted trade fell in July.

Breaking it down, both E&E and non-E&E exports fell (log annual and monthly changes; seasonally adjusted):

In fact, seasonally adjusted annual growth in E&E exports has been negative for a full year now.

How much of this is due to commodity price softening (at least for now)? Not much – the export price index fell just 0.2% in July, which means we’re seeing an actual reduction in (seasonally-adjusted) volume. The further softening of prices in August would also put more downward pressure on export performance.

All in all, not a good start to the third quarter of the year. And next month’s forecasts suggests things aren’t about to get better, though there’s the possibility that imports are being held off due to Ramadhan:

Seasonally adjusted model

Point forecast:RM55,397m (4.7% yoy, –6.7% mom)

Range forecast:RM62,334m-48,460m

Seasonal difference model

Point forecast:RM60,373m (13.3% yoy, 1.9% mom)

Range forecast:RM68,927m-51,818m

Technical Notes:

July 2011 External Trade Report from MATRADE.

No comments:

Post a Comment